The world didn’t stop while we were meeting, learning, and socializing in Las Vegas at NWCDC. Here’s what happened…

Sedgwick is getting bigger – again. The acquisition of Cunningham Lindsey makes Sedgwick the largest TPA in the land, with about 20,000 employees handling various aspects of claims and related functions.

Pharmacy and related topics

California’s work comp formulary goes into effect in 3 weeks. Make sure you’re ready by hearing from those who know it best – the folks at CWCI. Their webinar is available here (free to CWCI members, $50 for non-members)

An excellent primer on handling opioid treatment issues – specifically effective ways to end opioid treatment – comes from Coventry’s Nikki Wilson, PharmD via WorkCompWire. It’s simple, clear, and concise.

Sticking with drugs, Adam Fein reminds us “In 2016, U.S. net spending on outpatient prescription drugs was $328.6 billion, up only 1.3% from the 2015 figure.” [emphasis added] In contrast, CompPharma’s latest Survey of Prescription Drug Management in Workers’ Comp shows a drop of 11 percent year over year.

Employment

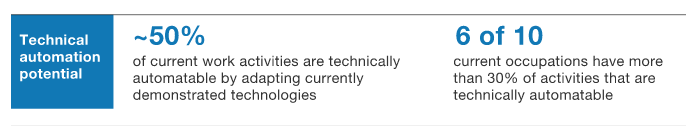

Employment is going to change – a lot – over the next decade. A thought-provoking report by McKinsey includes this prediction:

One result – “the share of the workforce that may need to learn new skills and find work in new occupations is much higher: up to one-third of the 2030 workforce in the United States” – with major implications for worker retraining, potential claiming behavior, and re-employment.

A reminder about the unseen consequences of the gig economy: airport revenues are dropping as passengers increasingly use ride-sharing services instead of paying for parking, renting cars or using cabs. I’ve reduced my use of rental cars; even if Lyft is occasionally more expensive, the hassle reduction factor plus the ability to work in the car to and from the airport are compelling.

A total of $5.8 billion was collected by airports from cab companies, parking, and rental car fees, more than they get from hotels, shops and restaurants combined.

Auto mechanic employment is also going to change – as more people switch to electric cars, there’s going to be a LOT fewer problems for mechanics to fix and even regular maintenance is limited to tires and wiper blades. We have an electric BMW i3; it has needed zero maintenance other than tires.

Takeaway – the downstream effects of the “gig economy” are far reaching indeed.