Two immutable truths were behind much of ACA’s original construction. These same truths are giving Republicans seeking to repeal/replace major heartburn.

First, healthcare is the single largest part of America’s economy. One out of every six (soon to be five) dollars flows thru the healthcare system.

“Controlling cost” really means someone is going to make less money.

As most of you reading this get a big chunk of your income from healthcare, that’s a problem. For politicians trying to come up with a plan to reform the reform, solving healthcare means some very, very powerful entities are going to get screwed.

The question is, which ones?

- Hospitals are often the largest single employer in an area.

- Pharma is hugely profitable and pharma workers are very well paid.

- Medical device and equipment companies are similarly disposed and their employees similarly compensated (the largest employer in our town is WelchAllyn)

- Healthcare professionals enjoy good incomes and generally good working conditions (full disclosure – our daughter and her husband are both ER RNs)

- Healthplans have generally done well under ACA – remember the Exchanges are just a small part of their overall business.

- Taxpayers, who don’t want to pay higher taxes

You can’t cut costs without cutting hospital revenues, reducing doctors’ incomes, lowering pharma prices, or slashing profits for device companies. (Healthplans are a bit of a separate issue as their gross income is based on underlying costs, so if healthcare costs go down, so do their revenues).

The power of the healthcare lobby is beyond measure; three years ago the industry spent over a half-billion dollars on lobbying in DC. Pikers. Last year,

So, which one of these incredibly well-funded and well-connected stakeholders is going to willingly give up a few tens of billions of dollars to keep your insurance costs and taxes down?

Put another way, are you personally ok with a lower paycheck?

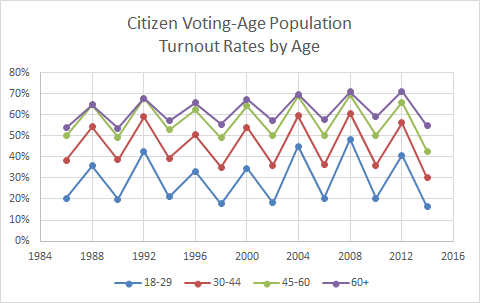

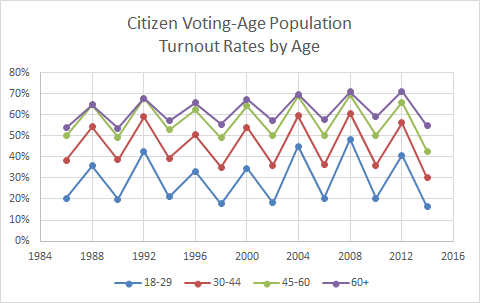

Truth Two – Older people vote, younger people don’t.

(credit US election project)

If you’re trying to keep insurance costs low, you have to get more healthy people (i.e. younger people) into the pool to help pay costs for us older folks. To get more people to buy insurance, you have to keep premiums low. The best way to do that is by allowing a big premium disparity between older and younger folks.

Currently, ACA only allows insurers to charge old folks 3 times more than young ones. The result – insurance for younger people is higher than it would be if healthplans could split the population into, say, five “age bands” and charge older people 5 times more than the youngest. Sure, it’s likely a lot more young people would sign up if their premiums were lower – and they would be – about 15 percent lower.

But if they do, the oldest people – who are about 2.5 times more likely to vote than the youngest group – are going to be hopping mad. Estimates are premiums for the older group would jump 22%.

What do these Two Immutable Truths mean for you?

It could mean your income drops a lot, your taxes go up, your premiums go up or down, your stock portfolio suffers…

Net is, to “fix” healthcare someone’s ox is going to be gored. And pissed-off oxen are scary indeed.