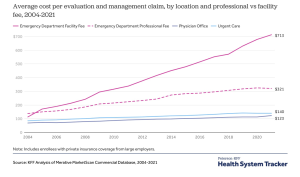

So what exactly are “benchmarks”?

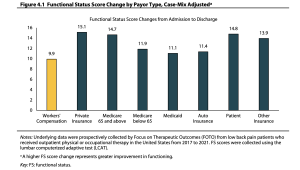

Yesterday we dove into outcomes vs process metrics, and why focusing on process measures (e.g. call abandonment rate, three-point contact timeliness, savings below fee schedule) instead of outcomes can result in the classic…

Benchmarks are standards by which outcomes can be measured or judged. Outcomes drive process improvements, financial results, and most importantly, healthy, fully functional patients.

In work comp, you’ll most often see vendors or payers comparing their results to ACOEM and/or ODG...while that can be somewhat useful, it’s important to recognize several issues/potential limitations…

(beware of comparison’s to the vendors’ clients…while that can be helpful and illustrative, it’s usually a very small sample set, and begs the question – “just how good are the vendor’s overall results?)

- median values are typically used…but they reflect average, run-of-the-mill performance, which is NOT the standard we should be aiming for.

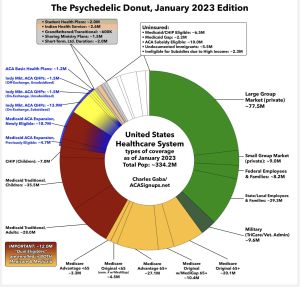

- data comes from a limited number of payers and other sources and may not reflect your injured worker population’s demographics, locations, injury types and other factors

- case-mix adjustment tools can be very helpful – IF the tools are:

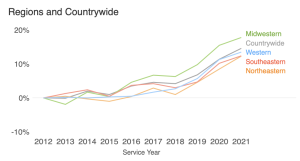

- used with robust data sets that reflect your patient population,

- specific to the time frames you are evaluating,

- relevant to payer type, and

- straightforward, with limitations explicitly acknowledged and explained.

This can get pretty complicated, as in migraine-inducing complicated. Don’t obsess…and unless you are a statistical whiz, Do NOT get caught up in the minutiae, it is up to the vendor to help you understand, not to baffle you with BS.

(very helpful to have a statistically literate person on your team to clarify, help explain, and when necessary call BS…there’s a LOT of it out there)

Rather, challenge the vendor to explain in layperson’s terms specifically and in detail why and how these benchmarks are relevant to your population, their limitations and strengths, and where you fall on the spectrum from worst to best. Also, get written documentation of their analyses and the methodology you can share internally and with your customers as necessary.

Vendors who cite benchmarks must be able to explain all of this...just don’t expect them to do this the first time around, as it is likely they’ve never been challenged.

What does this mean for you?

Know your outcomes.