My posting service sends out posts at 10 am eastern, so I decided to hold off on flooding your inbox with reportage from WCRI’s annual confab and spread things out.

Today we’re reporting on a panel discussion re the future of the workplace post-COVID (let’s HOPE we are “post” COVID)…[Ed note – these are paraphrases; corrections welcomed and apologies for errors]

Denise Algire, director of risk initiatives and national medical director for Albertsons Companies (and a good friend); Dr. Craig Ross, regional medical director for Liberty Mutual; and Dan Allen, executive director for the Construction Industry Service Corporation, a non-profit labor management association were the panelists.

Dan Allen – The vaccine requirements have been very well received by workers in construction – strong educational outreach, not a “hammer”, rather focused on getting the word out – safety is the imperative – healthcare demands all workers are vaccinated, so workforce depends on being being safe and being vaccinated to work in healthcare and many academic projects.

Construction workers are essential workers and are often right next to each other, so separating by 6′ is tough – collaboration is the key.

Denise Algire – Albertson’s relied on education and empowerment – did not have a vaccine requirement unless required by the state.

Long Covid –

Dr Ross – post acute symptom covid is considered a disability, so think carefully about how you approach this. There are 200 different symptoms in 20 different body systems…no consensus regarding diagnostic criteria or treatment for for Post COVID conditions (PCC). A recent study published in Nature compared post covid patients to a control group – one key finding was an increased risk for CV (cardiac) complications – most significant was myocarditis – 5x greater incidence in covid patients. [I think this is the link.]

Dan Allen – be ready to work with employees struggling with long COVID, there’s a very long list of potential symptoms/conditions…the key question is how do you address those? Employers must work with occ medicine specialists to better understand these symptoms and potential impact thereof. mental health resources- take frequent breaks – listen to understand where the patients are coming from – not as straightforward as our tupical WC claim.

Dan – there’s no WFH (work from home) in construction which leads to more risk of getting exposed on the job – to address this, construction sites have implemented scattered job site times; come early, come late hand washing stations, and mask regulations increased that safety.

Denise – grocery workers were essential workers as well – Albertsons’ put together a clinical team, realized no one size fits all – key is listen to employees and balance that with collaboration – looking at teaming and ensuring folks working on stuff together are at the office at the same time – going forward work will be a hybrid approach –

Also – we need to keep re-assessing as COVID persists as the situaiton changes – and may likely continue to change

Craig Ross DO – business needs to continue to invest in safety and safe workers

Dan – safety and health care critical – union training on these issues is paid for out of each worker’s hourly pay – “right to work” states kill apprentice and other training programs which strongly advocate for safety…Construction results in over 20% of workplace deaths in the US in an industry with <6% of workers.

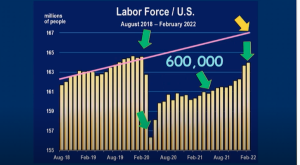

The construction work force is aging and unless you train them well you’ll get more injuries. The great resignation started before the pandemic – don’t overwork and overexert the workers you do have.

Craig – going forward we will likely see increased repetitive trauma due to WFH – calls for increased employee assistance.

Any changes in claim composition?

Dr Ross – claims composition didn’t change except more severe injuries – more severe multiple body part claims…there wasn’t a delay in care, telemedicine ramped up early and seems to be used in specific situations especially mental health. There have been very few vaccination claims to date; and multiple studies suggest it reduces risk of long covid.

Dan – suicide rates in construction are highest of any other industry – 53 workers/100k…why – big macho thing – injured workers don’t report injuries – working on mental health days, collaboration w businesses – have a foreman who talk to workers – let them know you care about them – talk to the workers so they can share issues.

Addressing the use of opiates and finding alternatives has been a big help – sometimes there’s a little bridge from using opiates as treatment to patients using them to address stress. Hope is we’ve learned from COVID and you’ll see safer workers and safer worksites, suicide presentation, calisthenics before work…there’s dollars for training in the infrastructure bill for minorities to help them get introduced to careers in construction.

Misclassification is a huge issue for insurers, workers, and builders – “cheat to compete” – they take advantage of immigrants – put em into jobs, unskilled, untrained, misclassified workers, cheap untrained unsafe labor means legitimate contractor loses that job construction is substandard and project has problems.

What does this mean for you?

Behavioral health was my big takeaway...be open, let workers know they are not alone and you’re open to listening, that there is no stigma.

As one who’s dealt with panic attacks for 25 years, I completely agree – yeah I get them, yeah they suck, and yeah you’ll get through this and we are here for you.