Greetings – David Deitz here. Joe has kindly offered to let me provide a guest post on the latest report on the opioid epidemic from the National Academy of Sciences, Engineering and Medicine (NASEM). The report is available here. It’s also 389 pages long in its current pre-publication form, and because I think there are some really worthwhile parts relevant to many of you who follow MCM, I’m going to give you my summary of the highlights.

The quick take – opioids are fundamentally different from other drugs due to the harm they can cause – and the FDA should consider this when addressing opioids. (JP observation)

Why is this report important and why should you care? Well, for one, the opioid epidemic is a true, deadly epidemic, that has left few areas of America untouched. As NASEM puts it (emphasis mine):

Current national trends indicate that each year more people die of overdoses—the majority of which involve opioid drugs—than died in the entirety of the Vietnam War, the Korean War, or any armed conflict since the end of World War II.

That’s about 90 a day. Every day. I don’t think that’s “opioid hysteria”. And WC has a lot of reasons to care, since analgesic drugs, most of them opioids, are the principal drugs prescribed for occupational injuries.

It’s worth noting that last week also saw the release of the interim report from the President’s Commission on Combating Drug Addiction and the Opioid Crisis. This report urged declaration of a national emergency – more on that below.

As many of you recognize, this is an incredibly difficult public policy issue, in which the legitimate needs of millions of patients with acute and chronic pain must be balanced with the harms opioids create. The earlier IOM report on pain in 2011 really punted on this one, but the NASEM gets right to it in the introduction:

- How exactly does a regulator….balance, for any particular regulatory action limiting access to opioids, the otherwise avoidable suffering that patients with pain would experience against the harms, not only to those individuals and their families but also to society, that would be prevented by the restriction? (pg 1-16)

The answers from NASEM are brilliant, well-reasoned and based on large servings of evidence – not only on opioid harms, but also on efficacy for chronic pain, likelihood of use and abuse in different contexts, alternative treatments, epidemiology of addiction and value and availability of various opioid addiction treatments, to name only a few. One of the most valuable concepts going forward is the doctrine of “opioid exceptionalism” a term coined by co-author Dr. Aaron Kesselheim in the NASEM webinar (you can get the slides here).

Put simply, opioid exceptionalism means that the FDA, as well as other public agencies, should go beyond the risk/benefit paradigm they currently use for new drug approvals that is based on individual patients and consider the implications of an individual opioid to patient’s families and society.

In other words, public health considerations need to come in because the societal implications are so large for this category of drugs. Drug manufacturers and some pain management professionals (and probably, libertarians) aren’t going to like this, but I think NASEM makes a compelling case that business as usual isn’t going to reverse the trends. They don’t really mention the workplace much as part of the public health discussion – there’s an opportunity for ACOEM to push up to the table.

I won’t review all of NASEM’s public policy recommendations, but some have implications for WC, including:

- Improved reporting and data collection. This has to include WC if it’s going to be complete.

- A call for insurers to reimburse for comprehensive pain management, including interdisciplinary approaches. Many in WC do, but it has to get better.

- Better patient and public education about opioids. Again, a role for WC here beginning at the first emergency department or occupational medicine clinic visit.

- Expanded treatment for opioid use disorder. There are cost implications for employers here, but it’s the right thing to do.

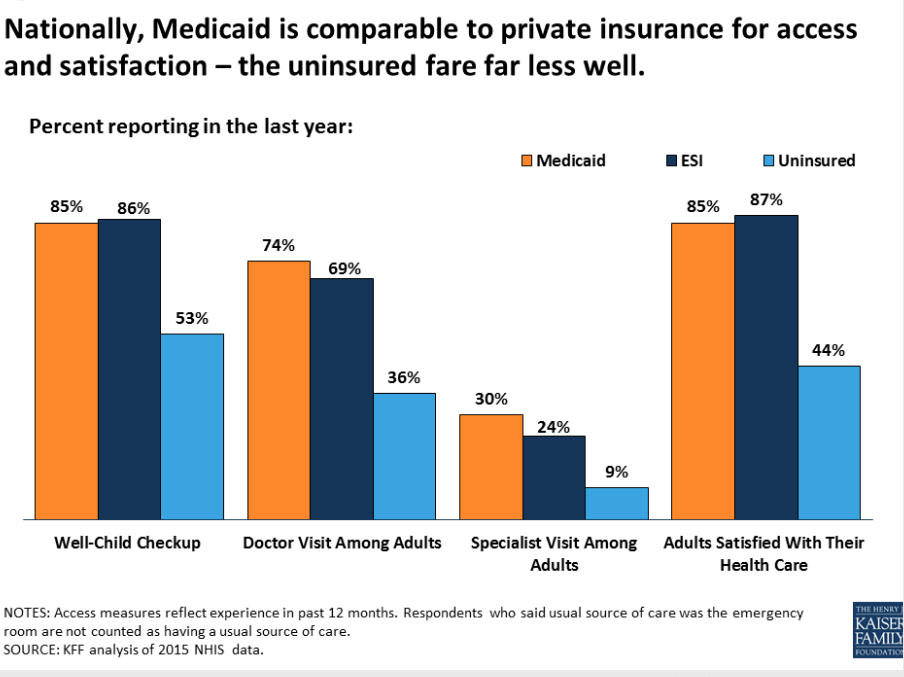

Meanwhile, the President’s Commission mostly agrees, and provides some of the same recommendations. Unfortunately, there are some thorny political problems with that emergency declaration (which I agree with) – it’s difficult to reconcile recommendations to “rapidly increase treatment capacity” and expand benefits for substance abuse treatment with cuts to Medicaid.

The NASEM is the meatier of the two, is better thought through and overall is one of the most comprehensive public policy documents I’ve read in a while. Take a few minutes to look at the slides, they are a good summary of the recommendations. Where do they touch your organization?

Let’s not just hope that the NASEM report makes a difference, but do what we can to ensure it.

David Deitz, MD, PhD is principal of David Deitz & Associates, a healthcare consulting firm based in Massachusetts.