Insight, analysis & opinion from Joe Paduda

If survey respondents’ estimates of claim count reductions are accurate, we’re looking at about 20% fewer work comp claims in 2020 than last year.

So, what does that mean?

That’s about 1.2 million fewer claims. We can expect a greater percentage of those filed will be lost time; in tough economic times, workers tend to not file claims for minor issues.

Insurers, State Funds, and TPAs

Profit margins for insurers and funds will be higher because there are fewer claims; yes revenues will be lower, but combined ratios will actually improve. But, while margins will be up, dollars of profit will be stable or, more likely, somewhat less.

I’d expect insurers to hunker down and hold on to as much cash as possible. Expect a big push to reduce Unallocated Loss Adjustment Expenses; think fewer dollars for IT projects and the like.

Execs will be looking for ways to reduce allocated expenses and claim costs. Here are a few that may get traction.

Service companies

Companies with very good customer relations and high service standards will win. While staff reductions are inevitable as case loads drop, service companies that manage those reductions wisely and humanely will reap benefits as the workers still employed will show their loyalty by going above and beyond for customers.

On the product side, many vendors are figuring out ways to help employers get safely back to work, prevent workplace infections, and facilitate medical access for patients with injuries. On-site employee assistance, testing access, cleaning services, scheduling support are all in play as is stress management and support for families dealing with illness.

Tele-services are a big part of this; big winners will be those that make the leap from using tele-as just a face-to-face visit to something more substantive, more diagnostic, more useful. There’s lots of creativity at work here…dare I say it innovation may actually become acceptable!

Expect more consolidation as private equity and venture capital owned firms (and others with solid cash reserves) try to buy out competitors, get their customers on board, and do it all on the cheap.

What does this mean for you?

Chaos brings opportunity – especially for those who remember this business is about helping people who are hurt get better.

Finishing up the second survey report on the impact of COVID19 on workers’ comp and one takeaway has me shaking my head.

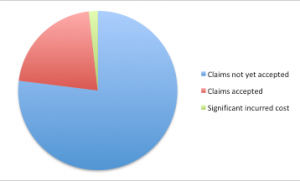

There’s a lot more fear and trepidation about presumption than I think is warranted. Across the 24 payers surveyed (including very large TPAs, insurers, state funds, and employers) there were less than 7,000 COVID claims accepted to date. Yes, several have considerable business in California, Kentucky, and Illinois and more than a few have a lot of health care and public entity clients.

Relatively few of those 7,000 claims are expensive, perhaps less than 5%. And even then they aren’t nearly as costly as real cats with expenses above $1,000,000. And this in an industry that is wildly over-reserved, like $10 billion over-reserved

There’s some – but significantly less concern over plummeting premiums driven by business closures and dramatic declines in payroll. That should be a lot scarier; we are talking billions of dollars of premiums lost, and the potential that figure premiums will not return to pre-COVID levels for a long time – if ever.

This will get worse as governmental entities are forced to layoff workers when sales tax revenues aren’t sufficient to cover payroll.

This is like worrying that your cable bill is going up when your salary’s been cut 30% and your hours reduced.

What does this mean for you?

Focus on the dollars, the pennies are just pennies.

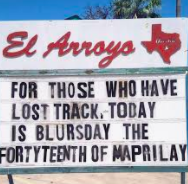

It’s been a not-fun week – but far better here in rural America than a lot of other places…Here’s a few of the better memes I came across.

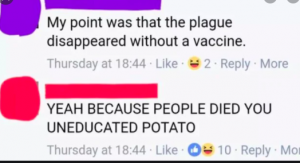

Science marches on!

For those who remember old movies…and why our kids are VERY thankful they are out of the house…

Here in upstate New York, barber shops and salons are open (Yay!) but getting an appointment is impossible (NOOO!)

My vote for best use of humor in a pandemic goes to…

This is just a bit too close to home…

Trekkies have weighed in…

EVERYONE is figuring out how to make their stuff relevant in these troubled times…

You can always rely on SNL to make the most of adversity…love in a time of COVID.

What does this mean for you?

There is life after pandemics – for some of us…

COVID19 is having an impact on work comp payers’ pharmacy programs – but this isn’t due to treatments for the disease itself.

That’s largely because there are no medications that have been shown to be safe and effective in treating COVID19 in credible clinical trials. As a result, there’s little consistency in how payers are approaching medications intended to treat COVID and the symptoms thereof.

