Briefly, Republican Attorneys General have sued to overturn the ACA. The AGs’ claim the entire law must be thrown out because the individual mandate — a penalty imposed on people who chose to remain uninsured – was killed by Congress in 2017.

You may recall that, in addition to the mandate, the ACA:

- expanded Medicaid to more low-income families and individuals

- reduced seniors’ drug costs by closing the “Donut Hole” in Part D plans

- reduced insurance costs for older Americans

- increased funding to fight healthcare fraud

- increased funding for rural healthcare

- increased tax credits for small businesses providing health insurance

- provided insurance subsidies for families making less than $88,000

- required insurers to offer complete insurance coverage to all without discriminating by medical condition, age, or sex

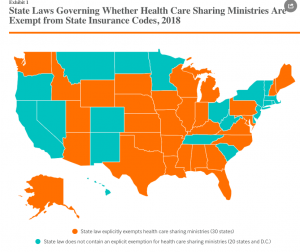

If the Republican Attorneys General prevail, the ACA will be overturned, and health insurers will be allowed to:

- stop covering pre-existing conditions;

- stop covering your adult kids;

- limit your maximum dollar benefit;

- exclude different types of medical care

- medically underwrite small groups; and

- subsidies for folks buying health insurance go away.

Meanwhile, there is NO alternative plan if the judge rules in favor of the AGs. While HHS Secretary Seema Verna says there will be a replacement plan, there are no details about this “plan“, and no information whatsoever from the President or Congress.

photo credit Leslie Boorhem-Stephenson for the Texas Tribute,

I don’t understand how the entire law can be overturned because one part of it is no longer in effect – but I’m no attorney and will leave that to those readers who are.

From a political perspective, this doesn’t seem too smart on the part of Republicans. People hate losing things they already have – much more than they don’t like not getting things they wish they had. And if the ACA is overturned, millions of voters – including millions of seniors – will be really mad.

What does this mean for you?

If you’re a Medicare recipient, parent, make less than $88,000 a year, are a small business owner, have pre-existing condition, and/or need comprehensive insurance coverage…

nothing good.

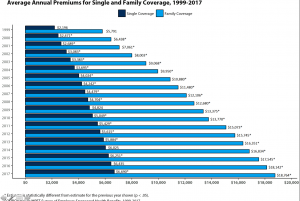

Stick with me here. The President doesn’t know the difference between tax policy (deductibility) and healthcare benefit design (deductibles). Unless, of course, he was referring to the deductibility of health insurance premiums, which many think is “ridiculously high”. Except, of course, Trump wasn’t.

Stick with me here. The President doesn’t know the difference between tax policy (deductibility) and healthcare benefit design (deductibles). Unless, of course, he was referring to the deductibility of health insurance premiums, which many think is “ridiculously high”. Except, of course, Trump wasn’t.