Yes, there is some “innovation” in workers’ comp – but none that’s “disruptive.”

Not yet.

and it’s because too many of us are like the hitter below.

After yesterday’s post, I received a slew of emails from folks detailing their innovative approaches/systems/applications, some of which are noted below. I much appreciate this.

That said, I would suggest that while to the folks involved their efforts may seem innovative, that innovation is limited to a pretty narrow segment of the work comp world. What is missing is disruptive innovation – game changing, real disruption.

Think smartphones – they’ve totally changed how we communicate, drive, get information, use telecommunications.

Here is an example of what I see as truly significant innovation. Next week I’ll be digging into a couple more.

Tele…

Make no mistake, the combination of broadband, smartphones, and new programming languages will disrupt how healthcare is delivered, managed, and reimbursed. For workers’ comp, this goes well beyond telemedicine – doctor visits enabled by the internet. Here are just a few ways “telepresence” will be used in workers’ comp,,,

- Tele-triage, with the triage nurse interviewing the patient, observing the accident site, and using professional judgment enhanced by artificial intelligence to recommend next steps

- Follow-up doctor visits delivered via telemedicine, enabling script re-fills, monitoring of functionality improvement, and eliminating travel and out-of-work time and expense

- “Tele-presence” case management – think a hybrid between telephonic and field, without the windshield time but with the real nurse-to-patient-to-provider-to-employer face-to-face interaction.

And all interactions are recorded, stored, indexed, and available to all parties instantly. Adjusters get notified instantly of potential issues, don’t have to wait for email downloads, or wonder if an “office visit” happened, or try to figure out on their own if the patient is “compliant”.

Think about this – workers’ comp is a declining industry – injury rates have dropped about 60% over the last 25 years – and will continue to drop. Whether you’re a bill review company, case management firm, occupational medicine provider, or TPA, you’re going to be fighting over a slice of a smaller and smaller pie.

A provider network can get into the care delivery business, gaining top line revenue by actually providing “office visits.”

A case management firm can deliver more value and gain revenue – with higher margins, across a broader spectrum of services. Directing patients to specific (affiliated or contracted) providers, documenting same, and actually providing that initial physician’s evaluation via telemedicine. More revenue, stronger ties to customers, and better margins.

A peer review firm can do face-to-face meetings between the peer reviewer and treating physician/patient/provider, gaining a better understanding of the issue, while documenting same for the claims handler’s use.

A catastrophic case can be routed to a physician expert in the diagnosis, who can provide insight into optimal treatment plans, evaluate the medical condition, and assist the local provider to ensure the right care is provided – immediately.

What’s standing in the way of widespread use of tele- in workers’ comp is what we talked about yesterday – our culture.

Fear of innovation; obsessive focus on “proof” something works before implementing it widely; complacency; deep-rooted comfort with the status-quo, all are why work comp is adopting tele- much more slowly than group health.

What does this mean for you?

If you never take the bat off your shoulder, you may earn a walk – but you’ll never get a hit and you will strike out a lot.

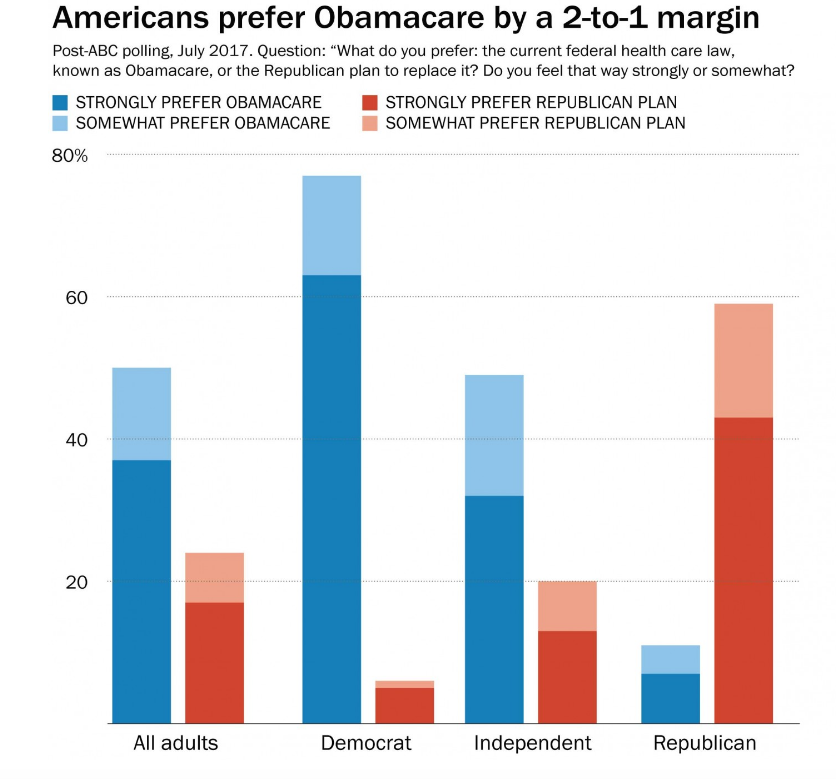

However, Republicans like repeal and replace. So, McConnell et al are stuck with a terrible choice – pass repeal and replace legislation that most Americans don’t want, or pass legislation that their base wants.

However, Republicans like repeal and replace. So, McConnell et al are stuck with a terrible choice – pass repeal and replace legislation that most Americans don’t want, or pass legislation that their base wants.