Recent personnel/management changes by two big work comp payers are causing some to wonder who’s in control of medical management buying decisions – and whether senior management fully grasps the implications of those changes.

While two examples do not a trend make, if two of the top five work comp insurers are increasingly relying on financially-oriented staff and/or procurement departments to

- develop medical management strategy,

- devise evaluation methodologies, and

- evaluate and select vendors,

they are headed down the wrong path.

Most recently, the Hartford suddenly terminated several senior staff in the medical management strategy and clinical support area. The highly experienced and very well regarded people were reportedly told their services were no longer required; it appears the entire “department” was shut down, so the staff was no longer needed.

Let me state up front that I:

- tried repeatedly (as in, six separate, increasingly-pleadingly attempts) to get the Hartford to respond to specific questions about the company’s strategy and intentions and got back a corporate-speak response (see below)

- asked specific questions about the department affected and its future, and received no response whatsoever except the “we do not comment on specific decisions or changes, whether at the individual or department level” even after I specifically asked about the Strategy and Clinical support “department’s” future role and what area/department/group would assume their responsibilities.

- have not spoken to ANY current Hartford personnel about this except the communications folks – who, to their credit – appear to have diligently tried to get a useful response from those in the know.

Thus I am left with no option but to engage in educated conjecture about the reasons behind the Hartford’s apparent decision to shut down the company’s Workers Compensation and Group Benefits Claim Strategy and Clinical Support group.

It can’t be that the group’s leader was getting close to the “magic 80”, when the combination of age and years served ensures the individual of a pension and other retirement benefits.

It may be a desire to reduce expensive overhead. The staff in this department are highly tenured and likely well-compensated, and thus expensive. Unallocated Loss Adjustment Expense is increasingly concerning to insurers intent on delivering profits despite market pressures to cut premiums and lower rates. With few exceptions claims departments are always looking for ways to cut overhead.

