Just chill.

Several readers have suggested I post on the coronavirus issue and how it relates to workers’ comp.

My quick takeaway – it’s highly unlikely coronavirus will be contained – but the death rate (percentage of people who die from it) will be pretty low.

Now, where things stand today.

First, there’s little hard, irrefutable evidence about coronavirus.

It’s so new that scientists and epidemiologists (scientists who study the spread of disease) don’t have any historical data to study. So, we do not know a lot – and much of what you hear is based on pretty sketchy information.

Second – do NOT just read the headlines; this one is a great example.

StatNews is a very credible source, but even here the headline “New data from China buttress fears about high coronavirus fatality rate, WHO expert says” is misleading.

While one expert avers that the mortality rate is relatively high, other experts refute that assertion, noting there just isn’t enough data to draw any credible conclusions.

Moreover, even in China the mortality rate varies greatly, with the death rate among those infected in the province where the virus originated 3 to 6 times higher than outside that province.

I get this is confusing and frustrating and scary – but it’s critical that we read objectively and question declarative statements especially those from people who aren’t scientists. [that includes me, dear readers]

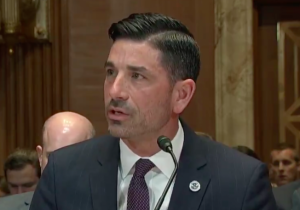

Example – yesterday the Secretary of Homeland Security said the death rate from coronavirus and the flu is the same – 2 percent. That’s flat-out wrong; the worst case estimate for coronavirus’ death rate is around 2%; that’s 20 times higher than the flu death rate (0.01% – one out of 10,000).

Third, it appears – at this moment – that the corona virus is much less deadly than the worst strains we’ve seen in the past. [please refer back to #1 above…]

Reality is, flu-type diseases that are really deadly don’t spread very fast because infected people die pretty quickly – which means they don’t infect many others. You may remember the deadliest one in memory – the avian flu. It killed more than half the people infected, yet only 455 people died.

Remember SARS and MERS? They are different strains of coronavirus than the current one, and quite deadly. Yet less than 1000 people died from each of these strains.

Fourth, some people infected with the virus don’t have any symptoms.

This isn’t surprising, as about 1 of every 7 people who have a “regular” flu are also asymptomatic. It also supports #3 above. But that’s also why it’s so hard to contain coronavirus – a bunch of infected people are walking around undiagnosed, spreading the virus to others.

Fifth, there will NOT be a vaccine for at least a year.

And likely longer than that. Vaccine development is tricky, frustrating, and marked with lots of false starts and stops and dead ends. And vaccine safety is a critical issue.

What does this mean for you?

There are about a gazillion things more worrying than coronavirus – including the flu. Take a step back, relax, and read critically.

Excellent fact checking here.