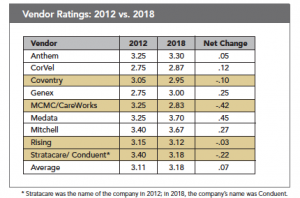

After almost 5 months of negotiations and COVID19-related delays, Mitchell International owns Coventry Workers’ Comp.

The price was around $875 million, with most of the value based on Coventry’s work comp PPO. The network is a cash machine, has been the industry leader since it started the work comp PPO business, and so far is holding off a new competitor – Optum – without too much difficulty. Press release is here.

Sources indicate Coventry will report up thru Genex, with current president and CEO Art Lynch staying on in that role.

Long time readers will recall Aetna tried to sell Coventry six years ago, an effort that failed due to what can only be described as ignorance on the part of Aetna; whoever was responsible for the deal didn’t understand that network contracts were the linchpin.

What’s next?

Way back in March I dug into this in detail, here’s an edited excerpt:

Now that Coventry will be owned by a workers’ comp entity run by people who know workers’ comp, I’d expect a pretty significant investment into the core asset – the PPO.

That will undoubtedly include building and staffing a network contracting and management capability – from scratch. In the interim, one can assume M/G will use Aetna’s technology and perhaps contracting/credentialing resources until it has completed building a network management capability. M/G will do everything possible to build that network management capability quickly and well.

Quick takes

Mitchell is likely out of the acquisition game for some time. Digesting Coventry while battling thru a no-end-in-sight COVID crisis is going to consume management’s time and focus.

If anything, the company might sell it’s PBM business, a move that would free up management time that’s been focused on a business that has been rather challenged – and generate cash to pay down older and quite expensive debt.

I know, combining Coventry’s PBM – First Script – with Mitchell Pharmacy Solutions would create a third significant player to compete with Optum and myMatrixx. But…

- First Script has suffered from chronic under-investment,

- Express Scripts (myMatrixx’ parent company) provides First Script’s pharmacy network,

- the work comp PBM business is brutally competitive,

- selling the PBM businesses would free up cash to help lower debt, and

- management time is needed to

- integrate the rest of Coventry’s assets,

- strengthen the network,

- figure out what to do about Coventry’s bill review operation (most is handled by Mitchell competitor Conduent) (myMatrixx is an HSA consulting client), and

- manage thru COVID.

It is possible Mitchell will hold onto the PBM, but there isn’t a compelling business case. And no, the “bill review and PBM synergy” argument isn’t it.

Bill review

Coventry’s bill review function runs mostly on Conduent’s platform. This will (very) likely change – the question is when.

Mitchell will want to cut costs and increase cash flow by switching customers over to a Mitchell platform. That is no simple task; systems connections and data feeds are business-critical; state reporting; integration with UR, claims, and financial systems as well as external vendors and other entities are notoriously complex and will take quite a while to build out.

This:

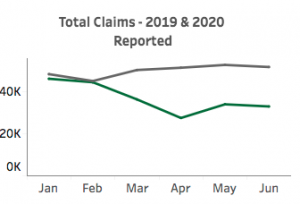

- in an industry that chronically under-invests in IT, and

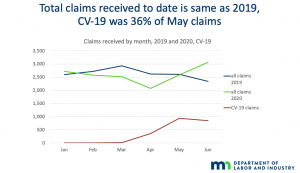

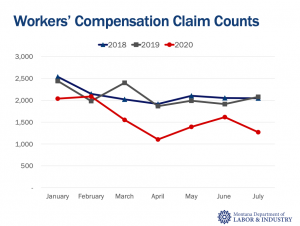

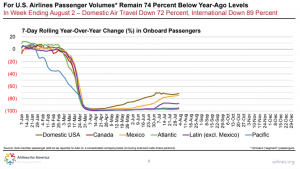

- at a time when insurers and TPAs are staring a in the face of a 20% reduction in claims volume and accompanying drop in premiums.

What does this mean for you?

Consolidation continues, Coventry’s network should get better.

Tomorrow – a deeper dive into implications.