After the blur that was the NWCDC in New Orleans last week, here are a few impressions.

Tough week

There were fewer insurance types this year, and a couple TPA execs noted they brought fewer people and most of their people only got Expo passes. The timing – after Thanksgiving – seemed to be a bit of an issue. End-of-year stuff including closing whatever deals they could to make this year’s revenue budget and finalization of budgets and 2017 plans kept some at their offices, while the all-too-common “let’s stop traveling to control expenses” played a part as well.

Next year the show returns to Las Vegas, and it’s another week later. We’ll see if that helps or hurts attendance.

Notably, overall attendance was reported as flat – after a couple years of record high numbers, that’s good news for conference owner LRP.

Presenters

Folks, please please please don’t be so damn dull. Workers comp is boring enough without we presenters making it even worse. If you aren’t used to presenting, get coaching. If your slides just include a bunch of bullet points, get your design folks to translate words into pictures. DO NOT READ YOUR PRESENTATION. Do not read your slides. Engage, entertain, focus. Make damn sure you tell them why what you’re talking about is important TO THEM.

No matter how important your points are, if your audience is asleep or playing words with friends you might as well be singing in the shower.

There are many, many people with different approaches and styles who are really effective. Friend and colleague Alex Swedlow, President of CWCI, uses a lot of charts and graphs – and a sardonic style and dry wit – to make complex issues understandable.

Bob Hartwig PhD has way too many slides, talks way too fast, presents way too much information – and is a terrific presenter. Why? Because he’s found a style that works for him.

Some need a lot of practice, others shouldn’t as it makes their talk seem wooden and stilted. Some can ad lib, others can’t. Find what WORKS well for you, and stick with it.

And always ask what you can do better. People will always blow smoke up your shirt about how great you were – ignore that. Sure, take away the things you did well, but seek out what you can do better. We can always improve.

Execution

There are few new ideas in the industry, few real innovations – but lots of talk about innovation. What there is – is a very real and very strong focus on execution by some vendors, TPAs, brokers, and service providers. The people and companies that impressed me were mostly the ones that were “innovating around execution”. What can they do to make their customers’ jobs, lives, operations, functions easier/smoother/less stressful? How can that be measured? And who are their customers – what do they do every day? How are those individuals measured and rewarded? What do they need, want, and have to have? What makes their job harder? Where’s the nuance, the small difference, the unseen need that can be exploited to differentiate?

Figuring out the “execution opportunity” is a big part of success, but it’s a total waste of time if it isn’t translated into different workflows, services, business practices. This can be tedious and frustrating and appear to be marginally rewarding at best.

But the whole is greater than the sum of the parts. Customers – buyers, front-line staff, employer supervisors, work comp patients – notice and appreciate the effort. More business comes your way. And competitors find it hard to get a foot in the door.

In several deep dive conversations with a wide variety of folks, I kept noting the ones that are doing well are relentlessly probing, asking questions, wondering why?. This isn’t flashy or in many cases really obvious – but it sure is working.

Industry Isolationism

The conference is useful in many ways; one can get lots of meetings done in a brief period; new, intriguing approaches/vendors/programs are on display; and reconnecting with colleagues is always rewarding.

What stuck out for me this year was something that is both troubling and encouraging: the insularity of the work comp industry is receding. Perhaps it’s the election, a vastly improved economy, or just more awareness; for whatever reasons, many of the people I spoke with are more attuned to and aware of external factors that may well impact work comp. A few examples:

- Inflation rates will affect investment income, which in turn moves reserve adequacy

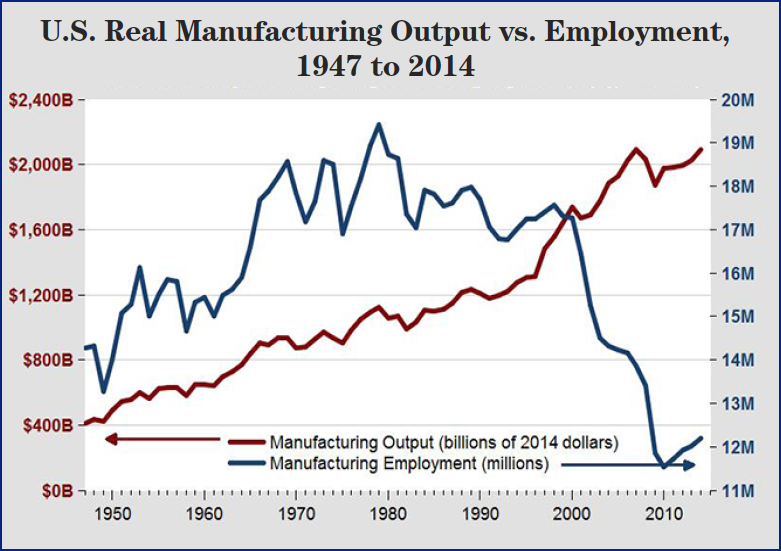

- Automation decreases risk for industrial workers, while reducing re-employment opportunities

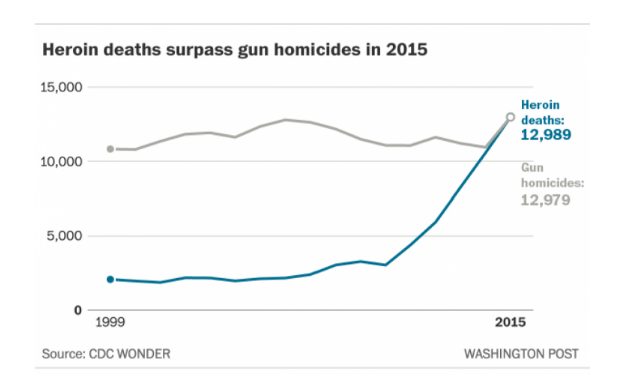

- Changes to health insurance status may increase or decrease claiming patterns, cost shifting, case shifting

This is good news indeed. However, there’s a lot of misinterpretation due to misunderstanding or just plain ignorance (not saying that pejoratively, but rather noting the fact that a lot of folks just aren’t very aware) about some of these issues. I’d suggest it’s always best to try to understand what’s really going on before jumping to conclusions about what “that” means.

A lesson I try to keep in mind myself…