What I missed when I was busy working last week…

Workers’ comp

HomeCareConnect launched a new service last week intended to smooth the transition for patients moving from acute care facilities to a skilled rehab facility. HCC folks have credentialed and contracted some 15,000 providers; combining these providers with HCC’s in-house care coordination staff should help adjusters and case managers manage the complex needs of these patients.

The folks at the California State Comp Insurance Fund produced a pretty campy – and pretty useful – video training series about data security. Not often a CEO allows her/himself to be the object lesson for training…

The fine folk at WCRI have a free webinar Thursday, Jan. 30, 2020, at 1:00 p.m. ET reviewing Pennsylvania’s workers’ comp system. Register here…And do it now, as there’s a 500 viewer limit.

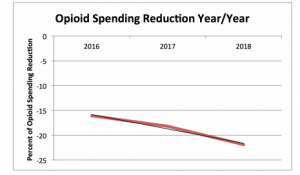

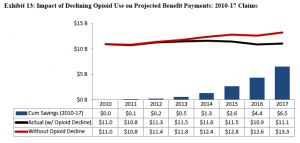

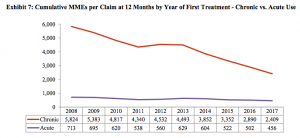

Friend and colleague Dwight Robertson MD penned an excellent piece on opioid management. Dwight, who is the Medical Director for Employers’ Insurance, has found that three tactics can make a big difference; get on those opioid claims much sooner, have a direct conversation with the prescriber about the opioid plan, and focus on alternative approaches to pain management.

A quick read and quite topical.

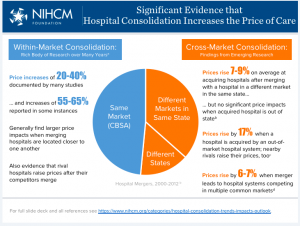

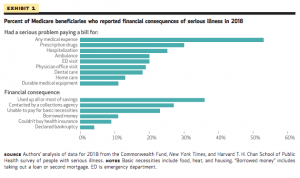

Group health

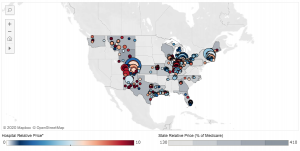

Private insurers’ facility payments differ wildly; comparing them to Medicare indicates inpatient costs are roughly 2.4x Medicare, while outpatient is even higher at 2.9x.

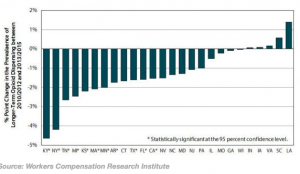

The pic below is from an interactive tool that enables you to see what your state looks like. Spoiler alert – Orlando’s Florida Hospital gets more than 3x Medicare…

Here’s my Capt. Obvious moment – your healthcare insurer is paying more than twice what Medicare is – which means huge profits for your hospital.

And that’s why your insurance premiums, deductibles, and out of pocket costs are so high.

What does this mean for you?

Good stuff happening in workers’ comp, while hospitals are the biggest reason your health insurance premiums, deductibles and out of pocket payments are zooming