Jason Shafrin, the best economist in health policy, is hosting this month’s Health Wonk Review.

Young guy that he he, Dr Shafrin is doing this Instagram-syle.

A quick read with lots of pictures…

Insight, analysis & opinion from Joe Paduda

Jason Shafrin, the best economist in health policy, is hosting this month’s Health Wonk Review.

Young guy that he he, Dr Shafrin is doing this Instagram-syle.

A quick read with lots of pictures…

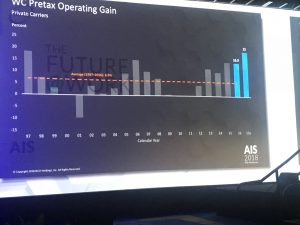

That’s the first top takeaway from NCCI’s Annual Issues Symposium. Over the last 30 years the average pretax operating gain has averaged 5.5%; last year the return was more than four times higher.

The big news came from Kathy Antonello, NCCI’s Chief Actuary. (the bullets below are derived from different data, complete presentation is here). Note “NCCI states” does not include several large states; California, New York, Pennsylvania, Ohio, and others.

A couple underlying stats reveal much more.

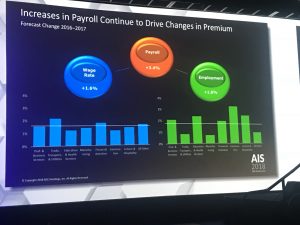

Comp premiums are driven by payroll and losses; payroll jumped 4.4 percent, while loss costs dropped by 4.2%. So, despite more pay to more workers, losses stayed flat.

Put another way, the frequency decline more than offsets increases in employment. So, the total number of claims likely declined significantly.

The result – filed premiums in the vast majority of states decreased last year, so most employers’ costs are decreasing. And, this may continue, as reserves are in very good shape, so insurers won’t have to raise rates in future years to build up reserves for past claims.

Finally, Kathy’s presentation was terrific. Great use of graphics, videos, and slides to communicate some pretty complicated and dense information. Kudos to the folks behind the scenes who developed the data, put together the graphics, and made it all understandable.

I’ll give my take on what this means next week; suffice it to say that this is:

There is a wealth of information in the presentation, SSDI and work comp, residual markets, BLS v WC claim rates – download it here.

After the boys’ annual mountain bike trip – this time to Sedona AZ – its back to work.

Off to Orlando to take in NCCI’s Annual Issues Symposium; I’ll be live-blogging a few of the sessions, starting with the State of the Line Report where we’ll get a first look at last year’s work comp results, medical inflation rates, premium changes and various other key metrics. Kathy Antonello does a bang-up job on this (supported by her able staff) so very much looking forward to it.

Bob Hartwig will follow; I’ll type as fast as I can but he’s always moving at warp speed…If I only miss half of Bob’s trenchant observations it will be a good day.

And we’ll be on top of our game for Dr David Deitz’ and NCCI’s Raji Chadarevian’s session on pain, opioids, and marijuana.

Rather than stuff your inbox with all of this at once, expect I’ll send them out over the next few days.

Beware…

We’re pushing to finish CompPharma’s Annual Survey of Prescription Drug Management in Workers’ Comp next week. After cleaning up the data, we’ve got final figures.

Quick takeaway – we workers comp types are doing a MUCH better job controlling drug usage than the rest of the world – and MUCH MUCH better controlling opioids.

Here are a few key data points:

While decreases in opioid spend have been dramatic, payers are still extremely concerned about opioid consumption – especially among long-term patients.

There’s a widespread and deep concern among respondents (29 payers of all types) that we’re a long way from figuring out how to help long-term opioid users reduce/eliminate their drug consumption.

This year we dug deep into that issue, and one key takeaway is the current regulatory focus on formularies and utilization review is focusing on a problem – initial prescriptions of opioids – that, while not solved, is much better controlled.

Where payers, patients, prescribers, and PBMs need regulatory help is with chronic opioid patients. Respondents had a raft of suggestions…

What does this mean for you?

Work comp isn’t known as an innovative or progressive – yet here you are, well in front of other payers and work comp regulators.

Well done.

Reed Group‘s current attack on WCRI is unwarranted, misguided, and out of line. Several Reed employees have publicly chastised WCRI for a variety of sins ranging from poor quality research to a lack of concern about worker outcomes.

