In a tiktok video circulating among healthcare workers a traveling nurse bluntly describes the very near future – no beds. For those blithely going on about their lives, ignorant of the impact of the anti-vaccine movement on our healthcare system and the people who take care of us, the video should be required viewing.

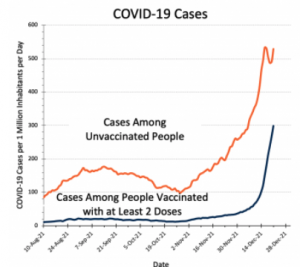

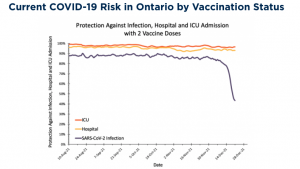

There is a direct connection between vaccine resistance and the dire state of our healthcare system, yet most resisters seem quite unconcerned about the effects of those decisions on their neighbors, family, friends, coworkers, and the healthcare system and healthcare workers.

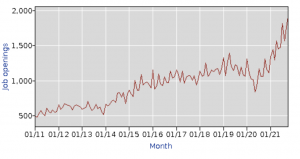

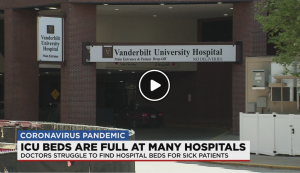

Today, one out of five hospitals is critically under-staffed, the result of staff burnout, increasing frustration and intolerable working conditions. Over the last year the nation has lost more than 10,000 staffed ICU beds and almost 4 out of 5 of the remaining beds are occupied.

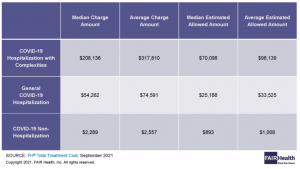

The combination of a flood of COVID patients and staff losses from resignation and COVID quarantine is exacerbating the staffing crisis and affecting non-COID patients. In almost half of all states, hospitals are postponing elective surgeries – forcing patients to delay hip replacements, cancer surgery, non-urgent cardiac bypass operations and other non-emergency care. Legally required to care for COVID patients regardless of their ability to pay, a growing number of hospitals have been forced to limit or forgo elective procedures. The longer this persists, the bigger the financial impact on facilities unable to bill private payers for lucrative services.

Here in New Hampshire’s Upper Valley hospital ICUs are nearing full capacity, National Guard troops are helping staff emergency rooms because ER nurses are needed in ICUs and CCUs. What used to be 12-hour shifts are now stretching beyond 13.

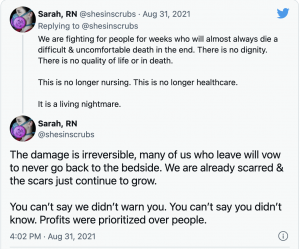

Nurses don’t have time to use the bathroom much less grab a bite to eat or get off their feet for a few minutes.

Staff nurses making $45 an hour are working alongside traveling nurses earning 3 times that. At some hospitals workers exposed to or testing positive for COVID are required to take PTO (personal time off) while in quarantine, a policy that infuriates the very people tasked with caring for us.

The explosive spread of COVID has led to more primary care physicians refusing to see patients in person, demanding patients go to Emergency Rooms for COVID tests, throat cultures, blood pressure tests, and other diagnostics. Staff are furious at this as it further overloads ERs and more people are needlessly exposed to COVID.

Of late, every day brings more bad news for staff. PPE supplies are tightening , the American Heart Association just released a policy change telling healthcare workers they don’t need PPE while doing CPR on COVID-positive patients and the CDC is telling healthcare workers exposed to COVID they need only isolate for 5 days. A few facilities are asking nurses that tested positive for COVID to come to work anyway. Hardly the policies, practices, and statements that will engender loyalty and strengthen commitment among healthcare staff.

It’s not as if administrators have many other options. They are beyond swamped, scrambling to find enough people to fill the next shift, unable to plan much beyond that. With more and more nurses and other staff quitting, that task will just get harder and harder. That said, hospital administrators can and SHOULD be doing a lot more for front-line staff.

Retention bonuses, day-care assistance, hazardous duty pay are among the measures smart administrators should be taking. Alas few are.

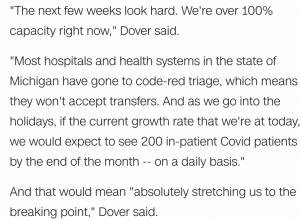

Health care is in crisis today in Alabama, Ohio, New York, Washington DC, Michigan, Georgia, and Rhode Island. More southern states are about to enter crisis stage, overwhelmed with COVID patients most of whom are unvaccinated.

The reality is America is not “in this together”; far from it.

Our healthcare workers, our healthcare system and the mask-wearing vaccinated are on one side, desperately trying to protect all, care for grievously ill patients and save lives. The unvaccinated and their enablers are on the other, blithely ignoring the consequences of their decisions while demanding care when they fall ill.

While some groups have every right to be careful if not outright suspicious of vaccines (the Tuskegee tragedy’s fallout is still resonating), the vast majority of the anti-vax crowd’s claims are patently false and easily refuted. Some states are even paying unemployment benefits to vaccine refusers who’ve lost their jobs, rewarding behavior that is directly responsible for our collapsing healthcare system.

It’s not as if COVID is the only problem facing our healthcare system. The mess that is information “sharing”, fee for service reimbursement, balkanized delivery systems, ineffective over- and under-regulation and the for-profit motive that drives most of US healthcare all contributed to the crisis. But COVID – and the politicization of vaccines and masks – is different.

With choice comes consequence, with freedom comes responsibility.

Unfortunately, that’s exactly what is missing – a willingness on the part of most vaccine refusers to take responsibility. What’s also missing is a willingness to hold refusers accountable. Pundits and politicians want us to be patient, to listen, to engage, educate, empathize and respect divergent opinions. For two years we have been doing just that, and while we have been listening and seeking to understand our healthcare system nears collapse.

We respect vaccine refusers’ right to make those decisions, and they must accept and take responsibility for their central role in the collapse of our healthcare system.

Without that, we will never be in this together.

As employment, payroll, and injury rates all remain under pressure, total premiums will remain significantly lower than we’d expect in a non-COVID, non-recession environment. We are also on the tail end of the

As employment, payroll, and injury rates all remain under pressure, total premiums will remain significantly lower than we’d expect in a non-COVID, non-recession environment. We are also on the tail end of the