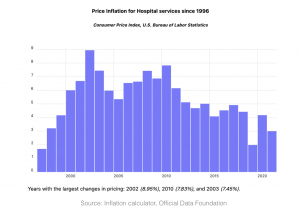

Healthcare costs are about to jump again, driven by exploding staffing expenses, continued healthcare provider consolidation, and the brilliant profiteering by some of the largest (mostly for-profit) healthcare systems.

So, what’s a family to do?

A few have turned to Healthcare Sharing Ministries, a thing that looks like health insurance but isn’t. HCSMs purport to “share” health care costs among members in what might best be described as a risk-pooling framework. Almost all claim to be “Christian”, they are largely unregulated (except as charities), don’t comply with insurance regulations or laws in most states, and most have requirements that members:

- are in good health,

- make a statement of Christian belief, attend church regularly, don’t use tobacco or have sex outside of marriage and

- commit to taking care of their own health.

note there are ministries focused on other religious denominations.

So…sounds good right? cheaper healthcare is better…well, HCSMs also:

- are not legally required to pay your medical bills,

- require enrollees to do much of the groundwork to get bills paid (negotiate upfront with the provider, get all the paperwork and documentation, pay upfront then seek reimbursement)

- medically underwrite – meaning they require disclosures of pre-existing conditions and can reject applicants for medical reasons,

- can refuse coverage to anyone for any reason,

- have limits on what they’ll pay for healthcare,

- can’t guarantee healthcare providers will accept sharing ministry coverage, and

- have appeals processes that aren’t subject to regulatory oversight.

Enrollment is a bit hard to nail down; the Alliance of Health Care Sharing Ministries claims 1.5 million enrollees although it doesn’t specify the year. Other reports indicate AHCSM reported membership was “over 1 million” in February of 2019. Other sources report membership closer to that 1 million figure.

HCSMs tend to be significantly cheaper than health insurance plans, making them increasingly attractive. However, most families that buy health insurance through the exchanges get major subsidies that significantly reduce their premiums.

There have been multiple reports of individuals and families stuck with huge bills after their “Ministry” refused to pay for care. Aliera Healthcare Inc. and Trinity Healthshares, Inc are the most visible example of what can happen without tight regulation. Regulators in multiple states issued cease and desist orders after concluding the companies violated laws; Aliera was found guilty of fraud and filed for bankruptcy late last year.

Tops among concerns is this – HCSMs are NOT required to have enough cash on hand to pay medical bills. Even more concerning, they don’t have to report their finances, cash reserves, expense ratios or other data.

There’s an effort underway to “accredit” HCSMs; the process/requirements don’t appear to address this critical issue and the accreditation board doesn’t include individuals with actuarial or financial credentials.

I’ve asked the lobbying outfit that purports to represent HCSMs for details on the financial portion of that accreditation process. So far they’ve been less than forthcoming.

What does this mean for you?

be very careful.

Why?

Why?