Reed’s frustration with WCRI first came to my attention in a post by Reed’s Carlos Luna a couple months back; Carlos said “I find it curious how WCRI, perhaps due to industry demand, focuses on one product (WLDI’s ODG).”

It’s not curious, Carlos. Much of WCRI’s research is driven by regulators looking for an independent, credible, analysis of potential changes. They ask, WCRI delivers.

More recently, a Reed researcher said that methodological concerns with one of WCRI’s studies (on opioids and disability duration) call into question ALL of WCRI’s research. In this morning’s WorkCompCentral Elaine Goodman quoted Reed Group’s Fraser Gaspar:

“Based on the substantial limitations and errors in their [WCRI’s] most recent opioid research paper…it is clear that their current review process is insufficient…[WCRI’s] information that does not meet basic research standards”

I strongly disagree.

Gaspar is claiming that WCRI should use blinded reviewers; that is, reviewers should not know that the research is coming from WCRI as that might bias their perspective. Couple of points here:

Goodman reported Reed SVP Joe Guerriero “is also concerned that WCRI’s research focuses primarily on workers’ comp costs, with little attention paid to injured worker outcomes or the possibility of cost-shifting to other payers.” [her words, not his]

Quoting Guerriero:

“looking at reduced drug costs to determine the efficacy of any program is far too narrow…” [emphasis added]

Guerriero is mis-directing here; worker outcomes and cost-shifting weren’t within the scope of the study WCRI was asked to do.

Not to mention WCRI has done quite a bit of research on cost-shifting and case-shifting. Moreover, it is not possible for WCRI – or anyone else for that matter – to figure out if patients no longer getting drugs via work comp were obtaining drugs via another payer.

And, WCRI has published dozens of research reports on worker outcomes.

While I understand Reed’s frustration that most regulators are focusing on ODG, the fact is for years ODG’s publisher has been a much more effective marketer than Reed. In addition, the binary nature of the ODG formulary is simple to understand and relatively easy to implement.

FWIW, I’ve long viewed ACOEM’s (affiliated with Reed) approach to guideline development and it’s formulary as more rigorous and more patient-centric than ODG’s. I still do. I’ve been a fan of ACOEM’s clinical guidelines for years. Their methodology, diligence, and professional dedication to the right care has always impressed. Yes, it’s more work, but it’s better for patients.

But that’s beside the point.

WCRI has always been open to collaboration and conversation. I would encourage Reed to work with WCRI and not cast aspersions about WCRI’s research.

[note – I’ve long been impressed with Elaine Goodman’s reporting and pursuit of the details necessary to provide a complete picture. Kudos to Elaine for an even-handed piece]

ed note – NO REPUBLICATION OR EXCERPTING OF THIS POST IS ALLOWED WITHOUT EXPRESS WRITTEN PERMISSION FROM JOE PADUDA.

copyright 2018, Joe Paduda, all rights reserved.

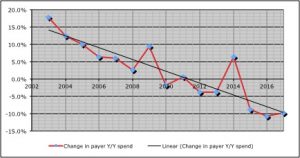

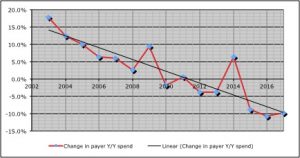

CompPharma’s latest Survey of Prescription Drug Management in Workers’ Compensation (past reports available for download) has some very welcome news; over the last two years, opioid spend is down by one-third.

Most of that reduction is from improvements in clinical management and changes in prescribing patterns and behavior.

(I’m finishing up this year’s report draft tomorrow…)

Of the 28 respondents to this year’s Survey, 25 had double-digit decreases in annual opioid spend, and six saw drops greater than 25%.

The opioid spend reduction was a big driver of a reduction of 9.8% in total drug costs across all respondents – the sixth decrease over the last 8 years.

Couple early takeaways:

This last is telling.

After dramatic improvements in opioid utilization, respondents remain quite concerned about the impact of drugs on claim closure, disability duration, and patient safety.

What does this mean for you?

Progress is great, and much remains to be done.

Stone Point has added yet another firm to its growing portfolio of workers’ comp assets; when the deal closes in a few weeks, Mitchell will join previous acquisitions Genex, AmTrust, and Sedgwick (the latter two have co-investors).

