We are three months into the COVID pandemic, and the impact on workers’ compensation is altering the entire industry in ways unimaginable just weeks ago (early takeaways are here).

(before we jump into this, you have to watch a few seconds of this video)…leave it to a Brit to come up with the most bizarre way to deal with a lockdown…

Now, back to our regularly scheduled post…There’s a lot of angst and fear over how COVID will affect jobs in workers’ comp and this is both legitimate and warranted.

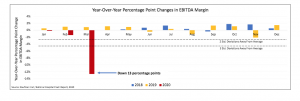

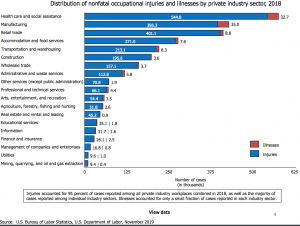

Claim volumes are plummeting, patients are unable to get treatment and employers aren’t able to re-hire recovered workers. Some service companies are reducing staff, payers are revising claim intake processes, and tele-everything is surging in popularity.

Here are some of the changes we’re seeing.

Tele-everything

With patients reluctant to enter medical facilities and providers equally reluctant to expose their staff, there’s been an explosion in the take-up of tele-rehab, tele-triage, and tele-medicine. Sure, providers still struggle to navigate the spider’s web of state-specific regulations, reimbursement schedules and other requirements. Nevertheless reality is forcing change at a pace never before seen.

Concentra CEO Keith Newton and I connected via email to discuss his company’s tele-services.

Newton reported two different tele-medicine “channels” [my word not his] are up and running. National payers are accessing occ med doctors for telemedicine services through the company’s centralized Addison, Tx intake group. The physicians aren’t physically located in Addison but are 100% dedicated to the group and multi-state licensed.

In the field, local employers and municipalities that already use specific clinics are starting to use center-based telemedicine and tele-rehab. This was “stood up and live over the last week at all 500+ centers.” So far, most initial injury intake and treatment is in person with followup visits and rehab available by telemedicine by the center-based clinicians.

The company is piloting an initial injury process in a couple of states for initial injuries as well.

Other companies, including OneCall, MTI America [HSA client] and MedRisk [HSA client] are also delivering tele-rehab services.

Staffing changes

In an email conversation with Concentra CEO Keith Newton, we also discussed staffing changes in light of anecdotal reports of a significant drop in new claims. Long story short, while Concentra has – and will continue to adapt to changes in injury counts, Concentra has not laid off any employees and kept furloughs to a minimum.

Given the rapidly evolving nature of COVID and responses thereto, I’d expect Concentra’s clinicians will find more than enough to do as employers seek to screen workers, train workers in exposure control/risk mitigation, and change policies to ensure workers manufacturing PPE [personal protective equipment] and COVID test kits and related materials – and the manufacturing itself – are safe and protected.

[note a “furlough” and a “layoff are different; A furlough is temporary and requires a worker to take some unpaid time off or work reduced hours. It could last from a couple of days to a couple of months. A layoff is a temporary separation of employment, meaning the worker is removed from the payroll for a limited time. more on this here]

One Call’s furlough has been widely discussed throughout the industry and appears to be driven by two issues – the previously mentioned decline in claim volume and the impact of India’s shutdown on One Call’s document processing operation. The furlough has affected top execs and front-line staff alike. Sources indicate One Call is working to on-shore much of the document processing, a step necessary to keep work flowing and bills processing. This will be a challenge as reports indicate almost half of the company’s US-based workforce was furloughed.

To One Call CEO Tom Warsop and the Board’s credit, the company is continuing to pay premiums for furloughed workers’ health insurance and other benefits and will be sending those workers an $825 check as well. Unfortunately, One Call will keep its non-compete in place for furloughed workers…Warsop did say he would be happy to talk individually with any furloughed workers and consider their individual situations.

I’ve also heard and read reports of significant staff reductions at CorVel; I sent an email to the company three days ago asking for a response by 9 am eastern this morning. No response came.

Friday the company filed an 8-K with the SEC providing notification it was suspending stock buy-backs but there was no mention of the staff reductions; I could not locate any other public report of the furlough/layoff.

Given CorVel’s reaction to a ransomware attack, this isn’t surprising.

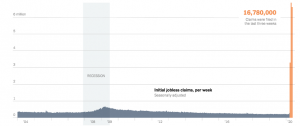

The good news is the federal relief program should provide furloughed, laid-off, and terminated workers with much-needed cash while they are off work; the bad news is reports indicate state unemployment phone lines are jammed 24/7 due to unprecedented call volume.

For those who are having tough discussions with management, coworkers, or employees about this situation, here’s a helpful guide to help you make it thru.

Later this week I’ll post a detailed report on a just-completed survey of 15 payers’ reactions to COVID later this week.