Reed Group‘s current attack on WCRI is unwarranted, misguided, and out of line. Several Reed employees have publicly chastised WCRI for a variety of sins ranging from poor quality research to a lack of concern about worker outcomes.

Reed’s frustration with WCRI first came to my attention in a post by Reed’s Carlos Luna a couple months back; Carlos said “I find it curious how WCRI, perhaps due to industry demand, focuses on one product (WLDI’s ODG).”

It’s not curious, Carlos. Much of WCRI’s research is driven by regulators looking for an independent, credible, analysis of potential changes. They ask, WCRI delivers.

More recently, a Reed researcher said that methodological concerns with one of WCRI’s studies (on opioids and disability duration) call into question ALL of WCRI’s research. In this morning’s WorkCompCentral Elaine Goodman quoted Reed Group’s Fraser Gaspar:

“Based on the substantial limitations and errors in their [WCRI’s] most recent opioid research paper…it is clear that their current review process is insufficient…[WCRI’s] information that does not meet basic research standards”

I strongly disagree.

Gaspar is claiming that WCRI should use blinded reviewers; that is, reviewers should not know that the research is coming from WCRI as that might bias their perspective. Couple of points here:

- WCRI uses outside experts to review all of its published research; I’ve helped a couple of times and I know many others who have as well.

- I know of NO other credible research entity involved in work comp that uses blinded reviewers. Does that mean the research by CWCI or NCCI is not credible or doesn’t meet “basic research standards?” Of course not.

- I have strongly disagreed with WCRI in the past, and they not only listened to what I had to say, they asked me to participate in a webinar to discuss my views.

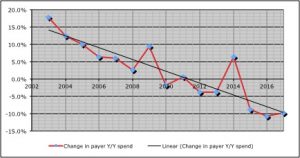

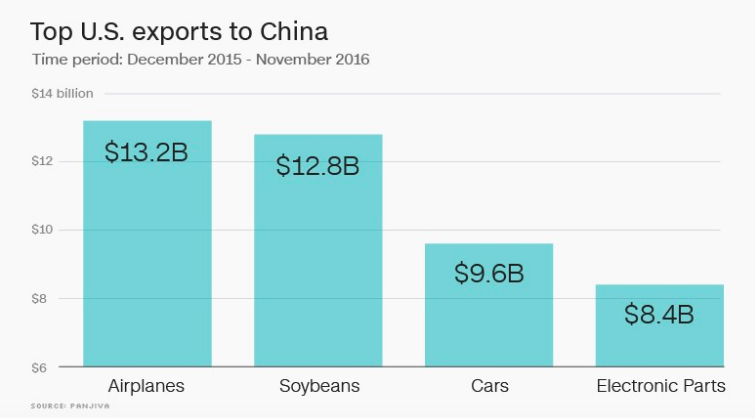

Goodman reported Reed SVP Joe Guerriero “is also concerned that WCRI’s research focuses primarily on workers’ comp costs, with little attention paid to injured worker outcomes or the possibility of cost-shifting to other payers.” [her words, not his]

Quoting Guerriero:

“looking at reduced drug costs to determine the efficacy of any program is far too narrow…” [emphasis added]

Guerriero is mis-directing here; worker outcomes and cost-shifting weren’t within the scope of the study WCRI was asked to do.

Not to mention WCRI has done quite a bit of research on cost-shifting and case-shifting. Moreover, it is not possible for WCRI – or anyone else for that matter – to figure out if patients no longer getting drugs via work comp were obtaining drugs via another payer.

And, WCRI has published dozens of research reports on worker outcomes.

While I understand Reed’s frustration that most regulators are focusing on ODG, the fact is for years ODG’s publisher has been a much more effective marketer than Reed. In addition, the binary nature of the ODG formulary is simple to understand and relatively easy to implement.

FWIW, I’ve long viewed ACOEM’s (affiliated with Reed) approach to guideline development and it’s formulary as more rigorous and more patient-centric than ODG’s. I still do. I’ve been a fan of ACOEM’s clinical guidelines for years. Their methodology, diligence, and professional dedication to the right care has always impressed. Yes, it’s more work, but it’s better for patients.

But that’s beside the point.

WCRI has always been open to collaboration and conversation. I would encourage Reed to work with WCRI and not cast aspersions about WCRI’s research.

[note – I’ve long been impressed with Elaine Goodman’s reporting and pursuit of the details necessary to provide a complete picture. Kudos to Elaine for an even-handed piece]

ed note – NO REPUBLICATION OR EXCERPTING OF THIS POST IS ALLOWED WITHOUT EXPRESS WRITTEN PERMISSION FROM JOE PADUDA.

copyright 2018, Joe Paduda, all rights reserved.