Until things calm down we’ll do an occasional post on the biggest health story out there – coronavirus.

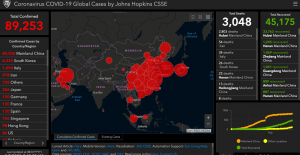

Thanks to Larry – here’s the latest numbers (as of 10 am EST 3-2-20) on cases, recoveries, and mortalities by nation. Source link here.

Note that all views/opinions/takes are based on what we know now – which will change as time goes on.

First, how afraid should you be?

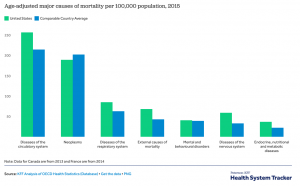

Quick take – it’s worse than the flu, but way less dangerous than other diseases.

This isn’t Ebola – which has an 80% death rate. It’s not MERS (death rate of 34.7%) or the plague (death rate of 15% if patients are effectively treated).

Based on very incomplete data, it looks like the death rate is equal to or less than the Spanish Flu – somewhere less than 2 percent. No question – that is a relatively high death rate – but it is based on very preliminary data.

Here’s a datapoint – in the US 18,000 people have died from the flu in the current flu season – and over 300,000 have been hospitalized.

So far, logic says you should be a heckuva lot more afraid of the regular flu.

More to the point, it appears those with compromised respiratory systems, or in poor health, or with other serious health problems are at much higher risk than healthier folks.

BUT – and it’s a big but – that mortality rate may be much lower, because:

- a significant percentage of people that test positive for corona don’t have any symptoms

- tests – especially the one initially used in the US – weren’t very accurate

How contagious is it?

Probably about the same as a “regular” flu; again initial reports indicate corona is more contagious, but that may be because it was a brand new disease, wasn’t managed well at the outset, and started in a very densely populated area.

What are the symptoms?

Initially, fever and a cough; some victims go on to contact pneumonia.

Will corona go away when it gets warmer?

We have no idea. There is no scientific basis for President Trump’s claim that warmer weather will end the epidemic; this is a brand new virus and no one has any idea if or how it will be affected by weather.

Lastly – be very careful about information sources.

The World Health Organization is the best I’ve seen.

One that pops up at the top of google searches is RT. RT is funded, staffed, and written by the Russian government. RT highly exaggerates death rates, here’s one example: RESEARCHERS DISCOVER MERS HAS A 65% FATALITY RATE

This is categorically false.

To date, White House announcements about corona haven’t been much better. White House statements have downplayed the risk of corona, the number of cases, how fast it is spreading, and claimed the flu’s death rate is the same as corona (it isn’t; so far corona looks to be 14 – 20 times more deadly than the flu).

What does this mean for you?

Science is important.