Well, yes – but it’s not intentional.

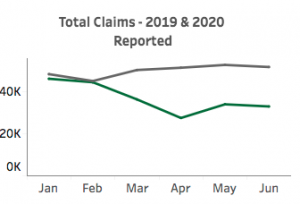

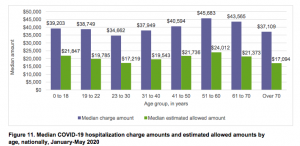

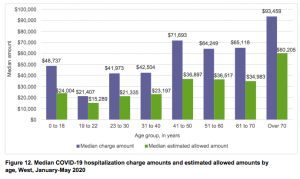

Most medical practices have seen a sharp drop in patient visits – and revenues – due to patient concern over COVID19 exposure. Hospitals have also suffered, as have ancillary providers, and many are on the brink of financial collapse.

Rural and safety-net providers are especially vulnerable, as many were on very shaky ground before COVID19.

Primary care providers are in the worst shape, as their patients often don’t have serious health needs that need to be addressed immediately. And primary care providers have the lowest pay as well. Research indicates that PCPs will lose about $15 billion this year.

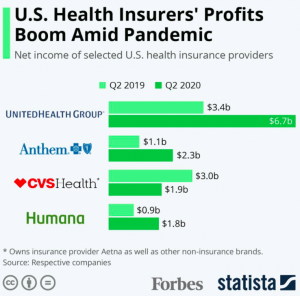

Meanwhile, health insurers’ finances have never been better.

The connection is clear – insured people are not getting care, so insurers don’t have to pay their bills.

For months, healthcare providers have called on insurers to help them out by prepaying for care, paying billed charges, authorizing all treatment requests, providing loans, or otherwise funding providers. Much of this is nonsensical; authorizing all treatment requests would certainly lead to widespread abuse, over-treatment, and poor outcomes. Paying billed charges is nuts; NO ONE pays billed charges, which can be 10-30 times higher than average reimbursement.

What’s clear is COVID has likely created a significant one-time profit bump for healthplans, as a lot of foregone care will not be “made up” as practices gradually return to normal. While insurers should carefully assess their reserves, it is highly likely their “excess profits” won’t all be needed to pay for future COVID19 costs.

So, what to do?

Prepaying care may be a viable option. Healthplans would mine their data to determine what they paid a practice in the recent past, figure out how many members are using that practice, and sign a contract with the practice to ensure the plan’s interests are protected.

That’s just a short-term solution to a problem with roots that far predate the pandemic.

Reality is primary care is still under-valued, fee for service creates huge administrative friction and incentivizes over-treatment, and health care prices are unsustainably high.

What does this mean for you?

COVID will accelerate systemic changes that are desperately needed. There will be lots of pain for some stakeholders – primarily specialists and facilities.