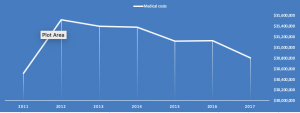

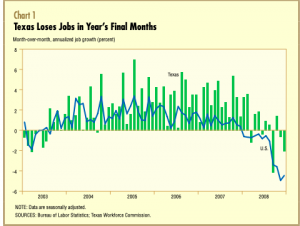

We know work comp medical costs are not increasing; the question is, how does this impact stakeholders?

Employers are pretty happy; comp costs as a percentage of payroll are at or near an all-time low.

Insurers are doing great; combined ratios (incurred losses + expenses/ earned premiums) are stellar. Yes, there’s rate pressure from lots of competition – but profits are still really solid.

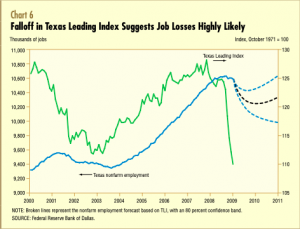

The claims service industry is another story; fewer claims generally mean less need for medical management services – case management, bill review, network services, and IMEs, as well as litigation and settlement support. Note I say “generally”; many carriers are working hard to close older claims, an effort which may well lead to more need for legal and clinical expertise, especially around pharmacy.

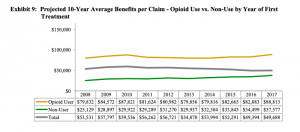

The older the claim, the greater the percentage of spend on pharma. For claims more than 7 years old, 40%+ of medical reserves are for drugs.

More broadly, the drop in demand for claim handling support services is driving massive consolidation. We’ve seen this with PBMs, TPAs, case management and specialty networks and services. And we will see more; expect horizontal consolidation (mergers of companies across service lines) as well as vertical acquisitions (companies in one service area buying their competitors).

This doesn’t mean there isn’t opportunity for smaller firms; those that are relentlessly focused on customer service, effectively differentiate via intelligent marketing, and concentrate on taking work off their customers’ desks will do quite well.

What does this mean for you?

Differentiate.

Identify pain points and show how you can fix them.

Focus your company’s structure, processes, systems, people, and service delivery around your customers – not around “efficiency” or anything else internally oriented.