This is the fourth attempt to warn you about the impending disaster facing all of us.

Our incredibly dysfunctional healthcare system is collapsing, falling apart as thousands of highly-experienced and very well-trained critical staff leave care provider roles.

- nurses who are inexperienced are replacing those who retired or were enticed by financial incentives to become travel nurses.

- So many older nurses have quit, and younger nurses are at the bedside.

Hospitals are turning to traveling staff, costing facilities 4 to 5 times more than full-time workers. In response, and in a classic “treat the symptom while ignoring the problem” move some well-intentioned but pretty clueless elected officials are trying to pass a bill that would restrict traveling staff agencies’ pricing.

That is both pointless and pathetic. It reflects those officials’ paying attention to healthcare executives while ignoring what’s happening to care workers on front lines.

Instead our Representatives should be:

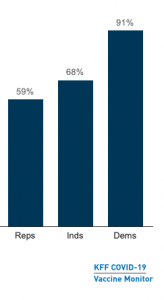

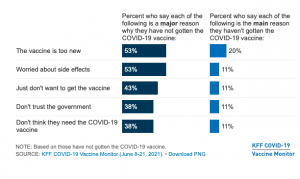

- confronting those who are lying about COVID and vaccines,

- using every tool and lever they have to support health care workers,

- implementing financial penalties for illegitimate vaccine refusers in the form of higher premiums, copays, and deductibles.

It’s even worse at long-term care and rehab facilities…and it has undoubtedly gotten worse since those data were collected back in June 2021. And it’s happening in Florida, California, and Indiana – and in your state too.

Here’s why. And no, it’s not vaccine mandates.

From a great piece in The Baltimore Sun:

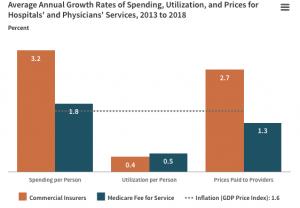

The great “financialization” of the health care industry has finally trickled down. Capitalism and the unfettered and unfiltered drive for the dollar has degraded the nursing profession in many regards. The historic exploitation of nurses to increase productivity and reduce costs, worsened by the pandemic, has led to a historic nursing shortage being faced today. [emphasis added]

This is the macro, structural driver – the unbound drive for profits..

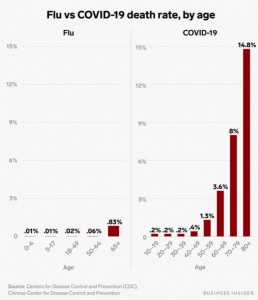

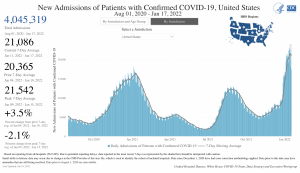

COVID – and more specifically disinformation and vaccine resistance – has greatly accelerated and deepened the crisis.

The multiple waves of COVID and the relentless flood of disinformation and lies have crushed the life out of nurses and healthcare workers, each successive wave burying healthcare workers ever deeper until many can see no escape. Nurses are at much higher risk for suicide than most other workers.

Experienced, trained, passionate and skilled nurses and healthcare workers are leaving patient care.

What does this mean for you?

Sooner or later you will bring a family member to a hospital.

The staff will be less experienced, less skilled, less knowledgeable and less able to provide care.

Lies and disinformation have consequences.