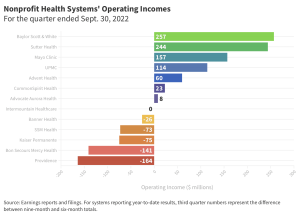

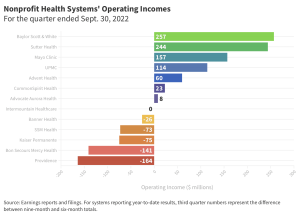

For profit hospitals have very solid operating margins.

Some Not for profits are really struggling…others are doing just fine thank you.

credit FierceHealthcare.

That’s the headline – the question is…why? and what does this mean?

First, a little more explanation…

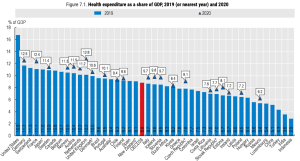

From the Kaiser Family Foundation’s report…

So far this year [2022], operating margins among the three largest for-profit health systems in the country have met or exceeded pre-pandemic levels. HCA and Tenet in particular have had high operating margins.

the largest for-profit systems have had operating margins that exceed pre-pandemic levels. [emphasis added]

Also, most hospitals and systems saw declines in investment income; as this falls outside their core business, we are focusing on operating income which excludes investment and other categories.

Why?

It appears that the more profitable hospitals/healthcare systems:

- saw surgical and other profitable service line volumes return to or exceed pre-pandemic levels

- better controlled staffing costs; contract staffing costs (traveling nurses and other clinicians) were a major factor for several not-for-profit hospitals

- benefitted from non-healthcare operations (insurance for UPMC) and financial gains from mergers (e.g. Intermountain Health)

- increased prices for commercially-insured patients (this is an assumption although there’s this…)

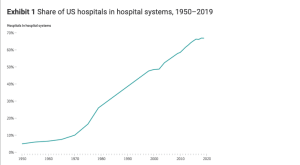

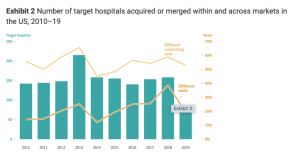

The merger thing continues to be a major influence, with $45 billion in transactions in 2022 across 53 deals… again the results aren’t consistent as some systems really benefited while others did not.

Meanwhile, the American Hospital Association continues to call for higher reimbursement and other federal intervention to help hospitals financials.

For my workers’ comp readers…

Look at the costs of providing care at an HCA hospital vs some of the not-for-profit hospitals in your service areas. You will very likely find HCA’s costs are several times higher than not-for-profits’.

Oh, and they are waaaay higher in Florida…

More on this here.

What does this mean for you?

Don’t use HCA or Tenet facilities.