RAND’s long-awaited research paper on Alternative Payment Models for California Workers’ Comp is out.

It is…underwhelming, incomplete, doesn’t focus on key metrics, did not include actual examples of APMs in WC (of which there are many), makes inappropriate comparisons, and…I could go on.

Yeah, I know it’s an initial study, but C’mon…

First, a couple intro notes…

-

- in laypersons’ terms, Alternative Payment Models (APMs) are different payment schemes/methodologies used in an attempt to improve care/patient experience/save money.

- APMs include pay for performance, bundled payments (e.g. flat fee for a surgical episode), per member per month flat fees, global payments and other models.

- APMs are quite commonplace in Medicare/Medicaid, group health, and exchange healthplans and have been for years.

- Broadly speaking, despite LOTS of different approaches, studies, methods and work, to date APMs’ impact on those metrics has been marginal.

OK…initial takes on RAND’s report. (note I haven’t thoroughly reviewed and analyzed all 95 pages, but wanted to get this out ASAP)

APM in WC

Most importantly, there have been numerous experiments AND long-standing programs with “alternative payment models” in California and other states…somehow RAND missed these. Yes RAND noted Ohio and Washington have done work on APMs, but RAND missed:

- Carisk’s Pathways2Recovery Program (Carisk is an HSA client)

- Paradigm’s HERO programs. – models include full risk transfer and episode of care payment for shoulder, back, knee and other diagnoses.

- Medrisk has had an episode-based managed physical medicine reimbursement model in place for decades. (Medrisk is an HSA client)

- other specialty network/service companies have had similar programs

- and others I don’t have time to get into.

I note that these are very patient- and condition-specific and narrowly focused – similar to many group health/Medicare/Medicaid APMs…yet should have been included.

Inpatient vs outpatient

Across all payer types, care has been shifting from inpatient to outpatient settings. Unfortunately RAND spends a lot of time on inpatient APMs and nowhere near enough on the outpatient side.

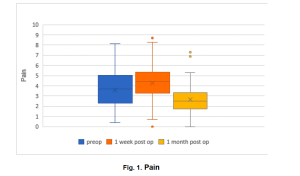

Outcomes

What is critically important in workers’ comp (and I argue SHOULD be across all payer types) is sustained and rapid return to functionality. There is precious little discussion of the central importance of this primary goal – and how it might/might not be affected by myriad different APM models/studies discussed in RAND’s report.

Comparisons

RAND relies extensively on comparing hospitals in the Hospital Value-Based Purchasing Program (HVBP) to critical access hospitals that are not in that program…without much discussion of the key differences between these facilities, differences that – I would argue – make comparisons sketchy at best.

One issue – poorer patients are more likely to get care at and represent larger percentage of the patient population at critical access facilities…that demographic also consistently rates patient experience lower than wealthier patients. Thus, comparing HVBP program patient experience data to critical access hospital data is difficult – at best.

Access to care

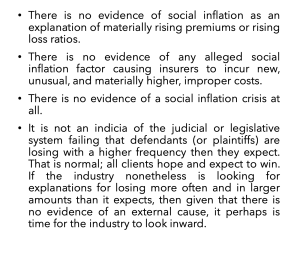

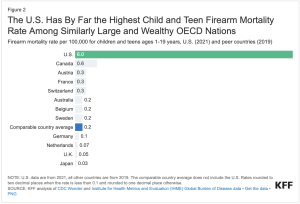

RAND makes a major point about “stakeholders” concerns about access to care. Actual real scientific research paints a different picture.

Let’s get real.

There’s a whole shipload of factors that RAND mentions (very briefly) that deserve a LOT more discussion.

One example – less than a penny of the US healthcare dollar is spent on workers comp medical. That, dear reader, makes it really hard to get the vast majority of health care providers to do ANYTHING.

What does this mean for you?

There are APM in WC…and a lot of history and knowledge and research and expertise around them. Much could have been learned if they were fully considered.

For a lot less money.