One of the top work comp events is three weeks away – WCRI’s annual research conference kicks off on March 23 and continues the following day.

Registration is here.

I connected with John Ruser PhD to get the scoop on what we’ll learn at the Conference; here’s an edited version of our interview.

1) We now have data to help us understand how the pandemic has affected workers’ comp. What are some of the key findings you and Dr. Fomenko will be discussing?

We have data over the first half of 2020, that is, the early part of the pandemic, which shows where claims were rising by state and industry. We show how COVID claims were associated with the severity of the pandemic in each state and with presumption laws in effect at that time. There was a large drop in non-COVID claims in the second quarter. We will address how these claims were linked to locations where the pandemic was more severe and employment dropped the most. We will also address the mix of medical-only versus lost-time claims. In the second quarter of 2020, there was an increase in the proportion of lost-time claims, likely due to COVID-19 claims that were much more likely to have more than seven days of time away from work, while non-COVID claims also had longer duration.

Regarding non-COVID claims, we continue to see the same distribution by type of injury, e.g., sprains and fractures, not a shift to fewer soft tissue claims – there were fewer of those but they were more severe.

We will also talk about how the pandemic affected the provision of medical care, that is, to what extent there were delays in the provision of care, particularly for elective surgeries.

2) As we’ve tried to understand the impact of the pandemic, one of the biggest challenges has involved data – what should we be collecting, how fast can we get it, what sources are most useful, and how can we best use data to understand a novel situation. How has WCRI adapted to quickly understand what’s happening during the pandemic?

We accelerated data processing to accommodate for COVID-19, not necessarily getting data faster, but rather processing and analyzing it more rapidly. Our report on the impact of COVID-19 on claim composition is also shorter due to the need to focus on higher priority topics in a shorter period of time. While there is a need to have rapid and timely data to understand the early impact of the pandemic, there are still a lot of questions you can’t answer with quick data. Other fundamental questions will be answered with more mature data, specifically issues including long haulers, impacts on the injured worker of surgery delays and disruption in provision of care, and other longer-term impacts that are not so apparent now.

3) Dr. Thumula and Dr. Savych will be discussing the latest research on prescription drug usage; our understanding of the impact of drugs on claims has evolved rapidly. What do we know now that we did not a few years ago?

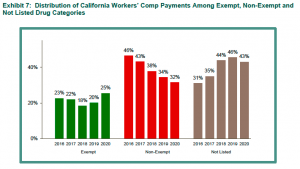

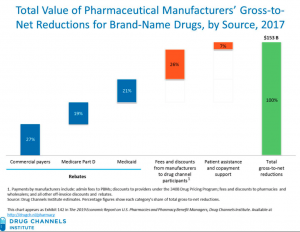

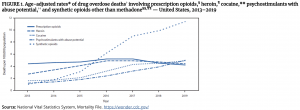

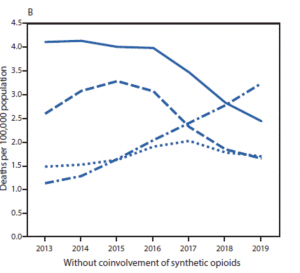

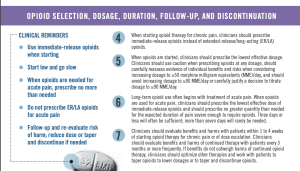

They will bring together a couple of different WCRI studies, looking at the relationship between opioid policies and utilization in workers’ compensation and off-label prescribing. Regarding opioids, what is new is measuring the impact of policies on changes in opioid utilization, including prescription drug monitoring programs and prescribing limits. The session will also cover the rise in workers’ compensation of off-label prescribing of gabapentinoids and topical dermatologicals. Physician dispensing will also be addressed.

4) WCRI had to change how it operated due to the pandemic and restrictions. Talk about how that happened, what the impact has been, and what you see changing over the long term.

Everyone is remote. There is a skeleton crew in the office every day to handle day-to-day stuff but nearly all work is done at home; we are fortunate that we had an emergency operations plan in place and had upgraded IT recently. On March 12 we had a staff meeting, planned a March 13 dry run of the operating plan, and planned to come back Monday – the dry run turned into a year working from home. We had to learn how to do work via video and maintain cohesion, handle staff meetings, and run social events. We have done several webinars – one with Judge Langham had 1,600 registrants.

We have been able to participate in more conferences and events, and with our virtual conference, we will reach a lot more people. Registration numbers are exceeding what’s normal for an in-person conference. Since the conference is virtual, we have been able to secure speakers we normally may not be able to get since the time commitment is less, such as

- Katharine Abraham ─ who ran the Bureau of Labor Statistics (BLS) and is a former member of the President’s Council of Economic Advisers ─ will talk about the economic impact of COVID-19;

- Jewel Mullen – former principal deputy assistant secretary for health and acting director of the National Vaccine Program Office in the U.S. Department of Health and Human Services ─ will talk about vaccines; and

- Director John Howard of the National Institute for Occupational Safety and Health will be speaking on the future of work and work safety.

Our conference will be a blend of recorded sessions and live Q&A.

5) More broadly, do you see the rest of the economy changing significantly ─ and for the long term ─ as a result of the pandemic? What does this mean for labor, employment, and workers’ comp?

Two plus years out, things will likely be different – we might anticipate more work from home and not as much business travel, and some structural changes such as more online shopping. The question is what will the magnitude of change be? Dr. Abraham will talk about that and what the future will look like. She ran the BLS and is well versed in the data. She’ll talk about the prospect of long-term unemployment and scarring effects of that. She will also talk about the extent to which changes in education might impact labor market prospects in the future.

Anything else you want to add?

We hope to see you at our conference, March 23 and 24. In addition to drawing upon the diverse perspectives of highly respected workers’ compensation experts and policymakers from across the country, we will be presenting our latest research findings. And it’s virtual, so you can attend from the comfort of your home or office. It is also shorter with four sessions per day in the afternoon from 1-4p.m. ET. Registration is free for WCRI members, state legislators, and members of the press, and $175 for non-members. To learn more and register, visit https://www.wcrinet.org/news/events/37th-annual-wcri-issues-research-conference.