No better description of our totally dysfunctional “healthcare” “system” from a good friend and colleague. (this is not my situation)

I thought you might get a kick out of something that happened the other day. I got a call from the hospital where I’ll be getting treatment over the next few months. They wanted to let me know that they have an estimate, based on discussions with my medical insurer, as to what my out of pocket costs would be for the treatment that’s so far been prescribed. After walking me through all the necessary ‘caveats’, the young lady then asked me how I would like to pay my responsible share, which is thousands of dollars.Here’s how the conversation went:Hospital Rep (HR): How would you like to pay these fees that you will be responsible for?Me: Are you asking me to tell you that now?HR: Yes – we can take a credit card or a check number and routing number right over the phone and get it all taken care of right now.Me: But I haven’t even seen the charges or received treatment yet.HR: Oh, don’t worry – you’ll receive the treatment and then we can bill you for any other responsible chargesMe: Is this a joke? You expect me to pay for something off of a verbal discussion – no documentation, no explanation?HR: But I just explained it all to you.Me: Ok – let’s try this – how about I go through the treatment, you run the charges through my insurance, and then we can see what my responsible share is?HR: We can do that too but we prefer to get confirmation of payment up front.Me: So is that required?HR: Is what required?Me: That I pay upfront, with no documentation or having had the benefit of my insurance actually look at the charges first?HR: No, it’s not required, we just prefer it.Me: Got it – we’ll do it the old fashioned way. Send it through insurance and we’ll handle the balance from there.HR: We do have payment plans available with no interest. You could make a payment right now and begin that process right now.Me: Will that be available to me after insurance sees the charges?HR; Will what be available to you?Me: The payment plan option you just told me about.HR: Oh yes.Me: Ok – let me try this again – send the charges to my insurance and once they adjudicate the claims I’ll get back to you on any charges I am responsible for.HR: Well, we know what your deductible is so why not just pay that amount now? Again, we can take a credit card or a check number and routing number.Me: I feel like I’m in a bad Abbott and Costello routine.HR: Who?Me: Never mind – let me be blunt – I’m not paying for anything without documentation. I appreciate you letting me know the estimate but I won’t pay off that either. If that means you won’t perform the service, I’ll find another provider.HR: Oh, of course we’ll provide the service, we just wanted to remove the stress of financial responsibility before the treatment begins.Me: Well, actually, I think you’ve done just the oppositeHR; The opposite of what?Me; Never mind – I have two questions. Can I still get treatment without paying any charges before treatment is provided and second, will you bill me after insurance has reviewed and adjudicated the charges.HR; Yes we will provide the treatments and yes we will bill you after insurance has handled thecharges.Me: Ok -thank you (and I ended the call).

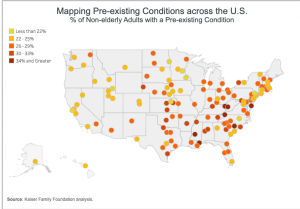

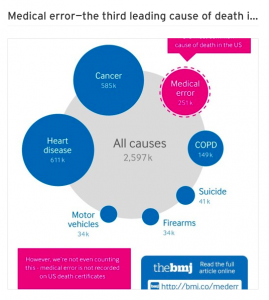

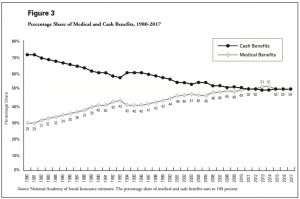

look familiar?

look familiar?