With Congressional efforts to repeal/replace/revise ACA behind us for now, it’s time to consider what all this means for workers’ comp.

First up – Medicaid expansion

Currently 32 states have expanded Medicaid; 19 have not. Expect more states to consider expanding Medicaid as the combination of Federal dollars and struggling hospitals makes a compelling case for state adoption.

In addition, the Trump Administration may well allow states more flexibility in expanding Medicaid, and this will likely lead to more states opting in. For example, Arkansas has applied for permission to add coverage to a more limited population…other states will almost certainly follow suit.

Other states, including Texas, are facing the dual realities that their poorer citizens’ health status is declining, and hospital financials are deteriorating as well.

A couple data points illustrate the linkage between Work Comp and Medicaid…

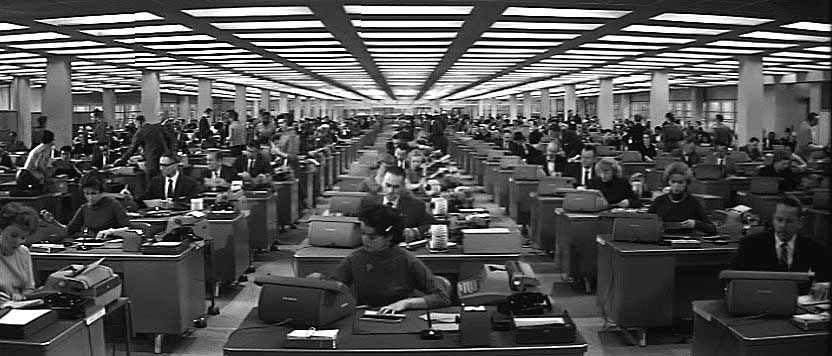

63% of Medicaid recipients have at least one family member working full time. This varies among states, from 77% in Colorado to 51% in Rhode Island. 15% have a part time worker. Only 19% of recipients’ familes have no one working.

Many employers (e.g. those with <50 FTEs) that

- don’t provide health insurance &/or

- aren’t required to provide health insurance under ACA

- &/or have a lot of part time workers who don’t qualify for employer-sponsored health insurance

recommend workers who qualify sign up for Medicaid.

The potential implications for claiming behavior are apparent.

We all know workers comp premiums are driven by employment. Most credible studies indicate Medicaid expansion increased employment in states that expanded Medicaid.

More employment = more payroll = more workers’ comp premium and more claims (NOT higher frequency, which is a percentage and not a raw number)

There’s also implications for disability filings…A just-published study found “a 3-4 percent reduction in the number of people receiving supplemental security income… in states that expanded Medicaid.”

What does this mean for you?

The work comp industry dodged a bullet when Congress didn’t repeal ACA. However, watch carefully as other efforts to de-fund and otherwise cut back on Medicaid are ongoing.