Some are approving hydroxychloroquine without a prior authorization (PA) while others require a PA for initial and refills. As the surveys were completed before the latest news that hydroxychloroquine research found less-than-promising clinical results for patients exposed to the virus, it is possible more payers will require at least a PA for future prescriptions. (Other research that reported specific health risks recently came under fire from multiple sources.)

None of the respondents mentioned remdesivir, a brand antiviral that has shown some promise (based on limited clinical trials). This may well change if and when additional trials are completed and the results are satisfactory.

What is consistent is payers’ moves to loosen other prior auth requirements to allow refills for other medications for longer periods and earlier than usual.

Home delivery has also ramped up appreciably, with many retail outlets offering delivery in an effort to keep customers tied to their local store as opposed to using the PBM’s mail order pharmacy.

What does this mean for you?

Unfortunately, we don’t yet have any medications that have been proven to be safe and effective in preventing COVID19 or moderating COVID19’s effects.

Read studies carefully, and get your clinical experts to weigh in on coverage decisions. Science matters.

That’s one of the questions I asked 36 payers and service providers; here’s a snapshot of their responses along with some interpretation…

Service types

Briefly, those services that happen earliest in the claim and/or require face-to-face contact have seen the greatest impact as new claims volumes dropped overnight.

Initial visits to occ med clinics, transportation, imaging, PT and rehab, IMEs, Field Case Management, surgery and management thereof have taken the biggest hit to date. Network revenues are suffering as a result, as is UR.

As the shutdown and peoples’ reluctance to expose themselves to infection continue, there have been significant reductions in bill review and network business volume.

Less – but still somewhat – affected are sectors that get most of their revenue from longer-duration claims. Think home health care and DME, Pharmacy Benefit Management.

Business models

Cash-rich companies with manageable (or no) debt are in far better position to weather the crisis than highly leveraged firms. This generally benefits founder-owned companies and those with solid cash reserves.

Networks may well weather the crisis as they are generally high-margin businesses with relatively low staffing requirements.

Companies that have kept more of their business functions on-shore are in far better shape than those that outsourced critical functions such as turning paper into pixels (processing documents), clinical support, provider relations, and call center operations.

There’s a lot of nuance to this; thanks to the 36 respondents for their insightful and sometimes surprising views.

What does this mean for you?

Cash is king. On-shoring is critical.

Note – A public version of the report will be available in 2 weeks; respondents will receive a detailed version. A third version with additional interpretation will be available for purchase.

COVID’s biggest impact on workers’ comp has not been from the disease, but rather from efforts to control its spread and the resulting impact on the economy.

35 workers’ comp insurers, state funds, TPAs, and service providers and large self-insured/self-administered employers took part in our second Survey of the impact of COVID-19 on Workers’ Comp. Payers have received about 33,000 COVID-19 claims to date and accepted just over 1/5th of all claims filed.

While there are major differences in claim acceptance policies across the respondents, by far the most common reason claims have not been accepted is a lack of a diagnosis, no symptoms, and/or a negative test for COVID19.

The “non-COVID” effects include:

For payers with large books of small businesses, retail, hospitality, and travel the picture so far is grim, with most expecting major declines in premiums.

The good news is the cost of COVID claims remains pretty low, with most accepted claims resolving with minimal expense. A relative handful have been quite expensive (>$200,000) due to costs associated with ICU and ventilator care.

The big winner is tele-everything. The big service providers all reported massive increases in tele-rehab, tele-triage, and tele-medicine visits with most indicating they expect this to persist after we are through the COVID19 pandemic.

As I work thru the data we’ll be publishing more details; a public version of the report will be available in about 3 weeks.

What does this mean for you?

This will be a very tough six months. The big decline in new claims and drop in premiums will have knock-on effects throughout the industry and every stakeholder.

After 28 calls with workers’ comp execs over the last 8 days it’s quite clear many are very concerned about specific issues.

Premiums

With payrolls plummeting, small businesses closed and many not likely to re-open, and many governmental entities under severe pressure due to lack of income from sales and other taxes, insurers are quite nervous about premium income.

With PPP expiring at the end of next month, more employers may lay off workers they had to keep on payroll.

Impacted most will be carriers focused on smaller businesses, especially hospitality, retail, and tourism-related sectors.

