You get more for your money this fortnight!

The Senate Republicans’ release of their repeal-and-replace bill – plus our usual plethora of wisdom from health care experts, gives you a double-value today – the first in the history of HealthWonkReview!

Part One – Repeal-and-Replace

Let’s be real – Republican Senators’ bill is NOT an ACA replacement, rather it is best understood as a major reduction in Medicaid. For some, that’s all to the good; for others, not so much.

Here’s what you need to know.

(note I looked for other blog posts supporting the Senate bill – if you read any good ones please send them to me)

From Forbes, Avik Roy says

“the Senate bill will have far-reaching effects on American health care: for the better….if you simply kept [some tax credits from the House bill] in force, and tossed overboard the Paul Ryan flat tax credit, you’d solve all of these problems with the House bill. By making that change, the near-elderly working poor would be able to afford coverage, and the poverty trap would be eliminated. [emphasis added]

I wholeheartedly disagree with Roy’s premise. logic, and selective use of data to support his contention. He just doesn’t understand healthcare and the delivery thereof. His contention that eliminating coverage for 20 million Americans is “for the better” is patently absurd.

Andrew Sprung at xpostfactoid cut to the chase – his takeaway is the bill trades Medicaid coverage for high deductible private market coverage. Andrew quotes Louisiana Republican Senator Cassidy…but notes Cassidy’s sentiment is misleading at best.

Right now, [low income people] might have a $6,000 deductible, which for someone who makes 150 percent of the federal poverty line might as well be $6 million.

Sprung…

It’s true, as Cassidy avers, that an enrollee with an income of 150% FPL [federal poverty level] might have a $6,000 deductible, but most don’t…In any case, “most of those 20 million” who newly gained coverage did so through the Medicaid expansion and have zero deductible.

Ezra Klein made a similar point even more economically at Vox – “The Senate GOP health bill in one sentence: poor people pay more for worse insurance.”

Margot Sanger-Katz’ New York Times piece entitled G.O.P. Health Plan Is Really a Rollback of Medicaid reminds us of Kaiser Family Foundation reporting that Medicaid covers :

- 20% of all Americans

- almost half of all births, and

- two-thirds of nursing home residents.

David Williams pushes things a bit further with his post, asking if we should consider Medicaid for all. David uses Nevada as a “template” for his assessment of the potential that when – my words not his – the GOP destroys ACA – there will be an open revolt and we’ll end up with single payer – using Medicaid.

Compelling case…

Timothy Jost and Sara Rosenbaum on Health Affairs Blog give us “Unpacking The Senate’s Take On ACA Repeal And Replace“; here are a few key quotes…

- the Senate bill…entirely strikes the House bill and adopts a new bill with a new title.

- the Senate bill is focused on changes to the Medicaid program.

- parts of the Senate draft will be challenged under the Byrd rule. (they violate rules allowing passage without 60 votes)

- the Senate bill would replace the House’s age-based premium tax credits (APTC) with tax credits based on age, income, and the actual cost of health insurance in particular markets.

Wrapping up our Medicaid – ACA – BCRA discussion, AHCA’s unkindest cuts is from healthinsurance.org; The premise:

The attention various AHCA provisions get is inversely proportionate to the damage they’ll do. and that the bill — and its likely Senate counterpart — should properly be called the Medicaid Dismemberment Act.

Nate Silver opines on the likelihood of BCRA’s passage – his considered opinion is:

I’d guard both against interpretation that the bill will necessarily pass the Senate because it passed the House. At the same time, Ryan and House Republicans overcame some of the same obstacles — and if that precedent isn’t dispositive, it’s at least highly relevant.

Part Two –

UPDATE – apologies to Hank Stern, who contributed a post about the Defense Base Act, and a contractor’s…challenges when encountering the Act…DBA is kinda like workers comp without the unlimited benefits…

Healthcare in the occupational arena is often the forgotten red-headed stepchild of the healthcare world, yet it is a significant issue for both the workers who sustain what can be life altering workplace injuries and employers who bear the full cost burden for medical care and wage replacement. At Workers’ Comp Insider, Tom Lynch offers a primer of best practices in his Eight Steps To Controlling Workers’ Compensation Costs part 1, part 2 and part 3.

