You or your spouse may well have a pre-existing health condition, one that, back in the bad-old pre-ACA days would have made it hard if not impossible to get insurance coverage in the individual and small group insurance markets.

Those days may be coming back.

A Texas court case is scaring the bejesus out of many; the Trump Administration and several state attorneys general are suing to overturn provisions of the ACA that require health insurers to cover pre-existing conditions.

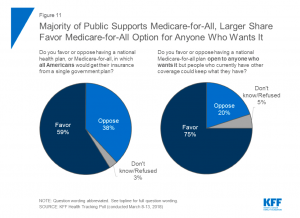

If this scares you, you’re not alone. More than half of people polled are afraid their insurance costs will go way up, and 4 out of ten think they may lose insurance coverage if insurers no longer have to cover pre-existing conditions.

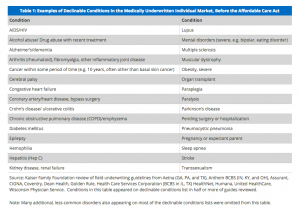

An old athletic injury, skin cancer, stomach trouble, anxiety, a heart murmur, migraines, allergies – all those and many more are pre-existing conditions that, if the lawsuit succeeds, would likely prevent you from getting individual insurance coverage for those conditions – if you could get insured at all.

Before the ACA,

- you couldn’t leave their job to try something new or retire early – a condition known as “job lock”

- small employers’ costs went up dramatically if workers got sick or had specific conditions because their insurer wanted to dump them.

Under the ACA, insurers must cover pre-existing conditions, and can’t charge individuals, families, or small businesses more based on those pre-ex conditions.

This strikes me as eminently fair; I had cataract surgery and started getting migraines years go, and until the ACA I had no coverage for ANYTHING related to my eyes or brain. That was pretty scary; any medical care related to those rather important organs was money out of our family budget.

Here are some of the conditions that you are insured for under the ACA, conditions that would not be covered if the lawsuit succeeds.

I’m all for freedom and choice and all that stuff.

What I’m vehemently against is stupid public policy that results in you going bankrupt because an insurer won’t cover your pre-existing condition.

For those who claim the “free market” will fix this – you are smoking crack. No insurance company will cover your pre-ex condition – or your spouse’s, or kids’ – unless they are forced to.

What does this mean for you?

If Trump et al win this suit, your freedom to change jobs just disappeared.