Off to Paris for a week with my lovely bride…will be studiously avoiding anything resembling work till we return Thursday.

Most excellent flight over on Delta.

I’m sure the world will get along just fine till then!

Insight, analysis & opinion from Joe Paduda

Off to Paris for a week with my lovely bride…will be studiously avoiding anything resembling work till we return Thursday.

Most excellent flight over on Delta.

I’m sure the world will get along just fine till then!

The latest news from Bloomberg put a damper on my plans to play point guard for the Warriors.

As loyal readers know, in a previous post on One Call I alluded to the company’s survivability having the same chance as me playing point guard for that esteemed NBA franchise.

Alas my hoops career appears stillborn.

We are now 10 days past the date One Call failed to make a $15 million debt payment, and it appears little progress is being made. Some have pinned their hopes on the company‘s future on One Call’s debt holders all getting together, joining hands and singing Kumbaya. Somehow I don’t think that’s likely.

Why would the most senior debt holders agree to take a haircut to help more Junior debt holders? The senior debt holders accepted a lower interest rate in return for their seniority in the event of a default. I doubt the senior debt holders are going to give up anything to help junior debt holders, who got higher interest payments in return for less security. However it’s possible – if some of the senior debt holders also own some of the more junior debt, they could work something out – if all the other debt holders agree.

IF they somehow manage to convince ALL debt holders to do this it’s possible a restructuring could occur. Notice the emphasis on ALL.

There’s also been a lot of talk about some sort of a debt-for-equity swap.

Again, I just don’t see this happening. The debt holders will end up owning the company if it enters bankruptcy, so (Sorry to repeat myself here) why would the senior debt holders agree to give up some of their ownership – – when they probably don’t have – to just to be nice to the junior debt holders? All debt holders would have to agree and that’s pretty unlikely.

Far more likely is the worst case scenario; the company runs out of money, defaults, and ends up going into bankruptcy.

I just don’t see how the company makes it given its huge debt load and cash flow problems, coupled with client losses and I would argue, feckless and far-less-than-forthcoming management.

I’ve heard from several colleagues that One Call management has repeatedly characterized my efforts to shed light on the problems at OCCM in pretty insulting terms. Those still undecided on who is right and who has been telling tales may want to reflect back on management’s multiple “all-is sunshine-and-puppies” pronouncements given today’s Bloomberg piece.

For the mid-level managers and other workers who have stock or stock options, this slow-motion train wreck must be beyond painful. While there are certainly some who contributed to this debacle, I’m sure there are many talented and hard-working folks in Jacksonville who deserve another chance.

Late this afternoon Standard and Poor’s downgraded One Call from CCC to CC. According to S&P:

An obligation rated ‘CC’ is currently highly vulnerable to nonpayment. The ‘CC’ rating is used when a default has not yet occurred but S&P Global Ratings expects default to be a virtual certainty, regardless of the anticipated time to default.

S&P also stated:

We are placing the ratings on CreditWatch Negative as One Call may not make its interest payment on its second-lien notes during the 30-day grace period.

There is an overall rating (referenced above) and individual ratings on specific bonds. Readers will recall that One Call has three levels of debt; the most senior is rated CCC, while second lien (the most junior) is rated at C. S&P does not rate the middle level aka the 1.5.

From S&P;

We lowered our debt ratings to ‘C’ from ‘CC’ on One Call’s second-lien notes due 2024 and senior unsecured notes due 2021, and placed the ratings on CreditWatch Negative. The recovery ratings on these debt issues are ‘0’, indicating our expectation for negligible recovery (0%) in the event of a payment default.

S&P on the senior debt’s CCC rating:

In the event of adverse business, financial, or economic conditions, the obligor is not likely to have the capacity to meet its financial commitments on the obligation.

We will know by Halloween what the future holds for One Call – likely before then. It is unlikely One Call is currently in compliance with its debt covenants.

