Whether you’re chatting around the grill, conversing at a swim meet or hockey game, or between quarters of a football game, here’s the real scoop on the economy, with immediate responses to show you’re the one with the real story.

hint…the “everything sucks” narrative is flat out wrong.

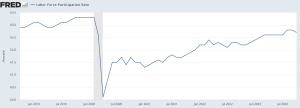

- No one wants to work these days!

Surprise…

Net is the percentage of everyone 16 and older working today is within a half point of pre-COVID participation rates.

No, there is NOT some huge number of Gen Zs, millennials, or whatever that’s said “screw it, we’re outta here, and I’m gonna live with/off my parents forever!”

And…for the core group – folks 25-54 – labor force participation is near an all-time high at 83.5%!

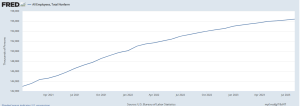

2. Well…there just aren’t that many people working!

Hmmm…There are more people employed now than ever, and employment has been increasingly steadily for the last three years.

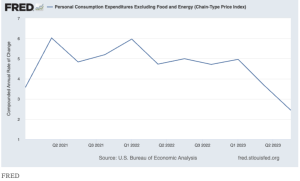

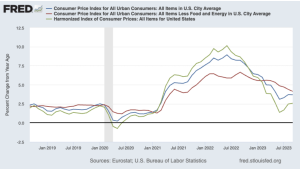

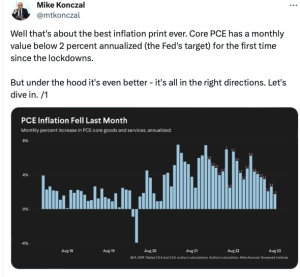

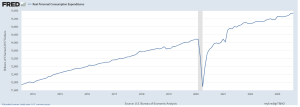

3. Okayyyyy…but inflation’s higher than wages, so we’re falling behind!!

Well, no – since way back in March – 9 months ago – earnings are growing faster and more than inflation, so you can buy MORE with your weekly paycheck today than you could a few months ago.

source Statista

What does this mean for you?

You are gonna be soooo smart.