(I mis-read the press release this am – Elliott, a hedge fund with $34 billion under management is EXITING Mitchell.)

One of – if not the – investment firm(s) with the most experience in the work comp space, Stone Point’s been busy. It just completed the acquisition of bill review and case management company Genex. As I wrote in February when that deal was announced:

“I’d also expect some much bigger acquisitions. I don’t think Stone Point bought Genex to get into the case management and bill review business; these folks have bigger plans.”

Mitchell fits that definition…I’m speculating the price was well more than double Genex’. KKR bought Mitchell for $1.1 billion a bit over 4.5 years. When Mitchell’s “book” was out about a year ago, word was KKR wanted to double their money.

According to internal sources, Genex and Mitchell will NOT be combined or integrated or even work together. They were pretty adamant about that.

Allow me just a bit of skepticism; private equity (PE) firms don’t often buy companies with similar capabilities and services and leave them alone. That’s inefficient: they own two separate entities – overhead, management, systems, staff, and all – that do the same thing. Especially when those two businesses are aligned as closely in many areas as these two are.

While Mitchell also operates the nation’s third-largest work comp pharmacy benefit manager, and provides a wealth of services to the auto claims industry, Genex’ offerings sort of “fit in” to Mitchell’s portfolio. Genex’ utilization management, peer review, case management, and related offerings are very similar to Mitchell’s. And, Mitchell provides Genex’ bill review application.

Sources indicate there’s a lot of leverage (debt) on the Genex deal – as there is in pretty much every acquisition – so cost-saving moves and elimination of redundant functions is likely a priority.

It is certainly possibly the two companies will operate completely independently – but I’d be surprised if that lasts very long.

Couple related points.

Mitchell’s Alex Sun and his team are smart and savvy. There’s sort of a California tech vibe at Mitchell, an impression that is in contrast to the more traditional, operational focus of Genex. There are few people in this business I like or respect more than Genex CEO Peter Madeja; he’s well-regarded and well liked by all, especially by his co-workers. Point being, there are different cultures here, and this might be a, if not the, reason Stone Point may not want to move some pieces around.

The team that runs Stone Point’s P&C operation is extremely knowledgeable, well-respected and highly regarded for their experience and expertise in the comp industry.

Most of all, they are strategic.

They most certainly have a plan, and the Mitchell acquisition is one part – albeit a very large one – of that plan.

What does this mean for you?

More consolidation in a very mature industry. If you haven’t figured out where you want to be and how you’re going to get there, get busy.

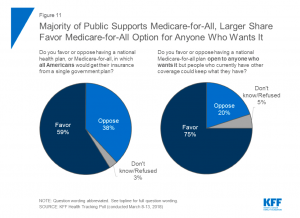

Some variation of “single payer” healthcare is going to happen, for one simple reason – the current “healthcare system” is going to blow up.

People are broke, fed up, and angry – and support Medicare for All.

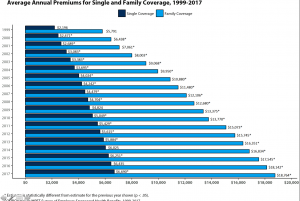

Health insurance is not useful for most of us: many can’t afford the deductibles, and premiums are just stupid expensive.

The people running Washington aren’t interested in or capable of fixing anything, they just want to blow stuff up.

While most think Medicare for all will happen, I lean more towards a standardized “Medicaid for all” option. Medicaid:

Our last best chance of keeping the “healthcare system” we had was the ACA, a solution rooted in a Heritage Foundation plan that relied on private insurers. When the GOP gutted it, the writing was on the wall.

Here’s a quick summary of steps Republicans took that harmed ACA. (more here; a LOT more here)

I don’t know when this will happen, I just know that it will.

Opioid prescriptions continue to drop, down 22% from 2013 – 2017. That’s great news indeed…but there are still far too many. The press release from the AMA calls for more Medication-Assisted Therapy, expanded treatment and access to that treatment – all needed.

One statement in the AMA release really bothers me:

Physicians and other stakeholders accept that bold action is needed. We go where the evidence leads us.

Bullshit.

