Haven Healthcare – the Amazon-JPMorgan-Berkshire Hathaway joint venture intended to re-invent healthcare – is no more. The quest to improve access to primary care, simplify insurance coverage, and make prescription drugs more affordable ended after three years.

We don’t know why Haven is now in heaven; it could be that three of the most powerful and well-run organizations in the world could not figure out how to build a better healthcare system.

Or it could be that they each had different motivations, different needs, and different priorities and could not figure out how to work together. That would not be a surprise. Or that their well-known, accomplished, and brilliant CEO was not an effective CEO (that’s not a slam; I’m no operator either).

Or more likely – all of the above plus more.

Regardless, it’s dead. Workers’ comp execs can learn three lessons from Haven’s failure.

CEO Atul Gawande MD lacked the intimate, deep knowledge of healthcare infrastructure, reimbursement, regulations and management required to be successful. A brilliant writer, insightful analyst, and highly visible public figure, Gawande didn’t have the management chops. He also didn’t give up his other jobs and had no experience as CEO of a start-up.

Implications – Two things – knowledge and commitment.

Do you know anyone in workers’ comp with deep knowledge of healthcare? Someone who understands reimbursement, infrastructure, process, the regulatory environment? Medical drives workers comp, and very few comp execs have that knowledge and understanding.

Many who think they do – don’t.

Then there’s commitment. Gawande was committed to Haven – and frankly the three founding companies were as well – like the chicken is committed to breakfast.

If you want to take on something as daunting as reforming healthcare, you’d best be committed to the task like the the pig is committed to breakfast.

Second, market share. With about 1.6 million employees – and perhaps 5 million insureds – the three giants had a lot of lives to cover, a lot of healthcare dollars to leverage (about $24 billion in employer costs and a total of about $30 billion). BUT, the proverbial mile-long-and-inch-deep problem meant Haven didn’t have local scale.

Healthcare is local – facilities and medical practices want insured bodies, the more the better. Outside of a very few markets where Amazon has big distribution centers, Haven didn’t have enough bodies to leverage big changes.

Implication – Total annual medical spend in workers’ comp is about the same as Haven’s – $31 billion. That is less than 1 percent of US medical spend. Haven tried to leverage all those dollars. It failed.

Unlike Haven, there are lots of workers’ comp networks all trying to negotiate deals – the largest may have $8 billion in spend nationally.

That is small potatoes indeed…A mere tablespoon of hash browns.

What does this mean for you?

The workers’ comp industry cannot “solve” healthcare. But that’s not the point.

The point is this – organizations and leaders that know more about healthcare, that are more committed to doing better, will far outperform their competitors.

As employment, payroll, and injury rates all remain under pressure, total premiums will remain significantly lower than we’d expect in a non-COVID, non-recession environment. We are also on the tail end of the

As employment, payroll, and injury rates all remain under pressure, total premiums will remain significantly lower than we’d expect in a non-COVID, non-recession environment. We are also on the tail end of the

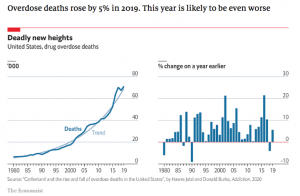

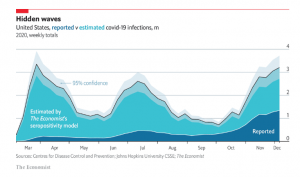

The Economist has a very well done

The Economist has a very well done