Roy Poses provided a different perspective on health care, asking why people with no healthcare background are running health care delivery organizations.

from Roy’s post…

I believe that managerialism in a health care context (leadership of health care organizations by people with only management training, and without any knowledge, understanding or experience in health care, based only on management dogma) is one of the major causes of health care dysfunction. Here is a great example of a managerialist hospital CEO who also seemed to demonstrate the Dunning-Kruger effect, that people who lack ability are likely unaware of this lack…To belabor the obvious, true health care reform requires health care leadership that understands health care and upholds its professional values.

An interesting post to juxtapose comes fromJason Shafrin, who asks “Does more spending improve outcomes?”

A number of studies have claimed that increasing health expenditures may result in no better, or even worse patient outcomes. The Healthcare Economist revisits the topic looking at the case of neonatal ward spending and patient outcomes in the UK.

Are the exchanges failing? well, depends on who you ask…

Louise Norris has become one of the nation’s leading experts on ACA and exchange matters; she tells us Nevada has a unique approach to their MCO contracts, and the result is that all of their current exchange insurers filed plans for 2018, and two new insurers have also filed QHPs to be sold on the exchange in the fall.

Health Access California’s reports that while Congress considers cuts and caps to Medicaid, California is showing a stark contrast in investing in this core health care program, restoring benefits like dental and vision, and using tobacco tax money to increase provider rates.

CMS Meaningful Use Payments to Providers: Incentives or Sophie’s Choice?is what I love about HWR; really smart, intelligent, deep thinking about what really drives healthcare.

For healthcare providers who are caught in the Meaningful Use regulatory net by participating in the program, they were given a choice between installing an electronic health record system, attesting to meeting a list of nearly-impossible targets to get reimbursement for their multi-million dollar investments, or choosing not to participate which resulted in losing participation in government-funded programs and incentives. Most providers bit. They had no choice. And when it came time to collect the Meaningful Use incentive dollars, they attested to meeting at least the minimum requirements. Now, the government has bitten back asking for repayments of $729 million.

This is Neil Versel’s obituary of Larry Weed, who invented the problem-oriented medical record and the SOAP note, and had been advocating for the computerization of medicine and the inclusion of patients for at least 60 years. One of the leading change agents in healthcare, and one we would do well to think about as we try to drive change

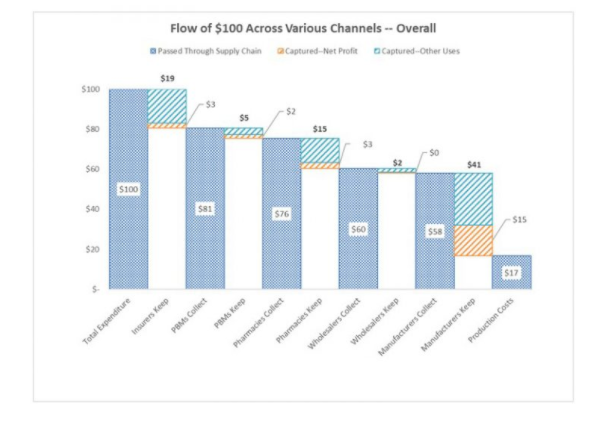

Adam Fein’s entry focuses on the wonders of charity care, and providers thereof. I did not know that “Pharmaceutical Manufacturers Operate the Biggest U.S. Charities…”

Dr Fein’s post says in part:

growth [of Patient Assistance Programs] is linked to pharmacy benefit designs that shift prescription costs to patients. Many insured patients face economically-debilitating coinsurance—in some cases with no limit on out-of-pocket expenses. The programs are an imperfect, but necessary, fix to our imperfect drug channel system.

Finally, I wondered why the Senate Republicans were so secretive about their healthcare bill, and now we know.

From HealthAffairs blog, a trenchant piece reflecting on the ways the AHCA would harm efforts to address the opioid crisis includes this

Because of the ACA, an estimated 26 million people have health coverage through the marketplaces or Medicaid that includes substance use disorder (SUD) treatment and prevention…Repealing the ACA will remove coverage for SUD treatment and prevention from millions of Americans, leaving a gap in care when it is most needed.

Whew…

Thanks for reading, and hope your weekend is splendiferous!