Got this from a colleague responding to last week’s posts on outcomes...

Insight, analysis & opinion from Joe Paduda

Insight, analysis & opinion from Joe Paduda

Got this from a colleague responding to last week’s posts on outcomes...

So what exactly are “benchmarks”?

Yesterday we dove into outcomes vs process metrics, and why focusing on process measures (e.g. call abandonment rate, three-point contact timeliness, savings below fee schedule) instead of outcomes can result in the classic…

Benchmarks are standards by which outcomes can be measured or judged. Outcomes drive process improvements, financial results, and most importantly, healthy, fully functional patients.

In work comp, you’ll most often see vendors or payers comparing their results to ACOEM and/or ODG...while that can be somewhat useful, it’s important to recognize several issues/potential limitations…

(beware of comparison’s to the vendors’ clients…while that can be helpful and illustrative, it’s usually a very small sample set, and begs the question – “just how good are the vendor’s overall results?)

This can get pretty complicated, as in migraine-inducing complicated. Don’t obsess…and unless you are a statistical whiz, Do NOT get caught up in the minutiae, it is up to the vendor to help you understand, not to baffle you with BS.

(very helpful to have a statistically literate person on your team to clarify, help explain, and when necessary call BS…there’s a LOT of it out there)

Rather, challenge the vendor to explain in layperson’s terms specifically and in detail why and how these benchmarks are relevant to your population, their limitations and strengths, and where you fall on the spectrum from worst to best. Also, get written documentation of their analyses and the methodology you can share internally and with your customers as necessary.

Vendors who cite benchmarks must be able to explain all of this...just don’t expect them to do this the first time around, as it is likely they’ve never been challenged.

What does this mean for you?

Know your outcomes.

OK, let’s agree that the best metrics to measure workers’ comp claims are:

NOT:

The latter are process measures – NOT outcomes. Yes, process can drive outcomes – but often does not. (See discussion of mythical “savings” from WC bill review and PPO)

How to evaluate a program, vendor, network, provider group, or delivery system: First, what types of information are relevant and for what? (we’ll get to benchmarks in a bit)

or…anecdote vs data, and treatment records vs, aggregate reports.

from Statistically Funny

Be prepared to be underwhelmed…and do NOT allow your vendor to provide case-specific reports or findings instead of aggregate data.

Vendors love to cite specific cases, which a)distracts you from their overall impact and b) is way more interesting as it is “real” and not just a bunch of numbers and statistics.

That’s NOT to say those specific case notes/treatment records aren’t helpful..in fact the next step – once you’ve decided the vendor produces good “outcomes” – is to find out how they do that.

And that is where and when case notes/treatment records can be quite useful…they show HOW the vendor delivers the outcomes.

So how do we know if outcomes are “good”, that is, if injured workers are being treated appropriately and employers/taxpayers are well served?

Enter an industry bugaboo – comparisons to meaningless/wrong/misleading “benchmarks.”

That, dear reader, is the subject of the next post.

What does this mean for you?

The mistake most work comp payers make is skipping the first – and by far the most important step – evaluating vendor performance based on REAL outcomes.

Medicaid is the second largest payer in the US, with spending approaching three-quarters of a trillion dollars this year.

In 2023, workers’ comp medical spend will be around $32 billion – just over 4% of Medicaid.

Medicaid is a major payer for many facilities in poor and rural areas, a financial lifeline that is thin indeed.

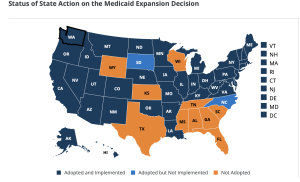

Ten states have yet to expand Medicaid, an ethically- and financially-unconscionable failure that has major repercussions for workers’ comp, poverty, child health and healthcare access (two – SD and NC – are in the expansion process).

Access to care

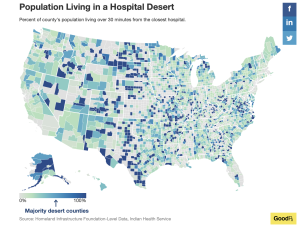

Most rural areas in those 11 states were already hospital deserts; that will get a lot worse as over a third of rural hospitals are in those eleven states.

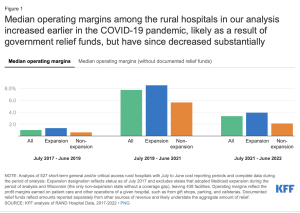

Average operating margins, razor thin before COVID, recovered somewhat during the pandemic but will turn negative as the pending Medicaid disenrollment takes effect.

More hospitals and their emergency and trauma units will close. Today in 40% of US counties most patients are more than an hour away from a trauma center…as more rural hospitals close even more trauma patients will be further away from hospitals.

What’s known as the “golden hour” is the first 60 minutes after an injury, when healthcare can save lives, limbs, and livelihoods.

What does this mean for you?

Claim severity will increase in those ten states.

note – reminder, Saturday is April 1…beware.