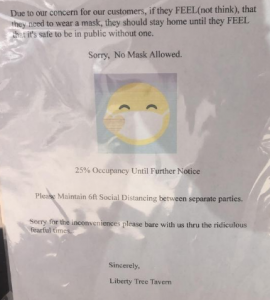

Multi-line liability

Several insurer execs voiced deep unease about general liability-related issues related to employees contracting COVID at the workplace. If those workers go home and family members become infected, there’s concern the employer may have some degree of liability. Especially if they knowingly flaunted or ignored safety guidance.

This unease may well be justified…

The tail

Several execs specifically tasked with leading their companies’ COVID response noted a lack of clear understanding about the near-term and long-term impacts of COVID on patients. Permanent lung damage, kidney problems, blood clots, cardiac issues, and health problems related to long-term use of ventilators were all cited as potential concerns for patients with severe cases of COVID19.

Relatively few patients are likely to suffer these conditions. However for those that do, the potential impact on the patient’s health and well-being, along with future employment implications merit close attention.

Presumption

Most of all, executives want certainty. Ideally, many want COVID to be classified as a “disease of life”, but in multiple states that ship appears to have sailed.

What does this mean for you?

We don’t know much at all about COVID, so we’d better pay very close attention to facts and data, not political pandering and nonsense.

We are more than halfway thru our second Survey of COVID19’s Impact on Workers’ Compensation (details on the first survey and a link to the abstract is here).

Respondents include:

Top takeaways from the 18 surveys completed to date:

Service provider takeaways:

I’ll finish the Surveys late tomorrow, then it’s analysis and report prep. Respondents will get a (very) detailed version of the Survey Report; an abstract will be available to the public.

And thanks VERY much to the 30+ payer executives who are sharing their experience; their reward will be knowing a lot more about the impacts of COVID, how other payers are responding, and how others are adapting.

What does this mean for you?

COVID’s impact on workers’ comp will not be COVID claims or costs.

Four months into the COVID pandemic, early data show workers’ comp insurers are doing the right thing.

Two data sources support this assertion – CWCI’s just-released analysis of 1,077 California claims and a dozen conversations I’ve had with insurers, large self-insured employers, and service providers over the last two days.

First, CWCI.

CWCI’s researchers and statisticians analyzed 1,077 COVID-19 claims from 28 insurer and self-insured CWCI members. Notably, these are claims filed before April 30, a week before the governor’s Order granted the disputable presumption.

Key findings:

Next, I’m in the midst of a second national survey of payers and service providers about their experience with COVID-19. (details on the first survey are here.)

Key preliminary findings (based on a dozen completed surveys):

What we know so far.

Based on what we know today, workers’ comp insurers, state funds, and self-insured employers are doing the right thing.

Despite that, several states are contemplating bills or executive action to make workers’ comp the default payer for COVID19.

California’s SB1159 is the poster child; from CWCI – “By including all types of employment without regard to the level of risk actually posted, the presumptions greatly expand the nature and scope traditionally encompassed by presumptions of compensability in California.

More specifically, the bill makes workers’ comp responsible for COVID-19 diagnoses even among workers deemed “low risk” for contracting the disease at work by OSHA. That is, workers with “minimal occupational contact with co-workers or the public.”

COVID-19 is a relatively small occupational issue, but a huge societal one.

Yes, workers who contract the disease through work should be covered by workers’ comp – and all the evidence to date indicates that’s happening.

But work comp should NOT be the piggy bank for any and all COVID claims – which is precisely what SB1159 and similar actions in other states would do.

What’s driving this is our totally dysfunctional healthcare system, one that relies on private insurers, employers, and employees to generate much of the revenue and all of the profits. Hospitals, health systems, medical practices and other providers are in desperate financial shape; it will get worse over the next few months.

Dumping the responsibility for a societal pandemic on a tiny industry that pays less than 1 percent of total US medical costs is not only irresponsible, it also won’t work. Workers’ comp insurers, excess insurers, employers, and governmental entities don’t have the financial resources, skills, staff, or capability to manage and pay for the care of hundreds of thousands of patients, while also covering their lost wages.

This is society’s problem. It’s time governors, state legislators, Congress and the President do their job. Take responsibility – just like the workers’ comp industry has.

What does this mean for you?

Workers’ comp payers – keep doing what you’re doing.