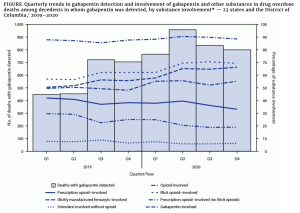

The CDC recently reported gabapentin was involved in one out of every ten fatal overdose deaths in reporting states.

Similar to opioids, gabapentin can cause severe breathing difficulties – which are exacerbated when the drug is combined with other central nervous system depressants (CNS) (e.g. opioids, antidepressants, antianxiety meds).

Illicit use of gabapentin appears to be on the rise…from JAMA:

Gabapentin can produce feelings of euphoria and intoxication and can potentiate opioids’ effects. Individuals who misused the drug reported multiple reasons in a 2019 study, including a desire to enhance the effects of opioids; to achieve a “high” when preferred substances were unavailable, such as when they were living in a treatment facility or were incarcerated; or to self-treat withdrawal or pain. [emphasis added]

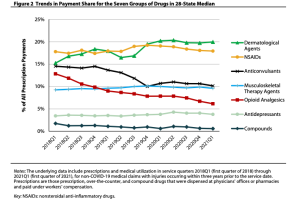

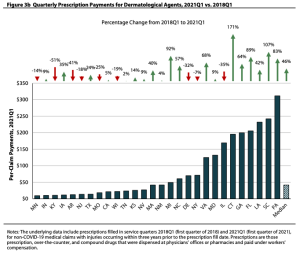

Gabapentin is a non-scheduled drug which became much more widely prescribed as opioid scripts declined. Back in 2018 one out of five chronic pain patients were prescribed gabapentin (or its cousin, pregabalin). There’s some evidence that misuse of gabapentin – which is almost always prescribed off-label – often occurs after the consumer had a prescription for the drug.

And, Parke-Davis, manufacturer of Neurontin – the brand name version of gabapentin – pleaded guilty to promoting off-label use and paid a $430 million fine.

So, what to do?

First – learn more. Start here – myMatrixx’ Shanea McKinney, PharmD penned an excellent overview way back in 2019.

Then…

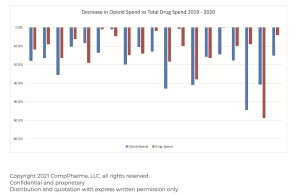

- Dig into your data – what’s been happening with gabapentin?

- When and where possible, require prior authorization for gabapentin and similar drugs.

- Educate patients and caregivers about potential risks of the drug.

- Pay special attention to patients prescribed gabapentin off-label and in combination of other CNS depressants.

- Consider recommending urine drug testing for gabapentin patients and include it in the drug test panel.

What does this mean for you?

This looks awfully familiar.