For the first time in forever I missed WCRI’s annual confab…a Board meeting conflicted darn it.

Thanks to Stuart Colburn for his comprehensive reporting from Phoenix...I hereby give up my as-it-happens blog-casting role to the estimable Mr Colburn Esq. (subscription required)

WorkCompCentral’s Yvonne Guibert and Rafael Gonzales dropped a most informative podcast today. Dr Les Kertay is the guest, and his discussion of mental health is one you need to listen to while out walking, cleaning the house, doing laundry, driving kids around or gardening.

Excellent piece in Harvard Business Review about the role of robots in customer service. Yeah, I mostly hate them too, but more and more insurance interactions involve robots. While HBR focuses on more “retail”-focused robots, there’s much in the article worthy of your consideration.

One takeaway…”Robot technology should not simply be added as a novelty, but carefully integrated to deliver value to customers and support employees — maintaining a balance between automation and human interaction…”

Here’s another you have to read…it’s about customer service in government. No, that’s not an oxymoron. And btw, anyone in healthcare or insurance shouldn’t be throwing stones at the dam’ gubmint’s customer service…

This has major impact – most dramatically on the less fortunate among us. Stuff that we wealthier folks take for granted – internet access, smart phones, reliable wifi, reliable transportation literacy…is usually NOT commonplace among poorer folks. Oh, and the research very, very much applies to insurers and health plans…

From HBR:

If you’re working on making communications more “efficient”, make VERY sure you always start and end with the “communications” piece – NOT “efficiency”.

Regular readers will recall Medicaid is about to drop a LOT – as in 5 to 14 million moms, babies, disabled folks, grandparents and families from its rolls, and many states are going to force those beneficiaries to use electronic communications to prove they qualify.

I’d like to think they are doing this out of ignorance, but my instinct – and research – indicates many state regulators and legislators are doing this purposefully – to deny health insurance to people who desperately need it.

What does this mean for you:

Meet people where they are. And be kind.

and for the first time in forever I’m not there…apologies to my friends at WCRI; a Board meeting conflicted with this year’s annual meeting.

Good news is the estimable Stuart Colburn Esq. provided an excellent summary of the session on climate change’s impact on workers’ compensation at WorkCompCentral (subscription required). LWCC’s Jill Leonard and Jeff Rush at CJPIA.

courtesy WCRI

[btw I’m eagerly awaiting news that several colleagues, long climate change deniers, have “evolved” their thinking to acknowledge the reality that is human-caused climate change.]

Stuart also reported on Dr Olesya Fomenko’s research into medical inflation, noting there’s been a steep rise in facility prices (no surprise to regular readers of this blog…a few relevant posts are here).

All told, hospital inpatient outpatient and ambulatory facility centers account for over half (!!!) of work comp medical spend. These costs have also been growing almost three times faster than physician expenses.

Think about that – facilities – which do what physicians tell them to do – are increasing their prices three times faster than physician services. Docs admit patients, order treatments/surgeries/PT/medications/rehab, write return to work orders…they are directly and solely responsible for the medical care your injured workers get and their return to work.

Yet you are allowing hospitals and ASCs to charge you and your employer customers more and more every year, while refusing to significantly increase what you are paying the people who actually care for those injured workers.

In word, this is dumb.

What does this mean for you?

Do. Your. Job.

The collapse of two banks and rescue of two others (so far) sent tremors throughout the financial world.

First and perhaps most importantly it looks like most workers comp insurers had very little – if any – exposure to either SVB or Signature. So even if the Feds had not stepped in to keep all depositors whole, work comp insurers’ financials would not have been at risk. While there’s lots of external factors that the comp industry has to worry about, this doesn’t look line one of them – at least not directly.

I spoke with Bickford Actuarial’s Mark Priven to get his take: Mark is a very well-regarded actuary and good guy to boot. Here’s his view:

I don’t think there will be a lot of fallout in the insurance P/C insurance industry in general. A good source of info on this would be Best’s Aggregates & Averages, which shows the industry balance sheet broken out by asset type. One would expect carriers would have a high percentage of invested assets in high-quality bonds. A very low % would be in cash/cash equivalents potentially sitting in a bank. But it’s possible that there are particular companies that have a lot of money tied up with some of the affected banks.

Fortunately insurers (unlike banks) aren’t subject to “insurance runs”. While the insurance liabilities are substantial, they claimants receive get their benefits dripped on them over an extended period, and claimants don’t have a lot of ability to demand immediate payment. Part of the delay is the whole legal process, settlement agreements and related factors.

What I am worried about is the debt ceiling. People keep telling me that since the consequences could be so severe, it’s in everyone’s interest to reach a deal on that. I disagree. If Rs or Ds think that they can blame the catastrophe on the other side, then they could very well want to bring it on.

I’ve got a couple other queries out and will share what I learn.

What does this mean for you?

Nothing (much) to see here folks…

Work comp and healthcare are probably the two most highly regulated sectors of the economy – and yes I’m including the financial sector.

