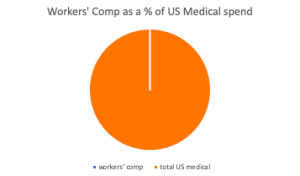

Work comp medical expenses total around $30 billion. Total US medical expenses amount to $3.6 TRILLION.

Clearly work comp is a minuscule part of the healthcare world; less than one percent.

This matters because health care providers – doctors, therapists, facilities, clinics – see very few work comp patients. While some providers tend to see more work comp patients than others, it’s rare indeed for a provider’s work comp patient population to amount to more than 10 percent overall.

Think about this in terms of regulations, network relationships, systems integration, clinical guidelines and UR requirements.

One patient out of a hundred – that’s how many work comp patients the average physical therapist, prescribing physician, pharmacy or clinic sees. When regulators require prescribers comply with a new formulary or UR prior authorization requirements, they are asking the provider, and the office and clinical staff that work with that provider to:

- learn something new; and

- develop, implement, maintain, and potentially modify new workflows and communications protocols and standards.

How would this work out in your world?

In your work, how much of a hassle would it be if one out of every hundred customers – or even one out of 25 – required unique and special handling, different processes, and a failure to comply with those requirements could lead to some type of legal sanction or unhappy customer?

I would suggest that many regulators don’t factor in the obvious challenge inherent in getting clinicians to change their practices for one out of every hundred patients.

Yes, regulators need to ensure regulations meet legislative intent, but often regulators can influence that intent, educate legislators, and if nothing else work diligently to hopefully reduce the potential friction inherent in changed regulations.

Unfortunately, this often isn’t the case. As a result, conflicts arise, conflicts caused by misunderstanding or misinterpretation, or just plain ignorance. These conflicts may well lead to increased litigation, angry patients, and/or delays in patient care.

It can also lead to providers dropping out of the workers’ comp system, as the hassle just isn’t worth it.

What does this mean for you?

A bit of perspective is always helpful. It is also essential.

As my late father used to remind me quite often, better to do it right from the start than have to fix it later.

I’d encourage all to read Dr Fein’s post – and to subscribe to

I’d encourage all to read Dr Fein’s post – and to subscribe to