Work comp is doing very well – so well that one may want to be a bit nervous.

A couple things you should consider:

Today’s WorkCompCentral arrived with the news that the Hartford’s profits improved markedly last quarter driven in part by “favorable development” in its workers’ compensation business.

Essentially the Hartford determined that it had set aside more funds than necessary to pay for old claims, so a chunk of those funds were removed from “reserves” and became profits.

A bit further down in the Hartford’s filing came a bit more detail, detail that may be illuminating. For example, “margin deterioration in workers’ compensation and a higher expense ratio” in the company’s middle market sector put a slight dent in that sector’s financial results..

Yet, while work comp renewal premiums for the small commercial sector were down, 4 percent growth in middle market revenue was “principally driven by workers’ compensation” new business.

So, we have better results than expected from old claims, tighter margins, higher expense ratios, and premium growth in a key sector. This may seem inconsistent – but it isn’t.

- With lower premium rates come higher expense ratios – that’s just math.

- Lower historical claims costs help reduce current premium levels; insurers may see this as lowering the cost of risk and therefore cut premium rates and/or offer discounts.

- In turn these lower rates may generate more business especially from employers who want to buy insurance from top-rated carriers.

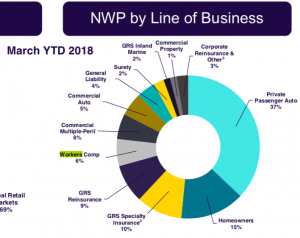

Quick aside…At Liberty Mutual, work comp accounts for 6 percent of net written premium. As a former Liberty employee, this is a pretty amazing statistic coming from the company that dominated US WC for decades.

From Liberty’s Q1 2018 earnings presentation

In the not-too-distant past, Liberty was at or very near the top of the largest writers of workers’ compensation insurance. Not anymore.

This from Chubb’s Q2 2018 earnings call (thanks to Seeking Alpha):

Well, the macro picture, you have record low unemployment, which actually can play – cut both ways on workers’ comp. You have less experienced workers on the job, so you have to be careful. We’ve been seeing frequency up until now, frequency of loss has been down. Severity has been reasonably tame. And so overall loss cost trends have been good in comp. I think you have to – in my own mind, the market is reacting to that, the insurers, and comp has become more competitive. And I think you have to be careful that you’re not too aggressive, you overshoot the market.

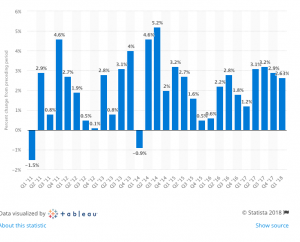

Work comp premiums for the big carrier were down just under 6 percent this quarter over last, while YTD premiums were slightly higher.

I won’t attempt to link these data points to strategic moves; you can ponder those yourself.

Rather, my sense of what’s happening is some carriers are really trimming back their work comp books, others are growing it carefully, and all are waiting for an indicator that this historically-long-lived soft market is about to turn.

What does this mean for you?

We do know that very few – if any of us – will time that market turn correctly.

That’s the perspective of my alter ego…Captain Obvious!