Over the last 25 years I’ve spent a ton of time with regulators, legislators, lobbyists and the government folks tasked with implementing those laws and regulations.

Here are my learnings…

According to sources that know a lot about financial regulation, the collapse of Silicon Valley Bank was due in large part to laws passed by Congress (with mostly R and some D support) that loosened capital and other requirements for a lot of banks.

Incompetence added fuel to the dumpster fire. Now staunchly-Libertarian Silicon Valley investors and business owners have suddenly become huge fans of central government intrusion into private business (what a bunch of %$#(*&># hypocrites).

credit New Statesman

From the LATimes:

venture investment firms…actually launched the run on SVB on Thursday, when they suddenly urged their companies to pull their deposits from the bank, triggering the $42-billion outflow. “And they now want the Taxpayer to bailout their investments…?! Capitalism, Silicon Valley-style.”

Tellingly, SVB dropped a half-million dollars lobbying to get those laws passed…and their CEO – a huge champion of de-regulation was the biggest champion.

Now we have what just might become a global financial problem that – with better US banking legislation and regulations – would never have happened.

What does this mean for you?

If you are a state legislator, find and talk with objective and informed people in each area you’ll be voting on.

If you are a regulator, do what you can with what the legislature gives you, but be realistic…work comp is <1% of US medical spend, so do NOT expect healthcare providers to do anything different for their work comp patients – even if your regulations require them to.

If you are a Federal legislator, think a lot more about some massive effort to shrink the government.

Those Silicon Valley Libertarians sure wish they did.

A recent report from Phillips O’Brien and podcast from War on the Rocks got me thinking about parallels between Ukraine’s military and the workers’ compensation industry.

The net is the military units that allow front-line forces to be creative, adapt, and make key decisions about tactics, weapons used and allocation of resources are much more effective than those units which must follow strict plans from distant leaders.

Parallels

Until relatively recently Ukraine’s military was pretty much a carbon copy of Russia’s. Recall Ukraine was a Soviet client state and its military’s structure, leadership model, training, and equipment was identical to the USSR’s. The result was very much a top-down military with even platoon-level 40 soldiers) and squad-level (12 soldiers) leaders required to follow strict plans on:

That’s how Russia is fighting in Vuheldar – where it is failing miserably in large part due to stupid tactics.

Some Ukrainian units have evolved to a less-dictatorial leadership model; Ukraine is by no means immune from Russian-style leadership, but it appears to suffer somewhat less from it. Bakhmut is an example; (my layperson’s guess is) leadership sees the battle as a key to the upcoming Ukrainian offensive; Russia is suffering huge and unsustainable losses in personnel and equipment due to human wave attacks and massive shelling. Ukraine is losing hundreds of soldiers as well, but it appears to be delegating authority on local tactics to local unit leaders, likely reducing casualties.

That means fewer Russian soldiers, shells, cannons and vehicles to resist Ukraine’s spring offensive, and more Ukrainian assets to attack.

Alas leaders at many workers’ comp payers – and most insurers – focus way too much on “the plan” and way too little on the planning process and figuring out how to enable local leaders to achieve objectives,

For an excellent discussions of where Russia is doing smart and dumb things due mostly to leadership click here.

What does this mean for you?

Planning and setting objectives is critical, as is delegation and enabling local leaders to figure out how best to accomplish those objectives.

Revenue Cycle Management.

RCM is the acronym for a focused, ever-evolving, highly sophisticated approach hospitals, ambulatory care facilities and healthcare systems use to suck as many dollars as possible from employers, taxpayers and insurers.

There are scores of RCM companies out there, some with programs specific to workers comp…

and this is a growth industry...

Reality is in many states workers’ comp is – by far – the most lucrative payer. Florida is the worst example of gaming by facilities to Hoover dollars out of employers and taxpayers pockets; Wisconsin is also hugely problematic as is Alabama and a bunch of other states.

And it is going to get worse.

With Medicaid enrollment scheduled to drop dramatically, CMS reducing COVID payments to hospitals, and many hospitals and health systems facing record deficits, hospitals’ scramble to find revenue is going to accelerate.

Meanwhile…bill review companies are woefully behind the Cognizants and Convergents, despite BR companies’ protestations otherwise.

Rather than seek expertise and capabilities and better performance by subcontracting to much-more-sophisticated and capable third parties, BR companies try to do it in-house…mostly so they can keep all those fees for themselves.

Meanwhile facility costs increase, and the ones getting screwed don’t seem to care. Expect Florida and Texas to be most problematic as those states did not expand Medicaid. 1.6 million Texans and 1.4 million Floridians will lose their Medicaid coverage, further hammering hospitals’ financials.

400,000 Wisconsinites could lose coverage…

Why I continue to berate the industry for failing to protect its own best interests is a puzzle even to me…employers aren’t exercised enough to demand better, neither are insurers, and TPAs are no better.

And don’t get me started on brokers and “consultants”…

What does this mean for you?

Do your job.