Well. that was welcome indeed.

Looks like the Dems in Congress have reached a deal on controlling (some) drug prices. As with all legislation, it is far from perfect, no one is particularly ecstatic, but then again, politics is the art of the possible, and the deal WILL help control drug price increases. Especially for older Americans who now get out-of-pocket spending on drugs capped at $2,000 a year and diabetics who will get a cap on insulin at $35.

Will this effect workers’ comp? Unlikely. WC drug fee schedules are based on AWP except in Cali, where it is based on Medicaid.

The Labor Department’s jobs report this morning showed over half a million people were hired last month, a major jump over prior months. Over 5 million (!) have been hired since January.

This means – higher payrolls = more people insured, more payroll, more consumption.

I expect employment will be a topic of conversation at WCRI’s annual meeting, slated for March 16 – 17 in Boston. Save that date and make sure you are on their mailing list as this always sells out.

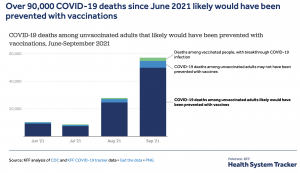

All things COVID

Two drug manufacturers reported positive results for their new COVID treatment medications. Just-released data from a clinical trial indicated Pfizer’s Paxlovid cut the risk of hospitalization or death a whopping 89 percent when administered within three days after the start of symptoms. Paxlovid won’t be widely available for several months, and then will likely be prescribed mostly to high-risk people. Treatment will cost about $700 per patient.

Merck’s molnupiravir will cost about the same; it has been approved for use in the UK and the manufacturer has applied for an Emergency Use Authorization (EUA) here in the US. As reported in the Economist, research

“found the interim results of a trial found that patients with a risk factor for covid-19 were 50% less likely to be hospitalised or die if the oral antibiotic was taken in the first five days after symptoms.”

While neither is available just yet, expect both to get EUA approval shortly. BTW, remember the vaccines were also administered under EUA.

We are learning more each day about long COVID, and much of what we are learning isn’t good (note that’s not surprising, as first we need to understand the problem and only then can we work on solutions). Significant GI problems are one issue, and the more severely affected patients also present with anxiety and sadness. That’s not surprising either, as nothing makes you more miserable than a severe GI problem.

BUT… one of the report’s authors noted “We do not know whether the psychiatric symptoms are a cause or a result of the GI symptoms, but we suspect it is likely to be both,”

About 20 million of us have experienced symptoms such as difficulty breathing, pain, hypertension and fatigue that are consistent with long COVID. Get the latest on November 17 at noon eastern when the National Institute for Health Care Management hosts a time of a webinar on the “Implications of Long COVID for patients and the health care system.” Register here.

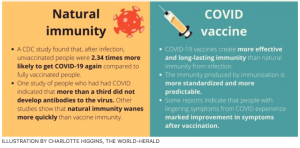

Alert for some readers advocating “natural”immunity… A new study found “unvaccinated US adults who previously had COVID-19 contracted the disease at more than five times the rate of those who were fully vaccinated.”

What does this mean for you?

Get the shot.