The issue at hand is a “7x first lien leverage covenant” which kicks into action when the company draws down its revolver debt by 20%. According to a DebtWire article, OCCM had a “razor-thin” margin at 6.9x as of March 31.

I do NOT know what those specific covenants are, however in my experience debt holders put covenants into contracts so the debt holders can take control – partial or total – of a company that is at risk of defaulting on its debt.

Debtwire also indicated OCCM had drawn down $50 million of the $56.6 million revolver.

Allow me to translate into language we non-financial wizards understand.

Among other debt instruments – bonds etc – OCCM has “revolving” debt, which is kind of like a line of credit. The company can borrow from it and pay it back as cash flows dictate.

The “7x” is calculated by dividing the total long-term debt – which was reported to be $1.375 billion on March 31 – by cash flow (adjusted EBITDA) – which was $200 million over the 12 months preceding March 31.

So, as of March 31 OCCM had drawn down its revolver by way more than 20%, but had kept its revenue-to-debt ratio just below 7, which prevented the covenants from kicking in.

Things have deteriorated since then.

Friend and colleague Alex Swedlow took the podium at the California Self-Insurers’ Association to discuss what’s going on in the Golden State, and what you need to do to manage your program.

First up – why are California’s admin expenses so unbelievably high?

Well, the medical delivery system is quite expensive. The volume of medical services delivered is just high – especially for pretty expensive services.

Second, there are few controls that limit demand – we’re talking deductibles and copays – and no shortage of supply of providers willing to meet that demand.

Third, dispute resolution is challenged by lots of litigation, by a UR/IMR process that is expensive and (my words not his) abused by a relatively small number of docs and attorneys.

Fourth – this all drives medical management expenses up. Waaaaay up.

The result – medical payments that are 58% higher than the median state – and second highest of all states.

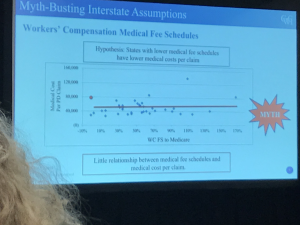

Myth bust – there’s no association between Fee Schedule levels and medical costs – so it isn’t a problem fixable by cutting the fee schedule.

Of course, some protested that the reforms – UR, employer direction, IMR, MTUS (clinical guidelines) etc – were going too far and harming workers. Citing the huge influx of UR, they contended a lot of needed care was being blocked.

Except that wasn’t true. In fact, the vast majority of care performed and/or reviewed was delivered – that includes the 95% of IMR requests submitted by applicant attorneys.

The good news is there are fewer UR/IMRs for drugs these days – which tracks a similar trend in drug spend overall – and in particular a major decline in opioid consumption.

Shout out to Peggy Sugarman who runs work comp for the City and County of San Francisco – she moderated the session, which in this case meant she clarified, provided her own insights, interpreted, and generally added a ton of value. Peggy made me re-think the “moderator” role.

CWCI will be releasing an update on current goings-on in the UR/IMR space, providing stakeholders with specific attention paid to modifications rather than approvals or denials.

What does this mean for you?

Costs can be driven up by admin expense- but without those admin expenses, costs would be even higher.

Three days ago One Call failed to make a $15 million payment to some of its bond holders. Last night I asked the company for a comment; the company responded saying they “…chose to take advantage of an available 30-day grace period for paying interest under the terms of one of our debt agreements…”

Simultaneously they released a statement about the situation – kudos to OCCM management for working to get their message out before the payment problem was revealed elsewhere. That was smart marketing.

In a followup email, I asked “Was one call’s very tight cash position a factor in the failure to make the payment on the due date?”

As of yet there has been no response.

Let’s parse this out. “Taking advantage” of an “available 30-day grace period” is not a tactic commonly used to “provide additional time to further advance these constructive lender discussions as we work together on a comprehensive capital structure solution that will best position One Call for the long term.”

