There’s a lot of hope – in my house just as in your’s – that we will have a safe, effective and durable COVID19 vaccine in 2020.

Hope is not a strategy, nor should it guide our personal or professional behavior and planning.

Consider this.

Vaccine development

- the record for the fastest vaccine ever brought to market was 4 years for Merck’s mumps vaccine

- We’ve been trying unsuccessfully to get an HIV vaccine since the 1980s

- over the last quarter-century, a total of 7 vaccines for new pathogens have been successfully developed and rolled out globally.

- From the CEO of Merck, the world’s largest vaccine company:

There are a lot of examples of vaccines in the past that have stimulated the immune system, but ultimately didn’t confer protection. And unfortunately, there are some cases where it stimulated the immune system and not only it didn’t confer protection, but actually helped the virus invade the cell because it was incomplete in terms of its immunogenic properties. [emphasis added]

Merck CEO Kenneth Frazier

Vaccine delivery

COVID19 is a global pandemic; many countries have no where near the healthcare infrastructure the US has, are conducting far fewer tests, and don’t have the money to pay for expensive treatment or widespread immunization. Right now, even the US is in deep trouble with almost a quarter of the world’s recorded infections and over 130,000 deaths in six months – more than twice the number of Americans that died from opioid overdoses last year…

And;

- some vaccines require boosters or are a two-shot series;

- some must be given every year while others convey lifetime protection;

- some require refrigeration and special handling;

- this will likely require hundreds of millions of bottles, caps, syringes, needles or other delivery mechanisms;

- all must be kept sterile until use;

Let us not forget there is a substantial number of people who reject immunizations for reasons of their own.

I’ll balance this with a note that the COVID19 vaccine effort is unprecedented; there are about 160 vaccine efforts now underway. Thousands of brilliant minds are using incredibly powerful computing systems to figure this out. They are using different delivery mechanisms, trying old vaccines, experimenting with RNA-based technology, working to stimulate the immune system all in an effort to stop or blunt the impact of COVID19 infections.

It’s possible we’ll have a proven vaccine proven to be safe, effective, and durable by the end of the year. It’s also unlikely.

Whenever it arrives, make sure you are alive and well enough to be vaccinated.

What does this mean for you?

Until then, wear the mask and don’t do stupid stuff.

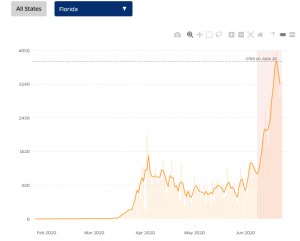

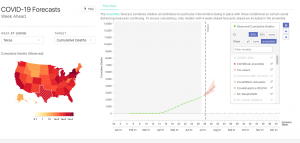

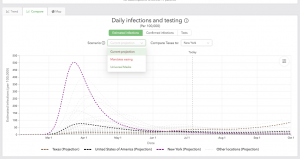

chart used by permission

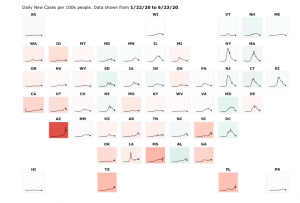

chart used by permission

Quick takeaways:

Quick takeaways: