Two mostly-ignored things will have way more impact on workers’ comp than any other ten factors.

And as usual, workers’ comp is out to lunch.

Let’s quickly review the work comp industry’s failure to understand reality. When COVID hit, the workers’ comp industry’s caterwauling and catastrophizing hit epic levels… mostly driven by

- ignorance of actual research on COVID’s cost,

- a failure to focus on COVID cost drivers,

- a complete lack of understanding of how the US healthcare system functions

- misguided focus on claims costs and initial failure to

- anticipate the real impact – a drastic drop in premiums.

That led to far too much angst and far too little reality-based planning by the workers’ comp industry.

Fast forward to today, where the opposite is happening.

The industry is blithely ignoring the impact;

- heat will have on claims, loss ratios, combined ratios, and claim duration, and

- infrastructure investment will have on premiums and claims.

Heat

The massive and seemingly endless heatwave in multiple states is affecting restaurant workers, agricultural workers, folks in logistics and manufacturing.

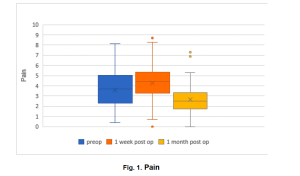

Sure there’s heat exhaustion and heat stroke and heat prostration (which costs about $38k per claim…)

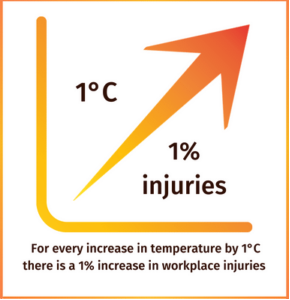

But that’s the (forgive the analogy) tip of the iceberg…Excessive heat also creates more injuries of all types…injuries to cherry harvesters in Washington State increase 1.5% for every 1 degree C above 25 C (77 degrees F) – mostly from falling off ladders.

Oh, and California data shows: compared to days with temps in the 60s,

-

-

- on days when the temperature was between 85 – 90 degrees Fahrenheit…the overall risk of ALL types of workplace injuries was 5 to 7 percent higher.

- when temps topped 100 degrees, the overall risk of injuries was 10 to 15 percent greater.

-

This means more claims in an industry that is generally unprepared to “manage” heat-related claims.

Jobs

Hundreds of billions of dollars is flowing into infrastructure, investment that has already created ninety thousand jobs in:

- construction,

- transportation improvements,

- highway, bridge and road maintenance and replacement, and

- heavy industry.

And many more jobs are on the way. (check out where this is happening here).

These are very well-paid, high-frequency and high-severity jobs.

This means premiums will increase as will claims and claims costs. And this will continue for years.

What this means for you.

At risk of belaboring the obvious, a more dangerous environment for many more workers in already high-risk jobs.

Heat + Jobs = more premium dollars, higher costs for self-insureds, more claims, and higher severity claims.