Four months into the COVID pandemic, early data show workers’ comp insurers are doing the right thing.

Two data sources support this assertion – CWCI’s just-released analysis of 1,077 California claims and a dozen conversations I’ve had with insurers, large self-insured employers, and service providers over the last two days.

First, CWCI.

CWCI’s researchers and statisticians analyzed 1,077 COVID-19 claims from 28 insurer and self-insured CWCI members. Notably, these are claims filed before April 30, a week before the governor’s Order granted the disputable presumption.

Key findings:

- Only 35% of the COVID-19 claims were denied

- 7 out of 10 workers whose claims were denied tested negative for the virus

- Other denials were due to:

- the employee had not been exposed at work,

- no diagnosis or symptoms of COVID-19,

- the employee had been working at home, or

- refused to take a COVID-19 test.

Next, I’m in the midst of a second national survey of payers and service providers about their experience with COVID-19. (details on the first survey are here.)

Key preliminary findings (based on a dozen completed surveys):

- most payers have developed COVID-specific intake processes, trained staff to handle COVID claims, and set specific policies and procedures to address COVID.

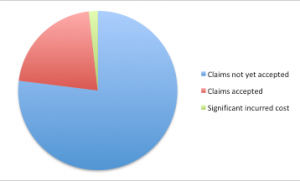

- so far, payers have accepted about 15% of COVID-19 claims

- the range is about 10% to 25% of COVID claims filed

- where possible, insurers surveyed are “paying without prejudice” on claims filed but not yet accepted or denied. That is, insurers are paying medical bills even if they don’t know if the patient has COVID-19.

- Several very large self-insured employers are providing two weeks’ leave with pay to workers who fear they’ve been exposed at work, regardless of test results

What we know so far.

- Some percentage of filed claims are still under review, so the acceptance rate will increase.

- Employees who think they may have been exposed at work are filing claims, even if they are asymptomatic.

Based on what we know today, workers’ comp insurers, state funds, and self-insured employers are doing the right thing.

Despite that, several states are contemplating bills or executive action to make workers’ comp the default payer for COVID19.

California’s SB1159 is the poster child; from CWCI – “By including all types of employment without regard to the level of risk actually posted, the presumptions greatly expand the nature and scope traditionally encompassed by presumptions of compensability in California.

More specifically, the bill makes workers’ comp responsible for COVID-19 diagnoses even among workers deemed “low risk” for contracting the disease at work by OSHA. That is, workers with “minimal occupational contact with co-workers or the public.”

COVID-19 is a relatively small occupational issue, but a huge societal one.

Yes, workers who contract the disease through work should be covered by workers’ comp – and all the evidence to date indicates that’s happening.

But work comp should NOT be the piggy bank for any and all COVID claims – which is precisely what SB1159 and similar actions in other states would do.

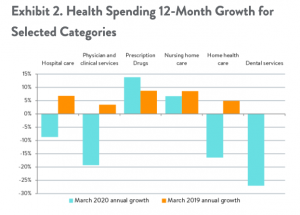

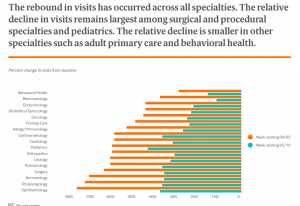

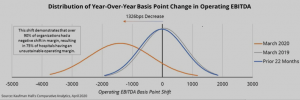

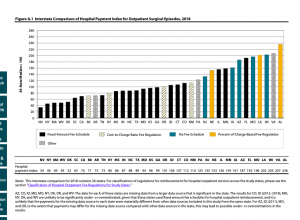

What’s driving this is our totally dysfunctional healthcare system, one that relies on private insurers, employers, and employees to generate much of the revenue and all of the profits. Hospitals, health systems, medical practices and other providers are in desperate financial shape; it will get worse over the next few months.

Dumping the responsibility for a societal pandemic on a tiny industry that pays less than 1 percent of total US medical costs is not only irresponsible, it also won’t work. Workers’ comp insurers, excess insurers, employers, and governmental entities don’t have the financial resources, skills, staff, or capability to manage and pay for the care of hundreds of thousands of patients, while also covering their lost wages.

This is society’s problem. It’s time governors, state legislators, Congress and the President do their job. Take responsibility – just like the workers’ comp industry has.

What does this mean for you?

Workers’ comp payers – keep doing what you’re doing.