at long last. Here’s a quick review of what happened this week.

Health care costs

Predictions for health care costs indicate a decrease in the rate of increase for those with private insurance, with PwC calling for a 6.5% increase dropping to 4.5% due to higher deductibles and copays.

While costs continue to escalate, one has to wonder what we’re buying for all those trillions.

According to the Commonwealth Fund, not much – when comparing US health outcomes to those enjoyed by other countries, we are well down – if not at the bottom – the “quality” list on indicators such as life expectancy, disease burden, medical errors, avoidable deaths…the list just goes on and on.

A good part of that is due to the lousy-to-nonexistent care for the poor, exacerbated by states that have refused to expand Medicaid. Kansas is but one example; the stories of people with jobs and no health insurance bankrupted, disabled, and suffering due to this short-sighted and cruel decision are all the more heart-wrenching because they didn’t have to happen.

You’ll note that many of the individuals dying from lack of insurance are now or have been employed – but don’t have insurance thru their employer.

This is NOT because they aren’t hard working solid citizens. These are NOT lazy, shiftless, burdens on society. These ARE people victimized by unaffordable health insurance and politicians who value demagoguery over compassion.

American exceptionalism indeed.

The jump in drug prices, specifically in generics continues to amaze, with the latest a huge increase in oxycodone/acetaminophen 10/325; from $1.29 up to $3.55. Thanks to a colleague for this tip; notably this is a Redbook AWP price; AWP is the basis for essentially all work comp drug fee schedules.

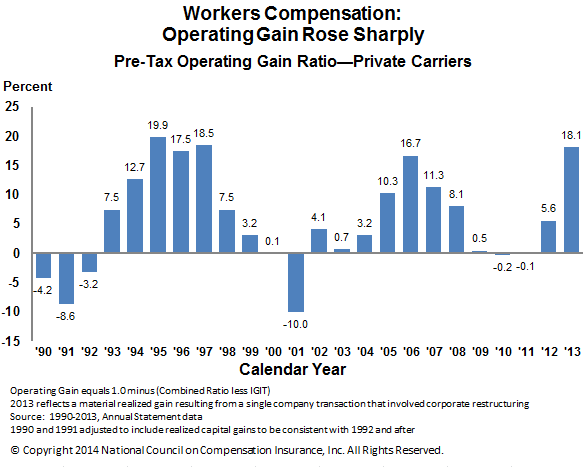

Workers’ comp

Had a conversation with two Concentra execs looking to provide a bit more perspective on the company’s plans. The focus is on growing their work comp business via acquisition and by taking share from other providers. Parenthetically, I also spoke with a colleague very knowledgeable about occ med in the northeast; he noted many health systems and hospitals are shutting down their occ med clinics as they focus on accountable care and other ACA, Medicare, and Medicaid – related priorities.

Sounds like a good opportunity for Concentra and other pure-play occ med enterprises. Expect to see Concentra somewhat less interested in urgent care opportunities; I don’t see the company doing anything that isn’t primarily occupational medicine.

The execs did note that prior owner Humana had split off the primary care operations from Concentra’s occ med operations some time ago. The health plan’s strategy and implementation thereof evolved considerably over the five years it owned Concentra; it doesn’t appear that Humana took full advantage of Concentra’s in-house M&A expertise early on, choosing instead to develop its own capability. This may (emphasize MAY) have been one reason the acquisition didn’t evolve quite the way Humana wanted.

There is a lot going on in the worker’s comp bill review world:

- Coventry has yet to announce the winner in the bidding process to handle their clients’ bill review needs; word is it is between Mitchell and Xerox/Stratacare with Mitchell rumored to be in the lead

- A major municipality in California is in the bid process; several other large payers are as well

- Mitchell is said to be increasing its focus on work comp as execs look to the long term future of auto claims and see a rather steep decline in future claims due to automated vehicles.

AIG’s implementation of Medata’s work comp bill review application is said to be all but complete. Word is the switch from Coventry’s BR 4.0 system, although not flawless, is going well. While Medata CEO Cy King would not comment, other vendors indicated the Medata application and support thereof is particularly good at maintaining and applying fee schedules.

I’ve also heard reports that Medata is all but consumed with the new client, but I’m thinking this may be competitor carping as a major specialty network is said to have recently decided to use Medata’s application.

[note – Medata is not a client]

Finally, look for more news next week on the ongoing PT coding clustermess. While on the surface things seem to have quieted down considerably, that quiet is misleading. There are several ongoing audits/reviews/investigations in process, involving both payers and treating providers.