Summer isn’t off to a sunny start for OneCall.

Two good-sized customers are moving their business to other suppliers. Sources indicate concerns over OCCM’s financial situation led to the switch to other vendors for transportation, PT, imaging, DME and home health.

Sources indicate MTI America, VGM HomeLink, MedRisk, HomeCare Connect, and Paradigm are among the winners. (MTI and MedRisk are HSA consulting clients)

Other customers have been in discussions with OneCall about ensuring payments for treating providers are made on a timely basis.

OneCall was carrying just under $2 billion in debt at the end of the first quarter; that has increased due to the refinancing of a big chunk of debt earlier this year. Despite the refi, debt service is eating up most of OneCall’s cash flow, dollars that would otherwise go to internal needs such as Polaris – the company’s name for their new IT platform..

The refi terms allow OneCall to not pay a portion of the interest on the new debt. Instead, the deferred interest becomes part of the debt owed. So, sort of like credit card debt, if you don’t pay the interest owed, you end up owing interest on the unpaid interest.

That saves cash over the near term, but increases the company’s total debt load and the cost of paying off that debt just gets bigger every month.

I’m hearing the customer-facing part of Polaris is gaining fans, but development of connections to and replacement of legacy internal systems isn’t keeping pace. This may be part of any cash-flow problem; Polaris was supposed to reduce headcount by replacing people with systems. If customer-facing staff hasn’t been reduced and customer service levels haven’t gotten better, OneCall has a couple challenges, namely:

- continuing to pay for Polaris development, while

- keeping more people on payroll, in an effort to

- keep customer satisfaction at some reasonable level and

- generate enough cash flow to pay the bills.

I’ve asked OneCall for their comments, but the company has been quite unresponsive of late so don’t expect anything substantive.

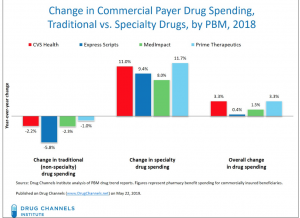

I’d encourage all to read Dr Fein’s post – and to subscribe to

I’d encourage all to read Dr Fein’s post – and to subscribe to