Could COVID have a “very alarming potential outcome that could have a huge impact on workers’ comp” due to claims for neurological and psychiatric issues? That’s a concern raised by Mark Walls in tweet that was noted in a recent article in WorkersCompensation.com.

Before we opine on Mark’s fears, let’s look at the science. I know, you just want the takeaways, but you have to eat your veggies before you get dessert.

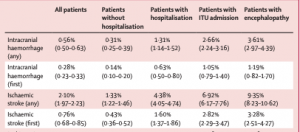

A few days back the Lancet published a study assessing the neurological and psychiatric “outcomes” of about 236 thousand US COVID survivors. Here are the key findings.

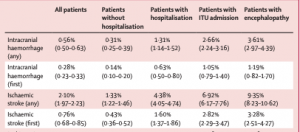

- there was a statistical correlation between COVID-19 and higher frequency of neurological and psychiatric diagnoses (the Brits used “outcomes”, but for we Americans, in this instance the analogous word is diagnoses)

- these diagnoses were more common in patients who had required hospitalisation, and more common still in those who had required ICU admission or had developed encephalopathy

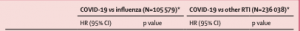

The researchers compared the increased frequency of those diagnoses in COVID survivors to increases in a similar set patients with non-COVID respiratory diseases including flu.

OK, here are some key considerations.

First, these patients are in the US; many of them may not have had regular healthcare prior to contracting COVID, and the neuro/psych conditions may have been present but not diagnosed pre-COVID. While the researchers attempted to control for this by comparing the group to a similar demographic of patients with respiratory infections, it is indeed possible – if not likely – the post-COVID patients had much more thorough medical care during and after COVID than the control group.

Interpretation – The more care, the higher the likelihood of a diagnosis.

Takeaway – The more you look for something the more likely it is you’ll find it.

Second, the older the patient group, the higher the correlation – and the less likely the patient was employed (note I did NOT say “risk” as the study did NOT show that a COVID diagnosis caused the neuro/psych diagnosis.) The average patient that was hospitalized or in the ICU was about 15 years older than non-hospitalized patients (58 vs 43).

Interpretation – COVID hits older people much harder than younger folks; the older the person, the less likely they are working.

Takeaway – the higher the correlation, the less likely the patient is employed, so the lower the potential for a workers’ comp claim.

Third, patients who already had neuro/psych diagnoses may have had that condition exacerbated by COVID. The research showed that a patient that had a stroke before COVID, was more likely to have another one than a COVID patient that had not had a stroke before COVID.

This is especially true for the most severe neuro/psych diagnoses…see “any” vs “first”

Takeaway – very tough to blame an ostensibly work-caused disease for a second stroke or encephalitis event.

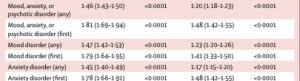

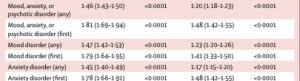

Fourth – the most common post-COVID diagnoses were anxiety disorders (occurring in 17% of patients), mood disorders (14%), substance misuse disorders (7%), and insomnia (5%).

But here, the differences between the COVID and control populations were minimal (HR is Hazard Risk – the risk that a member of that population will have that event occur)

Takeaway – very tough to blame an ostensibly work-caused disease for a mood/anxiety/psychotic disorder, especially when the control group’s incidence rate is so close to COVID survivors’.

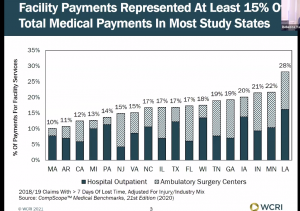

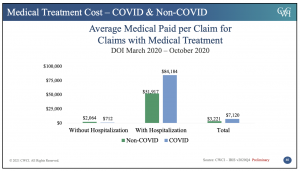

Fifth – Mark makes the point that outcomes for workers’ comp patients are worse than under group health for similar conditions – he goes on to say costs are higher too – and this may well be the case with COVID. Couple thoughts…

The definition of “outcome” in comp vs group health is pretty different and highly subjective; in comp we care about functionality – group health doesn’t. If you are worried about functionality, you will pay more for more care to improve the patient’s functionality. Ergo…more dollars spent.

There are any number of other reasons costs are higher in work comp – but I’d argue – vehemently – the primary reason is this – compared to other payers, WC does a generally crappy job managing medical. I work in both comp and group/Medicaid/Medicare, and the sophistication of medical management in group, managed Medicaid and Medicare is far superior to comp.

As in a graduate student vs a junior high student.

Takeaway – Lower quality healthcare = poorer outcomes at higher cost.

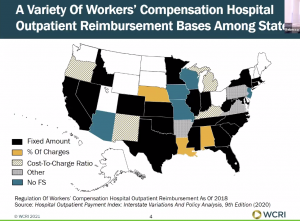

Finally, Mark says “we’ve never had a global pandemic where the government has mandated it be covered under workers’ compensation.”

Well…we still don’t.

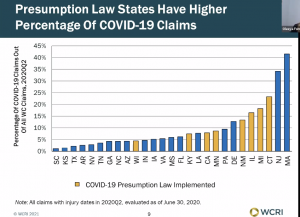

I’m not sure which – if any – government(s) have broadly “mandated COVID be covered under workers’ compensation”. Sure some states have passed presumption laws or had executive orders re presumption – but those are few, far between, rarely cover all workers – and typically come with a rebuttable presumption.

- Only California and Wyoming cover all workers with a rebuttable presumption

- Several states (NJ VT IL) cover “essential workers” – with varying definitions thereof

- MN UT WI only cover first responders and healthcare workers

An excellent and up-to-date resource on state laws is provided by the good people at NCCI…

I’m struggling to see how the science and current state mandates will cause anything like a “huge” impact on workers comp.

- The people with the most “risk” are older and less likely to have contracted the disease at work.

- The study did not show a causal link but a statistical correlation – and correlation is not causation.

- There have been relatively few COVID claims accepted by work comp.

- Only two states have passed broad presumption laws.

To his credit, later in the article Mark notes “when you see a study like this, it makes you pause.”

I agree. Pause, read the study, then step back and think it through. And avoid hyperbole.

What does this mean for you?

There’s a lot of fear out there about COVID – much of it more FOTU [Fear of the Unknown] than fact-based. Focus on the facts, and don’t react until and unless you know the details.

Side note – I opined on a related story 14 months ago…