Exclusive!!! photo of Texas’ elected representatives’ legislation development process

(earlier reporting on TM’s health benefits thing is here.)

The Net – If employers and their employees aren’t happy with Texas Mutual’s health benefits program, TM’s brand will suffer.

TM will NOT be selling health insurance, rather it will be selling “level funded plans” – a form of self-insurance. TM will be acting as a TPA and stop-loss carrier for health benefits plans.

This is a BIG deal, because unlike health insurance plans, Self-insured plans are regulated by the Feds under ERISA – NOT by the State of Texas.

ERISA is hugely complicated; very few small business brokers understand ERISA.

And you can rest assured NONE of their employer customers will have a clue…that is, until something hits the fan. Oh, and under ERISA, the employer is legally responsible and liable for compliance – NOT TM, the broker, stop-loss carrier, TPA, or any other party.

Here’s just a few of the issues…

- Unlike the employer’s single contract for health insurance, ERISA plans have multiple contracts (listed below) — all contracts must be completely consistent on coverage, financial liability, and which benefits are covered at what level.

- Stop loss – stop loss carriers determine what they’ll pay for; unless the contract explicitly states it will pay for EVERYTHING that’s approved by the employer, the carrier alone determines what it will – and won’t – pay.

- Oh, and stop-loss contracts do NOT pay for medical management fees, like those incurred in reducing huge hospital bills – the employer does.

- TPA

- Employer

- Possibly others e.g. network, medical management

- Stop loss – stop loss carriers determine what they’ll pay for; unless the contract explicitly states it will pay for EVERYTHING that’s approved by the employer, the carrier alone determines what it will – and won’t – pay.

- Brokers will have to explain to employers how TM’s plan is different from “health insurance” – but very few – if any – brokers will know or be able to clearly explain those differences.

- Example – ERISA plans don’t have to cover Essential Benefits (maternity, mental health, substance abuse treatment, prescription drugs etc.)…In fact ERISA plans can cover – or not cover – anything the plan sponsor (employer) wants. TM’s health benefits plans will likely be different from health insurance plans…thus comparing TM plans with alternatives will be complicated and hard to explain.

- Employee’s spouse…“wait, you’re telling me my pregnancy isn’t covered??!!”

- Example – ERISA plans don’t have to cover Essential Benefits (maternity, mental health, substance abuse treatment, prescription drugs etc.)…In fact ERISA plans can cover – or not cover – anything the plan sponsor (employer) wants. TM’s health benefits plans will likely be different from health insurance plans…thus comparing TM plans with alternatives will be complicated and hard to explain.

- TM will medically underwrite employers…that is, review all past claims and medical records to identify employees’ and their families’ health problems, then adjust the rates and/or refuse to cover treatment for those pre-existing conditions.

- This directly conflicts with several sub-sections of Sec. 2054-603 of Texas’ Insurance Code which reads:

TM must “fully explore all health coverage options that may be offered under this subchapter and place emphasis on:- ensuring adequacy of benefits and access to care for individuals in this state with preexisting conditions;

- issuing coverage in a manner that does not discriminate against individuals with preexisting conditions

- ensuring equitable costs regardless of gender or prospects of pregnancy or childbirth.”

(note the language says “place emphasis on”, which allows major wiggle room)

Employee’s spouse…“wait, you’re telling me my diabetes/hypertension/ depression isn’t covered?”

- This directly conflicts with several sub-sections of Sec. 2054-603 of Texas’ Insurance Code which reads:

What does this mean for you?

Do NOT blame Texas Mutual for this…blame Texas’ Legislature and Governor.

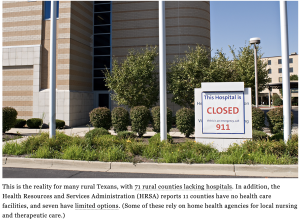

Next – why this won’t do a damn thing to solve Texas’ health care mess, but Legislators and the Governor score political points.