Ramona Tanabe, CEO of WCRI – a most excellent workers’ comp research organization – was kind enough to carve out a few minutes on the eve of this year’s gathering of the brainiacs to answer a few of your reporter’s questions.

MCM – Great to see a discussion of provider consolidation on the agenda – what was the trigger for this?

Ten years ago we looked at where care is being delivered across states…Massachusetts was particularly notable for how much care was delivered by hospital-based care providers. More recently this has been increasing in some states as facilities acquired practices. Stakeholders brought this up so WCRI decided to watch this and see how providers changed when they joined a larger group. [WCRI looked at provider billing before and after they were acquired by/joined a health system or hospital or large provider group]

- MCM – What was one of the surprising findings from the research on consolidation?

We had a hypothesis that assumed we would find duration of disability would decrease due to coordination of care – and lo and behold numbers were the opposite – duration increased. We will get into the causes at the conference next week.

- MCM – Thinking about the various sessions, which one will have the most long-term impact on workers compensation and why?

Two – excessive heat – this impact is external to comp system and is not going away…it is a different world.

And the changing medical workforce is going to have a long term effect – access to care specifically doctors RNs LPNs is changing . Prof Cutler will talk about changes to the healthcare workforce and what’s been happening about that – who is providing the type of care – how many providers, who owns them and hospitals it is all changing – it is not like it was 30 years ago and the effects of that will continue to impact workers’ comp.

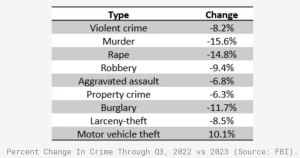

- MCM – There’s been what can only be described as a misunderstanding around medical costs in workers’ comp – in your mind what accounts for this? What WCRI research can help stakeholders grasp what’s really happening with medical costs?

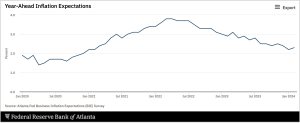

Yes to the second question; there will be a session on medical costs and effect on inflation. At the last conference some said there is a delay in how inflation in the economy affects workers’ comp and that was why we had yet to see medical inflation…Have prices changed over time? that is how economists think about inflation…there’s also been a shift in services – where it is being delivered or changes in the types of services that also factor into pricing…location of service, intensity, utilization all affect costs

- MCM – Drug costs have been declining for some years now – any indications this trend has ended or changed?

[Drug costs] have declined over time – [this varies] by categories of drugs, there have been decreases in some and increases in others – society helped with that change with publicity around drug issues…issuing report on this later this year.

What does this mean for you?

Pay attention to WCRI. Their research will help you plan for the future.