Yesterday we kicked off Workers’ comp pharmacy week with a quick review of WCRI’s latest research.

Today we’ll focus on our annual Survey of Pharmacy Benefit Management in Workers’ Compensation. We’ve been doing this for (gulp!) 19 years, and I’m (belatedly) ready to begin the 2022 Survey. Past public versions of the Survey are available here; there’s no cost and no registration necessary.

Respondents receive a more detailed version to reflect their contribution to the effort.

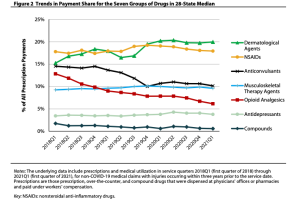

Top takeaways from last year’s report included:

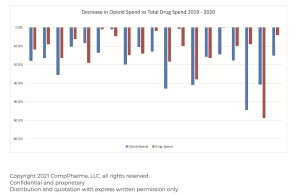

- Total work comp drug spend for 2020 was about $3 billion, or about 10% of total medical spend.

- The percentage decrease from 2019 to 2020 was 12.3%

- That’s down from $4.8 billion a decade ago.

- Opioid spend declined 19.3% from 2019 to 2020; Opioids accounted for 17% of total drug spend across all respondents.

- Pharmacy management remains important despite these decreases, primarily due to respondents’ view that drugs have a disproportionate influence on claim outcomes and disability duration.

Over the next few days we’ll be reaching out to past participants; if you are a payer and would like to participate in the Survey (and get the detailed report) please leave a comment below with your contact information (it won’t be published).

All responses are confidential, are only used in the aggregate or are de-identified to protect confidentiality.