You may recall One Call did a major debt restructuring earlier this year, one that allowed the company to forgo paying monthly interest but added that interest cost to the principal amount. That saved cash flow but increased the total debt burden.

That higher debt burden coupled with debt covenants made for a potentially bigger long term problem. Simply put, the higher the debt, the more pressure on the company to make sure it has adequate cash reserves and didn’t have to dip too deep into its line of credit.

If you can’t make a debt payment, you know that well before that payment is due.

If you haven’t been able to figure out how to come up with the cash to make that payment, chances are you won’t be able to do so in another month. Reports indicate One Call has been working on this for over three months

If you haven’t been able to “advance constructive lender discussions” when you’ve been working on it for more than three months, and after a major debt restructure a few months before that, one wonders how constructive those lender discussions have been – and will be.

Here’s what we know.

At the end of June the company had about $6 million in cash and equivalents on hand. That’s equal to about one day’s expenses…perhaps a bit more.

We also know there are three levels of debtholders – the first, “1.5”, and second lien holders. That’s the order of seniority in case of default; the first lien holders get first crack at any assets, followed by the 1.5, with second lien holders hoping there’s something left.

We also know One Call has debt covenants that way well be in play here as the company has drawn down its line of credit, which triggers certain rights for debtholders.

We also know One Call said everything was fine just three months ago; now we hear they are in “constructive lender discussions”. Quoting CEO Rone Baldwin;

I would like to share that One Call is stable and secure. The company is fully compliant with its debt covenants and meeting all of its legal and financial obligations, and we expect this to continue to be the case.

Finally, we know the three sets of lien holders are each working with financial advisers.

More to come later today.

One Call’s official statement is here.

There are several things that will affect workers’ comp in the next couple of years. Perhaps the least obvious, but most significant is consumer spending.

Here’s why.

Consumer spending drives travel, cars, homes, clothes, tools, food, retail; pretty much everything except government, heavy industry and infrastructure construction.

In fact, consumer spending amounts to two-thirds of our economy, manufacturing just a tenth. When we consumers sneeze, the economy catches the flu.

So far, consumer spending is holding up. This from Bloomberg…

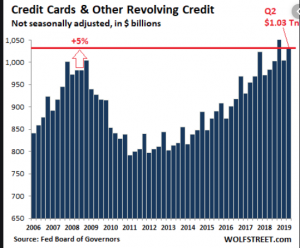

Easy credit drives a lot of this via credit cards. Essentially, some folks use their credit cards as consumer loans, allowing them to buy stuff they can’t pay just now.

That works great while wages are increasing and jobs plentiful – both true today.

While that spending is a bit shaky, what caught my eye was a report that those risky mortgages that cratered the economy a decade ago are back.

Nerd bomb alert – The Feds are backing $7 trillion in mortgages, way more than they (us) did before the debt crisis of 2008. With taxpayers holding the bag, mortgage lenders have no reason to not give mortgages to people who can’t afford them to buy over-priced houses. The Feds then package those loans and sell them off to other investors.

In fact, fully half of new FHA mortgages consume more than half of the borrower’s monthly income.

If all this sounds familiar, it’s because it is. This is precisely what happened a decade ago. Remember this?

If people run into trouble paying those really expensive mortgages, they’ll stop going out to eat, traveling, buying cars and furniture and washing machines and snowmobiles and anything else they don’t really really need.

The trickle down effect would hit trucking, manufacturing, retail, autos, hard goods, restaurants. Hours would be cut, workers furloughed, payroll slashed as employers conserve cash in an effort to stay afloat.

How does this affect workers’ comp?

We can expect a reduction in claim frequency at the outset of an economic slowdown as workers avoid filing work comp claims because they don’t want to lose income or be replaced. Severity also goes up, because those already out of work don’t have jobs to go back to – and can’t find new jobs.

Over time, frequency rises as we come out of a recession.

What does this mean for you?

Stay informed, and carefully monitor economic conditions in states where you do business.