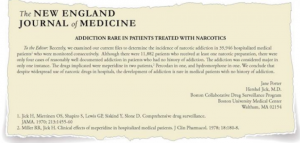

Reality is, too many prescribers went where the marketers led them, rarely asking the right questions, accepting at face-value claims of smiling detailers, mindlessly mis-citing “Porter & Jick” as rationale for ever-escalating doses of opioids.

If the AMA’s statement was true, we never would have had the opioid crisis in the first place. We all know NOW that the “research studies”, “evidence”, and “literature” used to get docs to prescribe mountains of pills was incredibly weak, completely mis-characterized, and/or non-existent.

We all make mistakes…in this case prescribers made a monumental one. If the AMA accepted some level of responsibility for the opioid crisis and spent a lot less time lobbying against mandatory Prescription Drug Monitoring Programs and quibbling over dosage levels I’d be a little less angry.

I’ve long pilloried many for their role in the opioid crisis, and many readers have as well. It’s long past time the AMA and their fellow travelers acknowledge the harm they caused – and continue to cause – by NOT “going where the evidence leads them.”

Then, and only then, will they will be a credible part of the solution.

What does this mean for you?

Taking responsibility is rarely easy, often painful, and always needed.

I’ve lauded the Ohio Bureau of Workers’ Comp for their great successes reducing opioid usage. But, I’ve heard from many stakeholders that Ohio’s got a unique advantage; BWC is both the regulator AND the payor, so they get to do whatever they think makes sense, and providers, patients, and pharmacies have to do what they’re told.

Fair point.

The implication is this – it’s way harder when you’re:

A) not a monopolistic state fund;

B) you don’t have the power to implement formularies, UR, pre-cert, and other care controls; and

C) you don’t have the full focus and influence of a state’s governor behind you.

Well, the State Fund of California is delivering stellar results without any of the inherent advantages listed above – in a state that is highly litigious, without a formulary (until this year), and where a subset of providers spends every waking hour thinking up new ways to screw the State Fund, insurers, employers, and taxpayers by gaming the system. (CA Gov. Jerry Brown is fully supportive of the State Fund).

(btw love the campaign…)

From 2014 to 2017, the State Fund delivered:

As a result, opioids now represent 16.9% of the State Fund’s total prescriptions, down 31% since 2014.

A couple more data points then we’ll dig into how they did this. There were 1458 patients prescribed 120 or more MED in 2014, today there are 186 cases.

Results for those patients prescribed 50 or more MEDs were almost as good; the number of patients declined by more than 80%, from 5000 to 994.

How’d they do this?

There are two primary foci; reduce initial opioid usage, and help long-term patients wean off of opioids; we’ll focus on the latter in this post.

Recall that these results occurred before the new formulary was implemented, so that did not have an affect on these results.

The State Fund’s long-term opioid reduction program begins with the adjuster, who remains involved in the claim throughout the process. The program involves multiple vendors, a variety of approaches, an openness to innovative treatment, and a lot of communication. There is no “canned” approach: Cognitive Behavioral Therapy, acupuncture, counseling, physical therapy and exercise programs, and Functional Restoration Programs have all been employed. Medication-assisted therapy, or MAT, has been used in selected cases but for the most part the State Fund is trying to stay away from using opioids to solve opioid problems (my wording, not their’s).

Key to the long-term issue has been using vendors to conduct peer to peer conversations with the prescribing physician(s). According to State Fund Medical Director Dinesh Govindarao MD MPh, this peer-to-peer education of prescribing physicians has been instrumental in the success of the program, as many treating providers don’t have adequate training on pain management and opioid prescribing.

For those patients with significant chronic pain, the State Fund developed a program specifically aimed at helping those patients cope with their condition. Patients willing to participate were enrolled in this program.

Going forward, the State Fund and Dr Govindarao are working to set up a more defined process to triage patients, one that will have different approaches and process flows for different types of patients. They will be looking at commonalities in patient groups to see if they can flow them through consistent treatment approaches.

What does this mean for you?

You can dramatically reduce long-term opioid usage through a well-designed, carefully-managed, patient-centric approach overseen by a very competent medical director.

And when you do, you can save scores of lives, hundreds of families, and millions of dollars for policyholders and taxpayers.

One last comment – these results were produced by a state entity and state workers focused on doing the right thing, the right way.