A couple weeks back NCCI released information about its annual survey of work comp execs. About 100 participated in the survey; some of the results were a bit surprising.

Execs were asked about their “concerns” re workers’ comp…frankly I found some of their concerns (financial health? rate adequacy? medical inflation?) puzzling at best.

Here’s a couple questions from my discussion with Damian England, Executive Director, Affiliate Services and Raji Chadarevian, Executive Director-Actuarial Research – and thanks tons to NCCI’s Cristine Pike for making this happen.

Where did the responses rank concerns?

Damian England, Executive Director, Affiliate Services – “While some carriers mentioned multiple concerns, roughly 40% of the responses were related to the financial health of the system and rate adequacy. About a quarter reflected the changing workforce, followed by medical inflation and the economy. Climate change and artificial intelligence were cited as emerging concerns.”

MCM – Rate adequacy concerns?

Damian England, Executive Director, Affiliate Services – Rate adequacy concerns are more of a global fear of the future and the unknown, amid a long-term trend of steady declines in loss costs/rates. Although the industry in aggregate has seen nearly 10 consecutive years of underwriting profitability, not every carrier has same results or books of business; rather, individual carrier performance varies in many ways from the aggregate. We also hear about changing underwriting cycles and whether we have the data necessary to recognize a turn in trends, as there is a recognition that recent trends will not last forever.

MCM – Why are they worried about medical costs – which are a non issue?

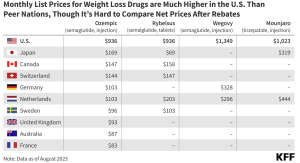

Raji Chadarevian, Executive Director-Actuarial Research (and all around good guy). – Medical cost drivers are not well understood; some are just looking at the overall medical price index, but medical cost drivers go beyond that. Changing medical practices, new medications, new ways to administer treatments and other transformations need to be considered. It is starting to resonate that some are understanding it is more complex…but there is a misconception in the industry that we look at health insurance rates and think that is representative of medical inflation – those rates [health insurance premiums] are going up but that is not medical inflation.

Also, WC is a long tail business, so a small change in the inflation rate one year can mean a lot in terms of overall cost of claims – that is where some of the concern emanates from – what does it mean for a 20-30 year claim? Furthermore, for LT claims it isn’t general medical inflation largely driven by physician and facility prices, rather, for claims that are beyond the critical treatment period, medical costs have more to do with the price of Rx, home health care, medical equipment. Prices for HHC and DME have gone up significantly in recent years.

Ok, couple things here. And please, this is not meant to argue with Raji or Damien, rather to point out that work comp execs need to study up on medical issues and worry about REAL issues, not NON-issues.

- Rate adequacy is NOT AN ISSUE. Over the last decade rates have been too high – evidenced by continuing rates drops in almost all states over that period, accompanied by huge profits AND $14 billion in “excess” reserves.

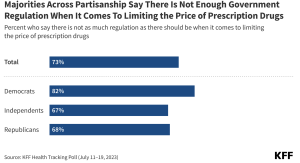

- Medical inflation is NOT AN ISSUE. Over the last few years there have been no reports of significant increases in medical trend. None. Zippo, Zilch.

- Drug costs have been dropping for years – for lost time claims as well as med onlies.

- Claims with ultimate costs >$1 million account for – at most – 15% of total WC costs – and a huge chunk of that is not medical, but indemnity expense. So, while I get some execs may be concerned about future costs, this feels more like catastrophizing than rational business thinking.

- Climate change – hard to believe that this was not one of the top concerns, but completely consistent with the industry’s ignorance of the issue. Talk to insurers, employers, and TPAs in Louisiana and California and they’ll regale you with the horrific and extremely expensive impacts of human-caused climate change.

What does this mean for you?

Execs are working about non-issues and willfully ignoring those that will have real and sustained impact on the industry.