Stuff you may have missed…

Spinal cord stimulators...Don’t work.

More specifically, multiple high-quality studies found little evidence of pain reduction, no impact on disability, no impact on opioid use, and a relatively high risk of complications (about one in five patients required device revision or removal)

Just as bad, the SCS industry fought back with highly questionable tactics: this from JAMA reported in MedPageToday:

“Industry-funded critics of independent studies often do not follow the usual route of scientific discourse…

Rather than respond to the journal where the original study was published, critics frequently publish in journals where they are the editors and can control the discourse (15 of 18 letters criticizing the independent studies cited in this article appeared in journals with industry-affiliated editors)…

The journal can then choose to paywall the subsequent response from the independent authors, giving critics the last word.”

and criticisms are typically narrow (but they didn’t look into the benefits for left handed red heads who speak Swahili!) and/or specious.

The net – science indicates the risks of SCS are high indeed, while the benefits of SCS are sketchy at best.

FDA approves test to assess opioid addiction risk

From the FDA”

“The AvertD test is intended to be used before patients who are being considered for a 4- to 30-day prescription for acute pain (e.g., for a planned surgical procedure) are first exposed to oral opioids. It is not intended for patients being treated for chronic pain.”

Excellent news indeed!

The test is NOT yet available…check here for more info.

Net – get your Medical Director(s) on this post haste to determine coverage policies and reimbursement.

Opioid settlement dollars

are in high demand, with a bunch of companies coming up with very creative ways to stick their heads in the trough. Spiderman-type cord wraps for police, locking pill bottles, safe disposal envelopes are among the pitches governmental entities are getting for their opioid settlement dollars.

Two points –

- addiction counseling, behavioral health, and other patient care is what is needed – and where dollars should go.

- illicit fentanyl is the big problem now – expensive locking pill bottles and disposal envelopes are marginally useful.

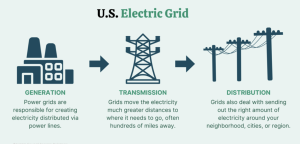

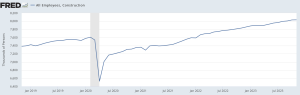

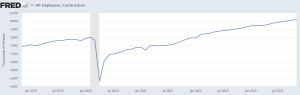

Texans may see rolling blackouts this winter, with implications for businesses, public safety employees, utility workers and essential workers.

In October ERCOT – the state’s power regulator, “… issued a request to increase [electricity producers] power capacity ahead of winter’s peak load season in Texas but canceled the request after it only found an additional 11 megawatts out of the 3,000 it was looking for.”

Power producers pointed to ERCOT’s request as too little, too late; University of Houston Energy Fellow Ed Hirs: “Just simply throwing some money out and hoping that people could bring a coal-fired power plant back out to operational capability within a period of weeks was really, ridiculously, ambitious.”

It’s not just Texas…with changing winter weather patterns driven by climate change other states are also at risk of similar blackouts.