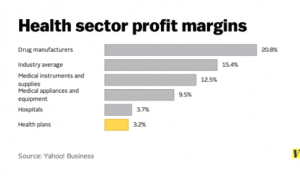

Ed. note – got an email from a colleague asking “so why should I care about who owns who or what their strategy is?” Because your service providers – that you pay a shipload of dollars to and through – determine your medical and combined loss ratios. So you’d best figure out if your priorities are the same as their’s.

Okay, we’ve dug thru the differences between corporate- vs private-equity owned work comp service providers, today we focus on multi-service providers and single-service providers – and how they compare.

The first group is Mitchell Genex Coventry (MGC), Optum WC, and OneCall; the second Conduent, ExamWorks and MedRisk (HSA consulting client).

The good thing about being a multi-service entity is you’ve got flexibility, a diverse income stream, and several services/products that may interest prospects and keep customers tied down. You may also be able to leverage one line to get more business, and depending on what your services are, perhaps even apply enough pressure to force customers to use those other services.

The bad thing is your business lines are rarely all best in class; an under-performing service may de-value your other lines. The other bad thing is they can be pretty different, require different expertise, systems, processes, reporting, and network development.

Example – Imaging is one-and-done, customer value is mostly scheduling and price (yeah people talk “quality” of reads…but its almost always talk). Physical medicine is utilization-driven as price-per-service way less important than a scan that often costs 15-20x more than a PT service. PM also requires lots of data and information feeds, more clinical oversight, a different contracting strategy, and ongoing monitoring of attendance and progress. Transportation is different as well, and so is DME.

Net is it is difficult indeed to be really good at multiple services AND have scale where you can get competitive prices and deliver all services everywhere payers need them delivered.

Single-service suppliers get really really good at one thing; this affords them scale, reduces distractions, and builds a lot of corporate expertise – and if done well – a solid brand.

But – and it’s a darn big but – if a big state changes its fee schedule, or Medicare does the same, you could be screwed. Example – California adopted a Medicare-based fee schedule the same year Medicare slashed reimbursement for imaging. Imaging companies got hammered, as California has about 17% of the nation’s WC volume.

Okay, so here’s the net – Multi-line businesses are tougher to manage, but can insulate the owner from regulatory risk and provide leverage over customers.

Single-service suppliers are usually really good at what they do, but there’s that regulatory risk thing.

All that said, each of these companies is – in some very important ways – unique. with their own strengths and weaknesses, strategies and tactics.

What does this mean for you?

Are your suppliers’ priorities, successes, and growth strategies aligned with yours?