Among the several things that could affect workers’ comp, the toughest to handicap is the trade war.

[The details are below – a very conservative estimate is the trade wars have already cut annual work comp premiums by $686 million. (300,000 workers, 2080 hours per year, average WC premium rate $1.10 per hour). (source data here)]

That’s about 10,000 lost time claims.

Predictions are difficult mostly because one of the protagonists is entirely unpredictable. While we don’t know what will happen in the future, we do know how the trade war has already affected employment.

This from Yahoo Finance:

Moody’s Analytics estimates that Trump’s trade war with China has already reduced U.S. employment by 300,000 jobs, compared with likely employment levels absent the trade war. That’s a combination of jobs eliminated by firms struggling with tariffs and other elements of the trade war, and jobs that would have been created but haven’t because of reduced economic activity.

If the trade war continues thru the end of this year, Moody’s reports another 150,000 jobs will be eliminated. If the trade war isn’t over by December 2020 the total will double to 900,000.

Other data indicate manufacturing has already shrunk and the number of new jobs created dropped from 1.9 million last year to 1.3 million for the same period in 2019. Most troubling, the CBO is forecasting economic growth will slip below historical averages next year to 1.8%.

Sectors most affected are manufacturing, warehousing, distribution and retail.

Where we live in farm country, the impact of the trade war is visible next door.

Farm equipment sales are slumping as soybean and grain prices have plummeted while steel and aluminum prices jumped. Dairy is a big part of agriculture here; when Mexico – the largest overseas consumer of our milk products – slapped tariffs on US dairy, we lost $1.8 billion in sales. Equipment manufacturers including Deere have lost sales, and the effect is rippling thru communities throughout upstate New York.

What does this mean for you?

If things aren’t resolved by the end of next year, work comp will be losing $2 billion in premium annually.

That’s about 32,000 lost time claims.

Work comp’s medical spend is about 1/100th of total US medical spend.

So we don’t control healthcare, healthcare controls us.

Sure, there are work comp rules and regulations, laws and courts, but medical providers are far more interested in and aware of what Medicare/Medicaid/Private insurance wants/demands/does than all-but-insignificant work comp.

Well, that’s not exactly true – providers are getting ever smarter about how to profit from work comp.

The US health care system needs major reform – covering most/all of us, forcing providers to reduce the cost of care and cost per person, and improving the health of all of us.

I believe we’ll see major national health reform by 2025; others think I’m nuts. (we may both be right!)

If reform happens – or doesn’t – work comp will be affected. Here’s why.

Over the very near term, let’s assume the ACA dies when the Republican Attorneys General win their Texas lawsuit.

The next day – or darn close to it – the legal basis for our healthcare delivery and reimbursement system could be effectively gone. What will providers and insurers do?

Most health insurers will do everything they can to roll back protections for insureds, limit coverage, and tighten provider networks, because they’ll make a lot more profit doing that.

Then, providers will find their patients are increasingly under-insured, or their conditions aren’t covered, or the treatment they prescribe isn’t allowed.

In comes Fred Flintstone with a mushed foot suffered when he dropped a boulder on it, and voila! Provider problem solved…thank you workers’ comp.

The result – workers’ comp may well see higher medical costs from revenue maximizing providers suffering under lower reimbursement and more uninsured care.

If I’m right about national health reform and massive reform does occur, its highly unlikely work comp will be included in that reform. Without much stronger regulatory protection such as a universal all-payer fee schedule, savvy providers will increasingly target work comp as we’re woefully unable to stop sophisticated schemes to suck more dollars out of workers’ comp payers.

The result – workers’ comp may well see higher medical costs from revenue maximizing providers suffering under lower reimbursement and more uninsured care.

What does this mean for you?

Prepare.

