Hospital in patient and outpatient, surgery, DME/home health, PT, pharmacy, imaging, lab…

Which one is NOT like the others??

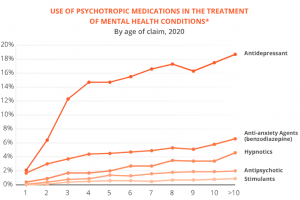

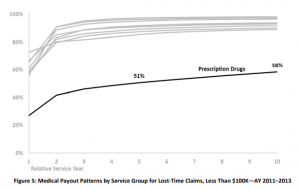

That’s easy – when it comes to impact on legacy/older claims, it’s all about pharmacy. The older a claim is, the greater the percentage of spend is for drugs.

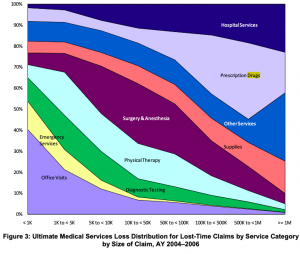

The older and more costly the claim, the greater the percentage of spend is for drugs (except for those cat claims needing long-term home health/facility care).

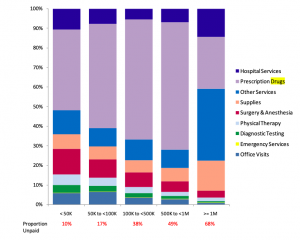

And, the higher the reserves, the greater the percentage of those reserves is for drugs (except for those cat claims needing long-term home health/facility care).

Both graphs from NCCI; Medical Services by Size of Claim—2011 Update.

Updated information from NCCI...shows drugs continue to be a major driver of claim costs in older claims…excellent research by NCCI’s Matt Schutz…

especially for those really expensive claims.

But that’s only half the story. The other half is the impact the type of drugs has on claim outcomes. Most simply, most patients on opioids after 8 years need a lot of help, assistance, patience, and support to recover functionality. Some can do well on opioids – most do not.

What does this mean for you?

So, how are you buying PBM services?

Do you even ask how the PBM will help reduce long-term drug spend?

Do you ask to see data on their results by age of claim?

Do you dive deep into their abilities, tools, programs and approaches to addressing long-term claims?

Does their reporting support this by identifying, tracking, and quantifying results?

If you aren’t focusing on the PBM’s impact on long-term claims, you’re doing it wrong.