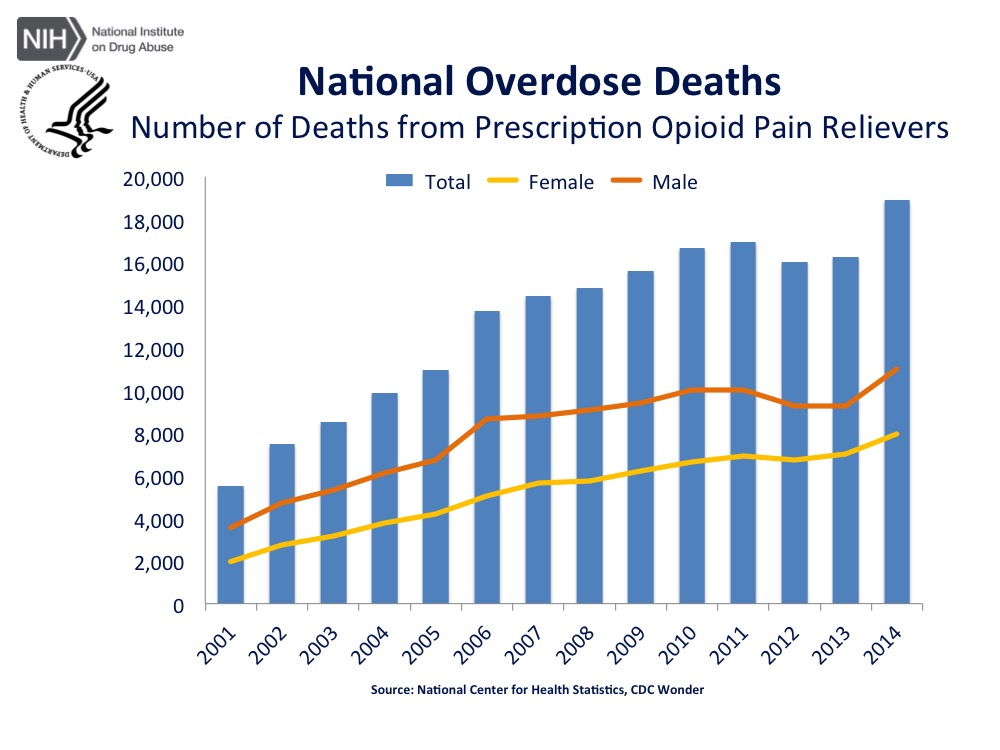

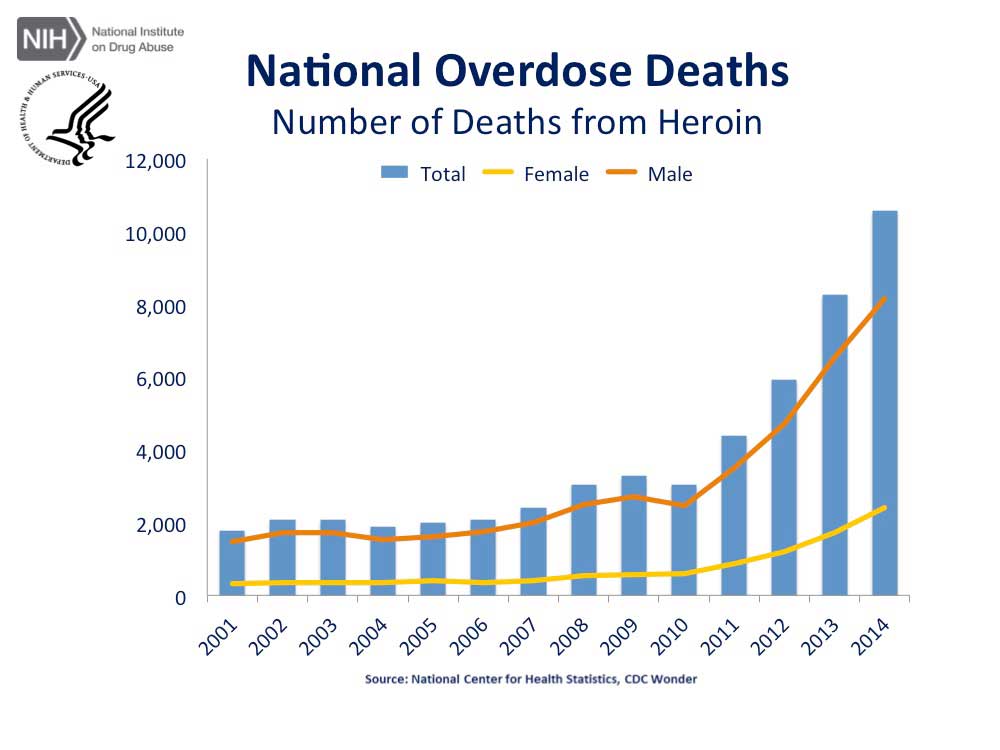

It’s not a competence or effectiveness issue. The folks now looking for work are very, very good. The Hartford’s work comp medical management program is solid, primarily due to the efforts and intelligence of this department along with very strong medical directors. Their approaches to opioid management, MSAs, and disability ratings are innovative, effective, and low cost.

Regardless of the rationale, it does appear that the Hartford will be relying less on medical management experts to make decisions about managed care programs and strategies, ceding authority and responsibility to folks that, while expert and experienced in procuring and/or other areas in general, do not have the depth and breadth of experience, the decades of accumulated knowledge, the analytical expertise, the industry knowledge, nor the operational knowledge critical to ensuring the 60 percent of claims dollars spent on medical care are spent wisely and prudently.

More broadly, a shift towards a more financially-focused strategy and clinical support function is, in my mind, problematic for any carrier.

I won’t wax eloquent about how the group health industry’s indemnity carriers were crushed by HMOs that understood their business was not insurance but health care delivery – even though that’s true, and instructive indeed.

I will note that 60% of claims expense is MEDICAL, medical drives much of indemnity, and some/many claims execs seem stuck in the days when indemnity was the majority of spend. And I’ll add that the given the rapid evolution in health care delivery; provider consolidation; major changes in reimbursement; the growing impact of ACOs, medical homes, and alternate delivery systems; a deep understanding of health care delivery is critical to long-term success in workers’ comp.

The impact of these changes likely will be felt more quickly than anticipated. All payers must move faster, evolve more rapidly, and address opportunities more efficiently tomorrow than they do today. That’s just the reality of the increasing speed of change in health care. Those that have the experience, depth of understanding, and expertise are going to do better than those that focus on short-term “gains”.

What does this mean for you?

- There are a few really talented, smart people now available.

- There’s opportunity aplenty in doing medical management better – if you have a) expertise and b) understand how to use that expertise.

- Medical management ≠ accounting

- Old-school PR policies and Corporate-speak responses are inadequate, unhelpful, and counter-productive. Engaging with social media, talking with bloggers and reporters, especially when those bloggers are trying to help your company explain what it is doing is far better than the alternative – dealing with the aftermath.

Note: Re the Hartford, sources indicated to me that procurement will likely be involved more in this area going forward. I checked repeatedly with the Hartford on this; Tom Hambrick in communications at the Hartford asserted:

“Procurement does not play a role in our workers compensation medical management decisions.”

I did clarify in a subsequent email to Tom that I was referring not to claim-specific issues but rather to strategy, vendor selection, and program evaluation; as of the time of the initial publication of this post I had not received any further clarification or explanation from the Hartford.

All due respect to Mr Hambrick and the Hartford, re procurement, that’s not my experience nor is it consistent with what credible sources told me. I’ve sat in meetings in the Hartford’s offices where vendors presented to several Hartford employees – including procurement/purchasing staff. These staff were involved in subsequent follow up emails and conversations. I also checked with former (as in left several years ago) Hartford folks and they confirmed procurement’s involvement in this area.

The Hartford’s original response:

We appreciate your patience and for providing us with an opportunity to respond. As I’m sure you understand, we do not comment on specific personnel decisions. Regarding the changes more broadly, we regularly assess our business needs and make structural refinements to ensure we have the appropriate resources to deliver on our strategies and priorities. The Hartford is committed to continued leadership and innovation in workers compensation and claims management. Our Claims organization is focused on helping our customers in their time of need while always seeking to improve claim outcomes, and we are confident in the talent and capabilities of our claims and clinical professionals.