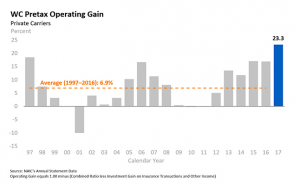

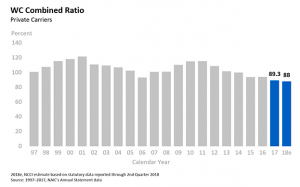

There are no challenges facing today’s work comp insurance industry.

Profitability has never been this high for this long.

The combined ratio – the cost of claims plus admin expense – is historically low, and getting even better.

While rates continue to drop, that isn’t hurting profitability.

Employment and payroll is high and appears (to some) to be stable.

Reserves are far beyond adequate, eliminating fears of a major expense shock or premium jump.

All this joy helps squash any whisper of innovation, any fleeting thought of change, any “risky” initiatives.

The work comp insurance industry has never been better, and has never had better reason to see nothing but blue skies ahead.

That is a grave mistake.

While we must pay close attention to potentially disruptive forces that may well significantly alter the landscape, many are too easily – and far too readily – dismissed. It’s analogous to global warming; the deniers long scoffed, protesting that climate scientists were catastrophizing the likelihood of major change, and here we are.

While outright deniers have much to regret, those who sort of knew the climate is changing have done little to prevent it, adapt to it, mitigate it. That’s in our DNA; we humans survived and flourished through our ability to quickly recognize and address immediate threats.

Very long term threats, not so much.

Some of the external forces are obvious, others are hidden. But all should be acknowledged, objectively considered, and, if necessary, planned for. Over the next few days we’ll be digging into these in some detail.

I offer a few for your consideration.

What does this mean for you?

To be sure, some/many of these won’t happen and/or won’t affect workers comp. But it’s likely some will. The time to prepare is now.

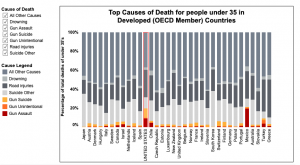

Guns are a major public health and safety problem. Guns are associated with tens of thousands of deaths every year, most preventable.

And we Americans are among the world leaders in death via firearm.

Before you make any assumptions – I own guns. I hunt – although I’m a pretty poor hunter.

My dad taught me to shoot, and handle firearms, and gun safety. Among the guns I own are his service rifle – a 1903 Springfield – from WW2 and the revolver he carried while flying in B-17s over Europe. They mean a lot to me, and one day I’ll pass them down to my kids.

A couple key factoids that are worth considering.

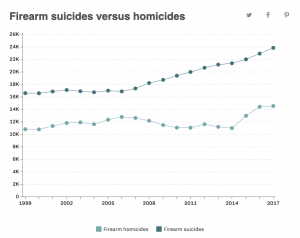

2. Firearms are used to commit far more suicides than homicides.

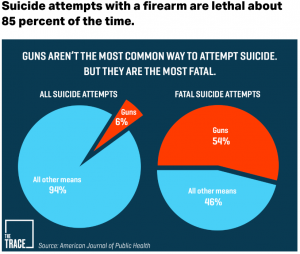

3. People who attempt suicide with a gun are much more likely to die than those who use other means.

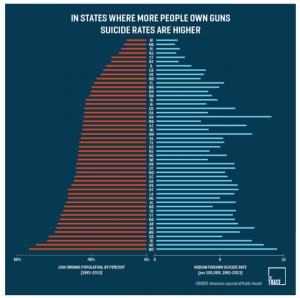

4. There’s a strong correlation between higher rates of gun ownership and higher suicide rates.

5. Lastly, every day 65 people use guns to kill themselves.

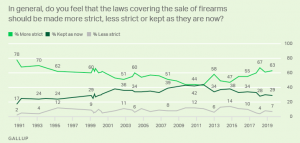

Guns are a major public health concern, yet no other public health menace gets the same public support. As a gun owner, I’m deeply troubled by the willingness of some to advocate positions that will get more guns into more hands – which will lead to more unnecessary tragedies.

What does this mean for you?

The data is clear – people want stricter gun laws – and for very good reason.